$13 Billion Bitcoin ETF Surge: US Institutions Lead The Charge

American institutions are making ripples in the cryptocurrency market, having invested a staggering $13 billion in spot Bitcoin ETF shares since its inception in January 2024. Many people are surprised by this move, given that traditional financial institutions were first hesitant to enter the world of digital assets. Related Reading: Dogecoin Rockets 30% In A Week, Sparking Hype For Uptober Rally According to CryptoQuant CEO Ki Young Ju, 1,179 institutions currently own a total of 193,064 BTC, indicating a major shift in opinion towards crypto investments. Institutional Adoption Grows The adoption of Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) has contributed significantly to the spike in institutional interest. This legal approval has created new opportunities for financial institutions to provide cryptocurrency investments, allowing them to tap into more revenue streams. Institutional ownership of U.S. #Bitcoin Spot ETFs is around 20%, with asset managers holding 193K BTC (per Form 13F filings). pic.twitter.com/9YTOEH3G5w — Ki Young Ju (@ki_young_ju) October 22, 2024 Big Chunk Of The Pie Interestingly, big players such as Millennium Management and Jane Street now hold over 20% of the total market through various Bitcoin ETFs worth about 961,645 BTC. This rapid absorption immediately shows that the anxiety over money related to digital currency was shorter-lived. Analysts think the more the establishments engage with Bitcoin ETF, the price will keep going. Even so, the current price of Bitcoin stands at around $67,000 and is likely to go to $100,000 in early 2025, based on past trends, but more importantly, how people’s thinking is changing towards embracing Bitcoin as a legitimate asset class. Options Trading Approved Another major turning point came when the SEC lately approved options trading for spot Bitcoin ETFs on NYSE American LLC and CBOE. This implies that with conventional financial instruments, institutional investors can now effectively reduce their Bitcoin exposure. A big change has happened for institutional buyers since they can now trade options on these ETFs. It not only makes Bitcoin easier to use, but it also makes it more like regular banking. Now that options trading is possible, experts think that more institutional buyers will get into the Bitcoin market. Institutional investors’ ability to trade ETF options is a turning point. Bitcoin becomes increasingly accessible and integrated into standard banking. Now that options trading is possible, experts expect more institutional investors to join Bitcoin. Related Reading: Shiba Inu Soars: Analyst Predicts 71% Rally In ‘Meme Super Cycle’ – Details A Bright Future Ahead Bitcoin and its ETFs appear to have a promising future. Institutions’ continued engagement with this asset class is anticipated to have a favorable impact on other digital assets. The SEC’s regulatory system provides a layer of protection that many investors value. This clarity may lead to increasing participation from traditional financial institutions, thus cementing Bitcoin’s position in the investment scene. Overall, the combination of institutional demand and governmental support suggests that Bitcoin is more than a passing fad; it is becoming an essential component of modern finance. As time passes, it will be interesting to see how this changing landscape affects both the digital currency market and broader economic trends. Featured image from StormGain, chart from TradingView

American institutions are making ripples in the cryptocurrency market, having invested a staggering $13 billion in spot Bitcoin ETF shares since its inception in January 2024. Many people are surprised by this move, given that traditional financial institutions were first hesitant to enter the world of digital assets.

According to CryptoQuant CEO Ki Young Ju, 1,179 institutions currently own a total of 193,064 BTC, indicating a major shift in opinion towards crypto investments.

Institutional Adoption Grows

The adoption of Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) has contributed significantly to the spike in institutional interest. This legal approval has created new opportunities for financial institutions to provide cryptocurrency investments, allowing them to tap into more revenue streams.

Institutional ownership of U.S. #Bitcoin Spot ETFs is around 20%, with asset managers holding 193K BTC (per Form 13F filings). pic.twitter.com/9YTOEH3G5w

— Ki Young Ju (@ki_young_ju) October 22, 2024

Big Chunk Of The Pie

Interestingly, big players such as Millennium Management and Jane Street now hold over 20% of the total market through various Bitcoin ETFs worth about 961,645 BTC. This rapid absorption immediately shows that the anxiety over money related to digital currency was shorter-lived.

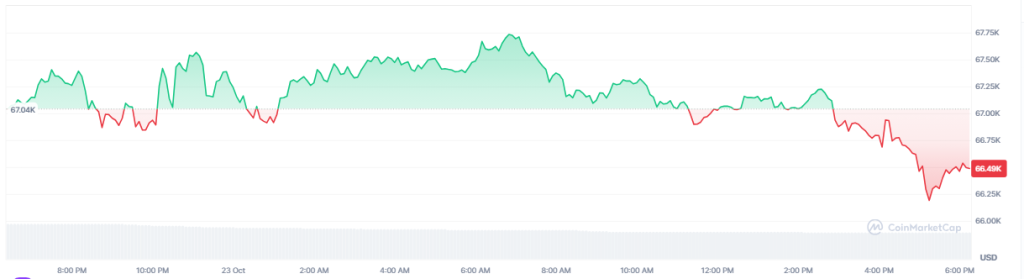

Analysts think the more the establishments engage with Bitcoin ETF, the price will keep going. Even so, the current price of Bitcoin stands at around $67,000 and is likely to go to $100,000 in early 2025, based on past trends, but more importantly, how people’s thinking is changing towards embracing Bitcoin as a legitimate asset class.

Options Trading Approved

Another major turning point came when the SEC lately approved options trading for spot Bitcoin ETFs on NYSE American LLC and CBOE. This implies that with conventional financial instruments, institutional investors can now effectively reduce their Bitcoin exposure.

A big change has happened for institutional buyers since they can now trade options on these ETFs. It not only makes Bitcoin easier to use, but it also makes it more like regular banking. Now that options trading is possible, experts think that more institutional buyers will get into the Bitcoin market.

Institutional investors’ ability to trade ETF options is a turning point. Bitcoin becomes increasingly accessible and integrated into standard banking. Now that options trading is possible, experts expect more institutional investors to join Bitcoin. A Bright Future Ahead

Bitcoin and its ETFs appear to have a promising future. Institutions’ continued engagement with this asset class is anticipated to have a favorable impact on other digital assets. The SEC’s regulatory system provides a layer of protection that many investors value. This clarity may lead to increasing participation from traditional financial institutions, thus cementing Bitcoin’s position in the investment scene.

Overall, the combination of institutional demand and governmental support suggests that Bitcoin is more than a passing fad; it is becoming an essential component of modern finance. As time passes, it will be interesting to see how this changing landscape affects both the digital currency market and broader economic trends.

Featured image from StormGain, chart from TradingView

What's Your Reaction?