Bitcoin Hashrate Continues To Be At Lows: Miners Not Confident About Rally?

On-chain data shows the Bitcoin Mining Hashrate has remained at its recent lows, indicating that miners may not be confident about the coin’s rally. Bitcoin Mining Hashrate Has Moved Sideways Around Lows Recently The “Mining Hashrate” refers to a metric that keeps track of the total computing power miners have currently attached to the Bitcoin […]

On-chain data shows the Bitcoin Mining Hashrate has remained at its recent lows, indicating that miners may not be confident about the coin’s rally.

Bitcoin Mining Hashrate Has Moved Sideways Around Lows Recently

The “Mining Hashrate” refers to a metric that keeps track of the total computing power miners have currently attached to the Bitcoin network. Its value is traditionally measured in hashes per second (H/s), but these days, larger units like terahashes per second (TH/s) are used instead, as they’re more practical.

When the value of this metric goes up, it means new miners are joining the network, and old ones are expanding their facilities. Such a trend implies that these chain validators are now finding blockchain attractive.

On the other hand, the indicator registering a decline implies some miners have decided to disconnect from the network, potentially because they are finding BTC mining unprofitable.

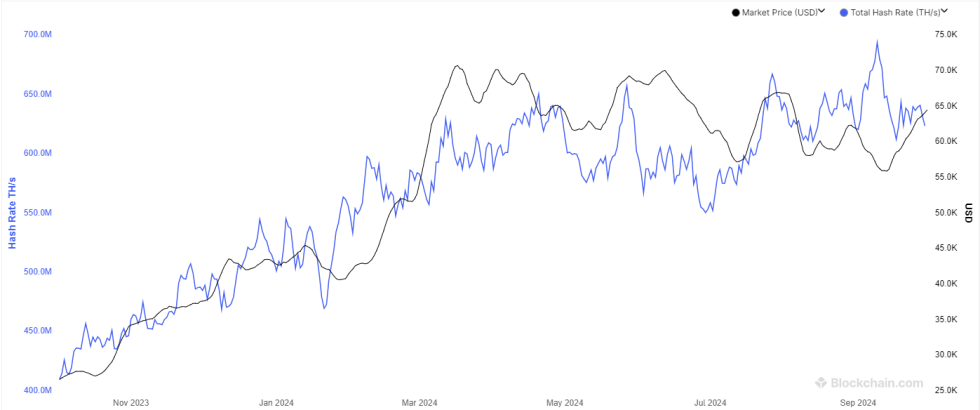

Now, here is a chart that shows the trend in the 7-day average Bitcoin Mining Hashrate over the past year:

As is visible in the above graph, the Bitcoin Mining Hashrate had surged to a new all-time high (ATH) earlier in the month, but it didn’t take long before the indicator crashed back to the same lows as in August.

A potential reason behind this may have been the fact that the Hashrate increase to the ATH was unsustainable due to the corresponding action in the BTC spot value.

Miners mainly make their income through block subsidies and transaction fees. Out of the two, the former makes up most of their revenue.

A feature of the BTC blockchain is that the block subsidy always remains fixed (except during a special event called the Halving, which cuts its value in half every four years) and is also given out at nearly a constant time rate. Thus, the only variable related to them is the BTC price.

Since the Bitcoin block subsidy corresponds to most of the miner revenue, this relationship means the revenue is highly dependent on the asset’s value.

When the Hashrate had risen to the ATH earlier, the BTC price had been going down instead. The revenue squeeze may be why the miners had decided to roll back on their upgrades.

Interestingly, the asset’s price has risen recently, but the Hashrate has continued to move around the same lows since then. Perhaps the miners are trying to be more cautious this time or are not optimistic about Bitcoin.

Whatever the case, miners’ concerns may be starting to become validated by the latest pullback that the cryptocurrency has seen.

BTC Price

At the time of writing, Bitcoin is trading at around $63,300, down almost 4% over the last 24 hours.

What's Your Reaction?