Bitcoin ETFs See $1.6B Inflows This Week – Is BTC Reaching A New ATH Soon?

Bitcoin is holding strong above $67,000 after setting a new local high of around $68,300, fueling excitement among investors. This bullish momentum is driven by price action and supported by key market data signaling a potential uptrend continuation. Related Reading: Dogecoin Buy Signal Hints At Upside As Funding Rate Keeps Rising Daan, a top crypto analyst, shared crucial insights showing that Bitcoin ETFs have been buying heavily for the past four days. This surge in institutional demand is a positive signal for the market, as it could further propel Bitcoin toward new all-time highs. The next few days will be critical for Bitcoin’s trajectory, with many traders and investors eyeing a potential breakout to historic levels. The anticipation grows as BTC edges closer to these highs, making the upcoming price movements pivotal in shaping the market’s direction. Bitcoin Demand Rising The whole market is buzzing with excitement and volatility, with Bitcoin leading the way by establishing a clear uptrend since early September. Analysts and investors are attributing part of this surge to the Federal Reserve’s recent interest rate cuts, but other significant factors influence Bitcoin’s price action. Key data shared by Daan, a top crypto analyst, reveals that Bitcoin ETFs have seen substantial inflows over the past week. The last four trading days alone have witnessed a combined $1.639 billion in inflows, making this week one of the most successful since the inception of Bitcoin ETFs. This surge in institutional demand signals that traditional investors are increasingly confident in Bitcoin’s future, driving up demand and boosting the price. Despite the current optimism, there is caution among market observers. Historically, periods of heightened excitement and euphoria in the market are often followed by price retracements or consolidation. Related Reading: Analyst Forecasts XRP Bullish Breakout – A 1,000% Opportunity? Bitcoin tends to mark local tops when sentiment peaks, which could signal a cooling-off period before the next major move. Investors are closely watching for signs of a potential pullback or whether Bitcoin will continue to climb toward new all-time highs in the weeks ahead. Key Levels To Watch Bitcoin is trading at $67,000 after a 2% retrace from its recent local top at $68,388. Despite this slight pullback, the price is holding firmly above the previous high of $66,500, signaling a strong consolidation phase that could set the stage for another move higher. For the bullish momentum to continue, BTC must maintain its position above $66,500. If it does, the price could soon push toward new highs. However, if Bitcoin fails to hold above this critical level, a healthy retrace to the daily 200-day moving average (MA) would still indicate strength in the market. The 200-day MA has historically been a reliable support level during uptrends, providing a foundation for further gains. Related Reading: Solana Targets $160 Resistance As TVL Hits New Yearly Highs If the price falls below the 200-day MA, a deeper correction to $60,000 is likely. This level represents significant demand and could offer another buying opportunity before the next leg. Featured image from Dall-E, chart from TradingView

Bitcoin is holding strong above $67,000 after setting a new local high of around $68,300, fueling excitement among investors. This bullish momentum is driven by price action and supported by key market data signaling a potential uptrend continuation.

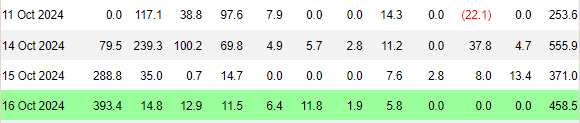

Daan, a top crypto analyst, shared crucial insights showing that Bitcoin ETFs have been buying heavily for the past four days. This surge in institutional demand is a positive signal for the market, as it could further propel Bitcoin toward new all-time highs.

The next few days will be critical for Bitcoin’s trajectory, with many traders and investors eyeing a potential breakout to historic levels. The anticipation grows as BTC edges closer to these highs, making the upcoming price movements pivotal in shaping the market’s direction.

Bitcoin Demand Rising

The whole market is buzzing with excitement and volatility, with Bitcoin leading the way by establishing a clear uptrend since early September.

Analysts and investors are attributing part of this surge to the Federal Reserve’s recent interest rate cuts, but other significant factors influence Bitcoin’s price action.

Key data shared by Daan, a top crypto analyst, reveals that Bitcoin ETFs have seen substantial inflows over the past week.

The last four trading days alone have witnessed a combined $1.639 billion in inflows, making this week one of the most successful since the inception of Bitcoin ETFs. This surge in institutional demand signals that traditional investors are increasingly confident in Bitcoin’s future, driving up demand and boosting the price.

Despite the current optimism, there is caution among market observers. Historically, periods of heightened excitement and euphoria in the market are often followed by price retracements or consolidation.

Bitcoin tends to mark local tops when sentiment peaks, which could signal a cooling-off period before the next major move. Investors are closely watching for signs of a potential pullback or whether Bitcoin will continue to climb toward new all-time highs in the weeks ahead.

Key Levels To Watch

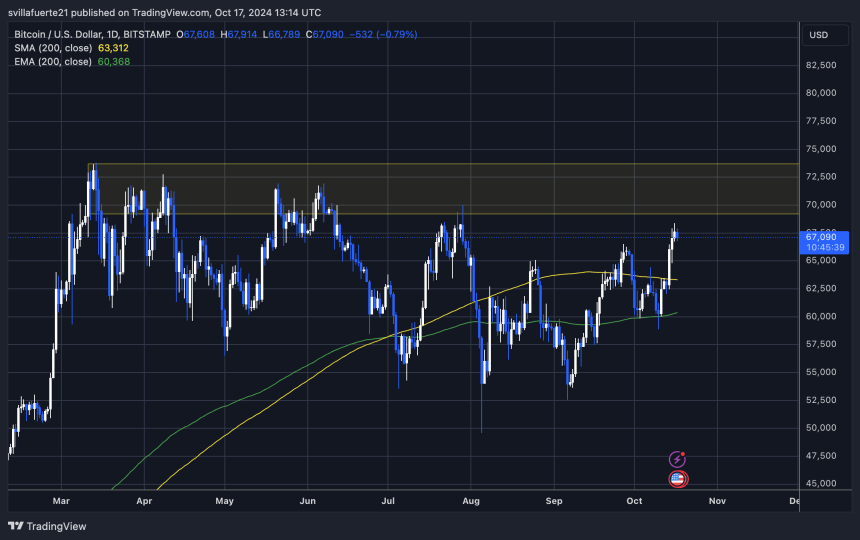

Bitcoin is trading at $67,000 after a 2% retrace from its recent local top at $68,388. Despite this slight pullback, the price is holding firmly above the previous high of $66,500, signaling a strong consolidation phase that could set the stage for another move higher.

For the bullish momentum to continue, BTC must maintain its position above $66,500. If it does, the price could soon push toward new highs.

However, if Bitcoin fails to hold above this critical level, a healthy retrace to the daily 200-day moving average (MA) would still indicate strength in the market. The 200-day MA has historically been a reliable support level during uptrends, providing a foundation for further gains.

If the price falls below the 200-day MA, a deeper correction to $60,000 is likely. This level represents significant demand and could offer another buying opportunity before the next leg.

Featured image from Dall-E, chart from TradingView

What's Your Reaction?