3 Reasons Why Ethereum Is Struggling Today: Will ETH Break $2,000?

Even after the welcomed recovery on August 6, Ethereum is under immense selling pressure today, August 7. Despite gains earlier today, losses saw the coin edge lower, as visible in the daily chart. The daily chart rejected the coin at around the $3,500 resistance level. At this pace, Ethereum could continue plummeting if bears step on, mirroring losses of the first half of the week. Jump Trading Liquidating Ethereum: Will Prices Drop Below $2,000? Multiple factors at play explain the recent weakness. As it is, the coin could drop even lower, targeting the $2,000 support line. With the general crypto community cautious, Jump Trading, a crypto market marketing firm, has been dumping ETH incessantly over the past few trading days. Related Reading: Bitcoin Bull Run Still Intact? Here’s What On-Chain Data Says According to Lookonchain data, Jump Trading claimed 11,501 ETH worth over $29 million from the liquidity staking platform Lido Finance. The blockchain analytics platform said the block of ETH is set for sale. Jump Trading, currently being investigated by the United States Commodity Futures Trading Commission (CFTC), also plans to redeem another 19,049 ETH worth over $48 million from the same platform. This amount will likely be dumped in the secondary markets, weighing down prices even more. On August 5, Jump Trading liquidated over 120,000 wETH, accelerating the sell-off. Though Bitcoin lost over 20% that day, losses were more pronounced on Ethereum, which dumped by nearly 40% from July highs, dropping to as low as $2,100. PlusToken Ponzi Scheme Tokens Moving, Impact Of The Ronin Bridge Hack Beyond the liquidity impact of Jump Trading, large amounts of ETH are being moved from wallets associated with the PlusToken Ponzi scheme, according to Scopescan data. The last time these wallets were moved was in 2021, when Chinese authorities shut down the scam. The PlusToken Ponzi wallets control roughly $2 billion worth of ETH. Similar to the panic when the United States government moved $2 billion of BTC and when Mt. Gox began distributing BTC, the same is being witnessed. Presently, sentiment has been dented and could depress ETH prices in the short to medium term. Related Reading: Explosive XRP Prediction: Analyst Foresees 20-Fold Gain Though minimal, ETH faces more pressure following the Ronin Bridge security breach. While the white hacker has returned roughly 2 million USDC of the reported $10 million lost, the fact that ETH was the main asset stolen is a concern. This is not the first time the Ronin Bridge has lost money. In 2022, it lost over $600 million in a disastrous hack. Feature image from DALLE, chart from TradingView

Even after the welcomed recovery on August 6, Ethereum is under immense selling pressure today, August 7. Despite gains earlier today, losses saw the coin edge lower, as visible in the daily chart.

The daily chart rejected the coin at around the $3,500 resistance level. At this pace, Ethereum could continue plummeting if bears step on, mirroring losses of the first half of the week.

Jump Trading Liquidating Ethereum: Will Prices Drop Below $2,000?

