Bitcoin Hashrate Nears All-Time High As BTC Price Recovers Above $67,000

On-chain data shows the Bitcoin mining hashrate has neared its all-time high (ATH) as BTC has recovered beyond the $67,000 mark. 7-Day Average Bitcoin Mining Hashrate Has Seen A Surge Recently The “mining hashrate” refers to a metric that keeps track of the total computing power the miners have currently connected with the Bitcoin blockchain. […]

On-chain data shows the Bitcoin mining hashrate has neared its all-time high (ATH) as BTC has recovered beyond the $67,000 mark.

7-Day Average Bitcoin Mining Hashrate Has Seen A Surge Recently

The “mining hashrate” refers to a metric that keeps track of the total computing power the miners have currently connected with the Bitcoin blockchain.

When the value of this indicator registers an increase, it means that new miners are joining the network, and old ones are expanding their facilities. Such a trend implies the network is looking attractive to these chain validators.

On the other hand, the metric going through a decline implies some miners have decided to disconnect from the chain, potentially because they are finding it unprofitable to mine BTC.

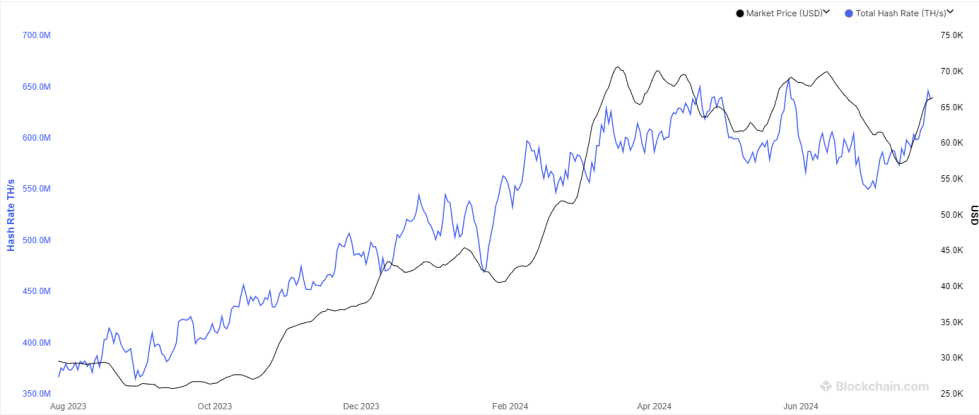

Now, here is a chart that shows the trend in the 7-day average Bitcoin mining hashrate over the past year:

As is visible in the above graph, the 7-day average Bitcoin mining hashrate had observed a steep decline after setting a new ATH back in May. The reason behind this drawdown likely was the bearish action the cryptocurrency had been going through earlier.

Miners make their revenue mainly from the block subsidy, which they receive as compensation for solving blocks on the network. The block subsidy is more or less given out at a fixed interval as well as a fixed BTC value, so the USD price of the asset is the only variable related to them.

As such, when the asset price goes down, so does the miners’ revenue. This cohort has been under especially high pressure since April for another reason: the fourth Halving.

Halvings are periodic events occurring approximately every four years that permanently slash the block subsidy in half. The Halving that occurred this April was the fourth event that the cryptocurrency has witnessed in its history.

As these events drastically reduce the main income stream of the miners, they naturally have a bad effect on their finances. They aren’t anything miners haven’t been able to shake off in the past, though, as usually, the combined effect of more efficient technologies and increases in the BTC price gets miners back into profits.

Indeed, the same has happened this time, as the 7-day mining hashrate has almost completely recovered since its bottom at the start of the month. The price rally Bitcoin has enjoyed back to the $67,000 level is naturally the driving factor behind this growth.

BTC Price

At the time of writing, Bitcoin is trading at around $67,500, up 3% over the past week.

What's Your Reaction?