A Record $21.77 Billion In Bitcoin Shorts Will Be Liquidated Once BTC Breaks $70,500

Bitcoin is trending higher at spot rates, floating above $60,000 and confirming gains of September 13. From price action in the daily chart, buyers appear to be back in the picture. The confidence follows the United States Federal Reserve’s (Fed) decision to slash rates by 50 basis points on September 18. Over $21 Billion Of Shorts To Be Liquidated If Bitcoin Breaks $70,500 While buyers double down, flocking back to BTC, looking at the sharp uptick in trading volume over the past day, one analyst on X has identified an interesting observation if bulls continue to dominate. Citing market data and the liquidation map of Binance perpetuals, the analyst said if Bitcoin flies above $70,500, over $21 billion of shorts will be liquidated. Liquidation happens in the perpetuals market where leverage traders aim to clip market volatility for profit. There are longs, or traders banking on bulls to press prices higher, and shots, betting for prices to drop. Related Reading: October To Remember: Descending Broadening Wedge Says Bitcoin Is Going To $90,000 These positions are leveraged in both instances, meaning they borrow funds from the exchange. The collateral, in this case, the margin, acts as an “insurance” for the exchange. As a result, they will forcefully sell it should the market move against the trader. Looking at the state of price action in the daily chart, Bitcoin needs to expand by around 11% from spot rates of $70,500 to be hit. The immediate liquidation level is at around $66,000, marking August highs. If this level is broken, and the leg up is rising trading volume, the resulting rally could easily be the basis for bulls to overcome the intense liquidation pressure of around $70,000 and $72,000. The $70,000 And $72,000 Resistance Zone Is Crucial For BTC Traders Bitcoin bulls have struggled to break $72,000 since the retest in June. Accordingly, any firm and decisive close above $70,000 can trigger a short squeeze. Therefore, it is highly likely that BTC may retest $73,800 and even print print fresh all-time highs. Related Reading: Cardano Goes Bullish On-Chain: Can ADA Price Catch Up? Coinglass data on September 19 shows that over $69 million of leveraged shorts have been liquidated in the last 24 hours. Meanwhile, more than $13 million worth of longs were also forcibly closed due to market volatility. Over 66,000 crypto traders were liquidated in the past day, and the largest leveraged BTCUSD position worth over $8.9 was closed on Bybit, a perpetuals trading platform, during this period. Feature image from DALLE, chart from TradingView

Bitcoin is trending higher at spot rates, floating above $60,000 and confirming gains of September 13. From price action in the daily chart, buyers appear to be back in the picture. The confidence follows the United States Federal Reserve’s (Fed) decision to slash rates by 50 basis points on September 18.

Over $21 Billion Of Shorts To Be Liquidated If Bitcoin Breaks $70,500

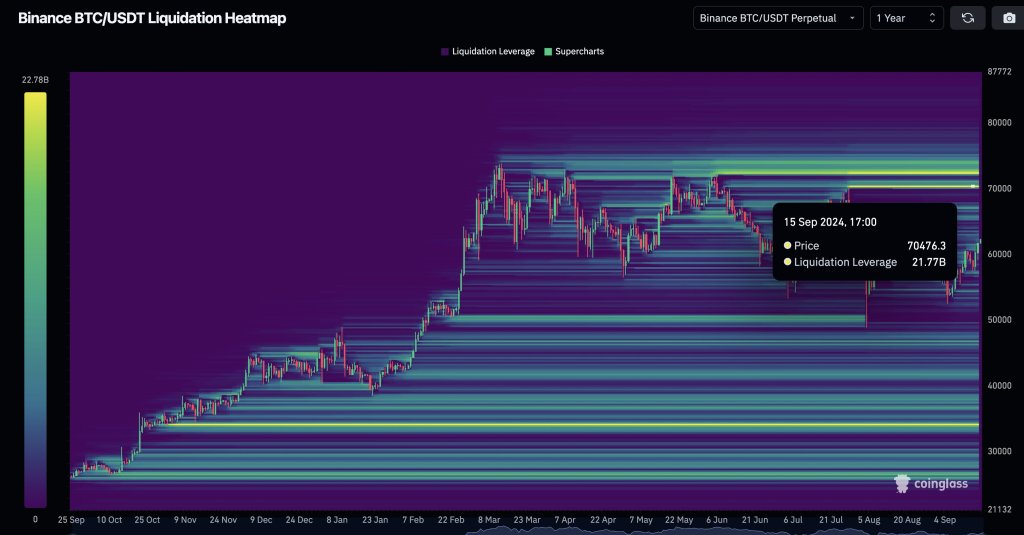

While buyers double down, flocking back to BTC, looking at the sharp uptick in trading volume over the past day, one analyst on X has identified an interesting observation if bulls continue to dominate. Citing market data and the liquidation map of Binance perpetuals, the analyst said if Bitcoin flies above $70,500, over $21 billion of shorts will be liquidated.

Liquidation happens in the perpetuals market where leverage traders aim to clip market volatility for profit. There are longs, or traders banking on bulls to press prices higher, and shots, betting for prices to drop.

These positions are leveraged in both instances, meaning they borrow funds from the exchange. The collateral, in this case, the margin, acts as an “insurance” for the exchange. As a result, they will forcefully sell it should the market move against the trader.

Looking at the state of price action in the daily chart, Bitcoin needs to expand by around 11% from spot rates of $70,500 to be hit. The immediate liquidation level is at around $66,000, marking August highs.

If this level is broken, and the leg up is rising trading volume, the resulting rally could easily be the basis for bulls to overcome the intense liquidation pressure of around $70,000 and $72,000.

The $70,000 And $72,000 Resistance Zone Is Crucial For BTC Traders

Bitcoin bulls have struggled to break $72,000 since the retest in June. Accordingly, any firm and decisive close above $70,000 can trigger a short squeeze. Therefore, it is highly likely that BTC may retest $73,800 and even print print fresh all-time highs.

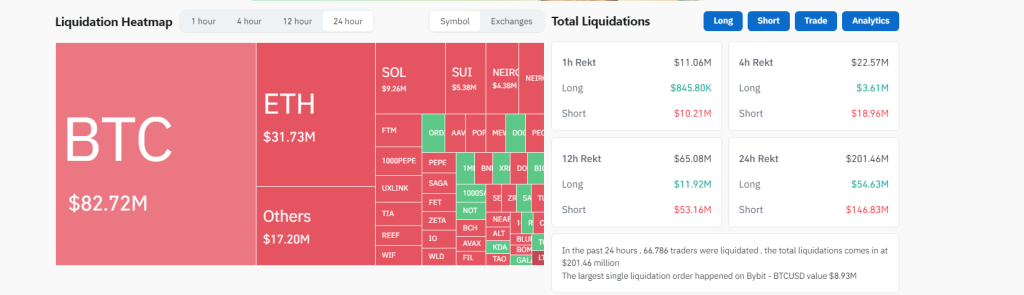

Coinglass data on September 19 shows that over $69 million of leveraged shorts have been liquidated in the last 24 hours. Meanwhile, more than $13 million worth of longs were also forcibly closed due to market volatility.

Over 66,000 crypto traders were liquidated in the past day, and the largest leveraged BTCUSD position worth over $8.9 was closed on Bybit, a perpetuals trading platform, during this period.

What's Your Reaction?