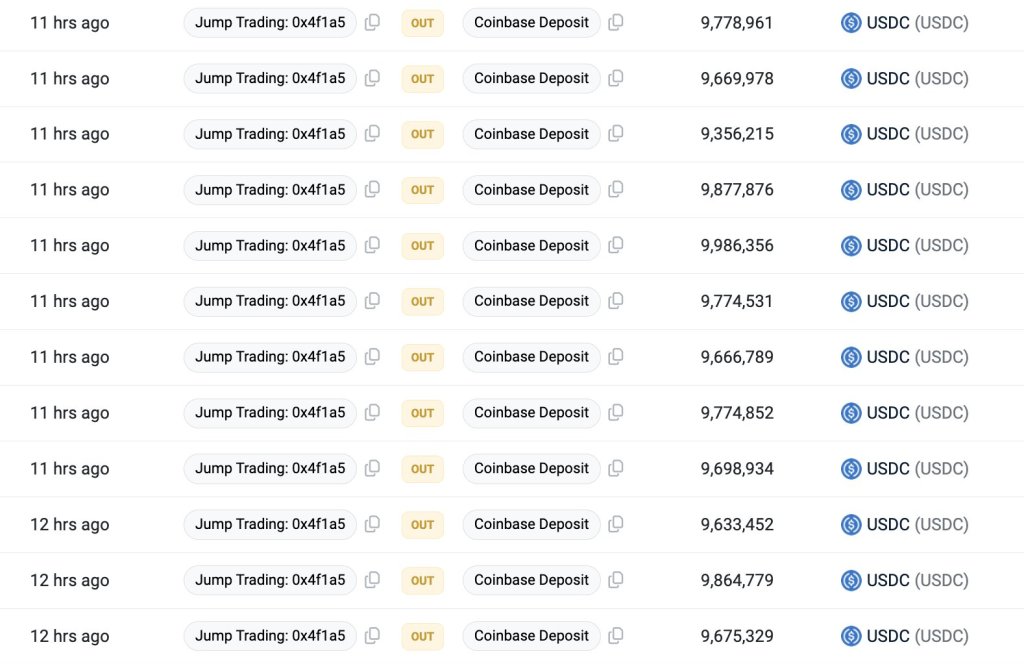

Multiple factors at play explain the recent weakness. As it is, the coin could drop even lower, targeting the $2,000 support line. With the general crypto community cautious, Jump Trading, a crypto market marketing firm, has been dumping ETH incessantly over the past few trading days.

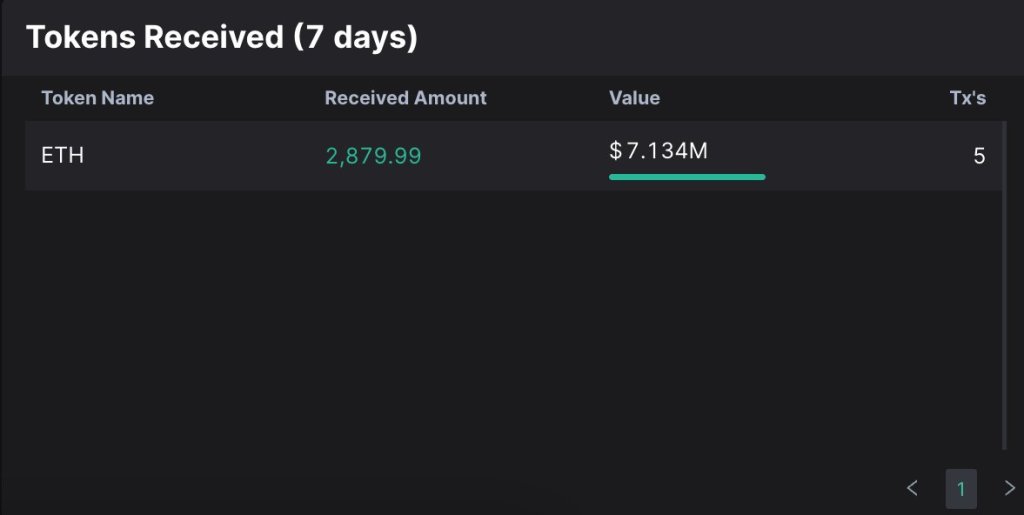

According to Lookonchain data, Jump Trading claimed 11,501 ETH worth over $29 million from the liquidity staking platform Lido Finance. The blockchain analytics platform said the block of ETH is set for sale.

Jump Trading, currently being investigated by the United States Commodity Futures Trading Commission (CFTC), also plans to redeem another 19,049 ETH worth over $48 million from the same platform. This amount will likely be dumped in the secondary markets, weighing down prices even more.

On August 5, Jump Trading liquidated over 120,000 wETH, accelerating the sell-off. Though Bitcoin lost over 20% that day, losses were more pronounced on Ethereum, which dumped by nearly 40% from July highs, dropping to as low as $2,100.

PlusToken Ponzi Scheme Tokens Moving, Impact Of The Ronin Bridge Hack

Beyond the liquidity impact of Jump Trading, large amounts of ETH are being moved from wallets associated with the PlusToken Ponzi scheme, according to Scopescan data. The last time these wallets were moved was in 2021, when Chinese authorities shut down the scam.

The PlusToken Ponzi wallets control roughly $2 billion worth of ETH. Similar to the panic when the United States government moved $2 billion of BTC and when Mt. Gox began distributing BTC, the same is being witnessed. Presently, sentiment has been dented and could depress ETH prices in the short to medium term.

Though minimal, ETH faces more pressure following the Ronin Bridge security breach. While the white hacker has returned roughly 2 million USDC of the reported $10 million lost, the fact that ETH was the main asset stolen is a concern. This is not the first time the Ronin Bridge has lost money. In 2022, it lost over $600 million in a disastrous hack.

What's Your Reaction?