Bitcoin Hash Price Hits New Low — Is It Time To Buy?

The price of Bitcoin failed to capitalize on its recent momentum over the past week, losing its hold above $60,000 yet again in August. As of this writing, the premier cryptocurrency is valued at $59,131, with no significant price change in the past day. Interestingly, the Bitcoin price appears to be nearing a bottom and gearing for a rebound, according to the latest on-chain data. Is Bitcoin Price Resuming Its Bull Run? A pseudonymous analyst on CryptoQuant’s Quicktake platform has revealed a “buying opportunity” for Bitcoin, the largest cryptocurrency in the market. This analysis is based on the changes in the Bitcoin hash price in the last few weeks and its potential implications on the BTC price. Related Reading: Bitcoin’s Sudden Drop: Could This Be a Setup for a Massive Rally? Analyst Weighs In The hash price measures the daily revenue generated by BTC miners per terahash per second (TH/s). This metric is calculated by dividing the total daily revenue of miners by the network hash rate. The hash price basically estimates miners’ profit based on the computational power they contribute to the network. The chart above demonstrates the relationship between the Bitcoin price and the hash price. “The highlighted sections in the chart (blue boxes) indicate periods where the Hash Price dropped to lower levels, corresponding to times when Bitcoin prices were also at or near their lowest points,” the analyst said about the chart. As of this writing, the Bitcoin hash price stands way below $0.1, the lowest level since 2023. Historically, periods of extremely low hash prices have coincided with Bitcoin price bottoms, with a price rebound often coming after. With the current hash price at an all-time low, it appears that Bitcoin’s price might be bottoming out and preparing for a comeback. BTC Market Back In Bear Phase? In a new post on X, CryptoQuant’s head of research Julio Moreno revealed that the Bitcoin market cycle indicator is back in the bear phase. As shown in the chart below, this indicator has been swinging from the bull to the bear phase in the past few weeks, mirroring the current inconsistencies in the market. Moreno also sounded a warning about the recent slump in BTC‘s value to below the $60,000 mark. According to the expert, if the price breaks $56,000 to the downside, the potential for an even more significant correction increases. Related Reading: How Will The US Upcoming Fed Rate Cut Impact Bitcoin? QCP Analysts Weigh In Featured image from iStock, chart from TradingView

The price of Bitcoin failed to capitalize on its recent momentum over the past week, losing its hold above $60,000 yet again in August. As of this writing, the premier cryptocurrency is valued at $59,131, with no significant price change in the past day.

Interestingly, the Bitcoin price appears to be nearing a bottom and gearing for a rebound, according to the latest on-chain data.

Is Bitcoin Price Resuming Its Bull Run?

A pseudonymous analyst on CryptoQuant’s Quicktake platform has revealed a “buying opportunity” for Bitcoin, the largest cryptocurrency in the market. This analysis is based on the changes in the Bitcoin hash price in the last few weeks and its potential implications on the BTC price.

The hash price measures the daily revenue generated by BTC miners per terahash per second (TH/s). This metric is calculated by dividing the total daily revenue of miners by the network hash rate. The hash price basically estimates miners’ profit based on the computational power they contribute to the network.

The chart above demonstrates the relationship between the Bitcoin price and the hash price. “The highlighted sections in the chart (blue boxes) indicate periods where the Hash Price dropped to lower levels, corresponding to times when Bitcoin prices were also at or near their lowest points,” the analyst said about the chart.

As of this writing, the Bitcoin hash price stands way below $0.1, the lowest level since 2023. Historically, periods of extremely low hash prices have coincided with Bitcoin price bottoms, with a price rebound often coming after. With the current hash price at an all-time low, it appears that Bitcoin’s price might be bottoming out and preparing for a comeback.

BTC Market Back In Bear Phase?

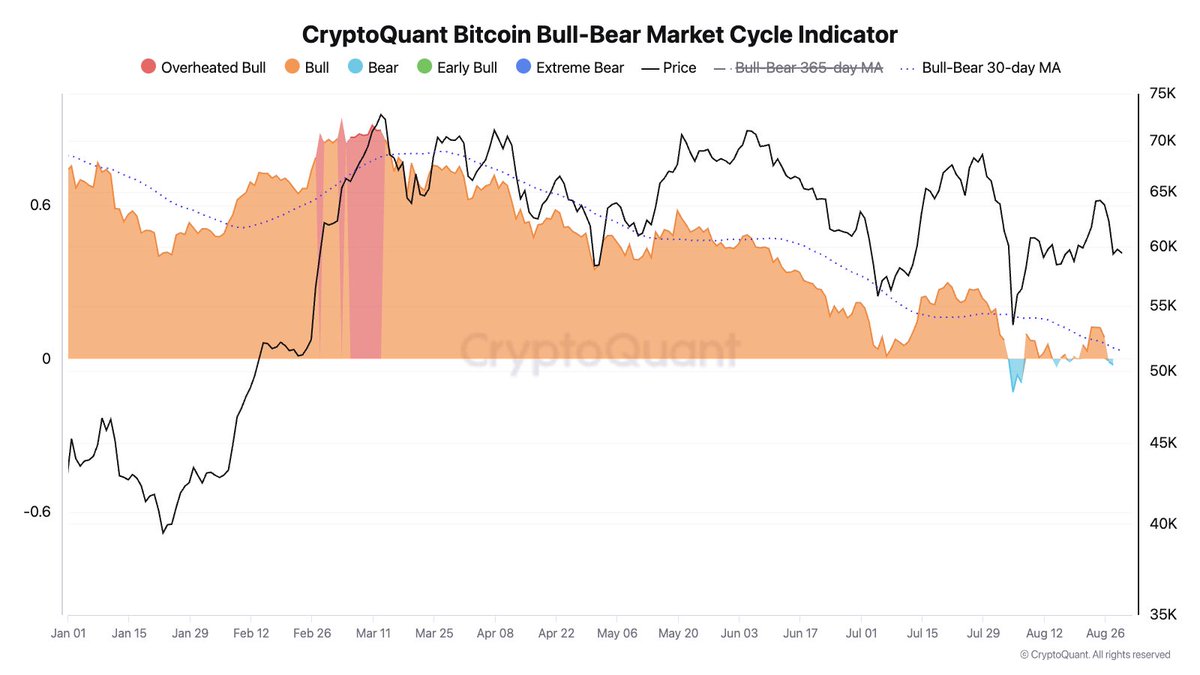

In a new post on X, CryptoQuant’s head of research Julio Moreno revealed that the Bitcoin market cycle indicator is back in the bear phase. As shown in the chart below, this indicator has been swinging from the bull to the bear phase in the past few weeks, mirroring the current inconsistencies in the market.

Moreno also sounded a warning about the recent slump in BTC‘s value to below the $60,000 mark. According to the expert, if the price breaks $56,000 to the downside, the potential for an even more significant correction increases.

What's Your Reaction?