Bitcoin LTHs Start Taking Profits – Metrics Reveal Whales Are Actively Spending

Bitcoin has reached new all-time highs for four consecutive days, hitting $99,500 just hours ago. The relentless surge has fueled extreme bullish sentiment in the market, with investors eagerly anticipating Bitcoin’s historic breakthrough of the $100,000 mark. However, on-chain data suggests that the rally may face challenges as signs of profit-taking emerge. Related Reading: Ethereum Consolidation Continues – Charts Signal Potential Breakout Key insights from CryptoQuant reveal that Long-Term Holders (LTHs) are actively spending their Bitcoin, capitalizing on profits exceeding 350%. This behavior indicates that some seasoned investors are beginning to lock in gains after the aggressive uptrend. Whale activity and profit-taking by LTHs could temporarily slow the rally, potentially triggering a consolidation phase before the next leg up. While Bitcoin remains shy of the six-figure milestone, the market closely examines whether it can sustain its momentum or if a pullback is imminent. Consolidation at these levels could provide the foundation for BTC to reclaim its bullish trend and break through the psychological $100,000 barrier. Bitcoin Rally Seems Unstoppable Bitcoin has surged an impressive 45% since November 5, displaying relentless upward momentum that appears unstoppable. Despite increasing selling activity, demand continues to support the price, driving Bitcoin to new highs and maintaining its bullish trajectory. Market participants are now closely watching for potential signals of a slowdown or correction as BTC pushes deeper into uncharted territory. CryptoQuant analyst Axel Adler recently shared X data highlighting a significant trend among Long-Term Holders (LTHs). According to Adler, LTHs are actively spending their Bitcoin, capitalizing on profits exceeding 350%. This marks a critical juncture, as these holders are often regarded as market stabilizers, and their selling activity could indicate potential shifts in sentiment. Adler further notes that if Bitcoin’s price surpasses $119,000, LTH profits would soar to over 500%. Such extraordinary profit levels could trigger a wave of selling pressure, potentially leading to the first major correction after this unprecedented rally. However, he emphasizes that predicting an exact price point for a correction remains speculative, as no definitive threshold exists to determine when LTHs might overwhelmingly exit their positions. Related Reading: Polkadot Holds Key Demand Level – DOT Could Hit $11 In Coming Weeks While the rally shows no signs of slowing down, this dynamic between demand and LTH profit-taking underscores the importance of monitoring market behavior. Traders should remain cautious as Bitcoin’s rapid ascent unfolds. BTC About To Reach $100K Bitcoin trades at $98,600, less than 2% from the highly anticipated $100,000 mark. This psychological level is expected to be a significant supply zone, with many investors closely watching price movements around this milestone. Recent “only up” price action has left little room for traders to buy at lower levels, frustrating those who hoped to accumulate during dips. If Bitcoin holds above the crucial $93,500 support level in the coming days, market sentiment suggests a powerful surge above $100,000 could follow. Breaking this barrier would likely usher in further bullish momentum, pushing Bitcoin into uncharted territory and fueling optimism for additional gains. However, failure to maintain support at $93,500 could trigger selling pressure, leading to a price pullback. In such a scenario, Bitcoin might test lower demand zones, with $85,000 and $80,000 identified as key levels to watch. These zones could provide new accumulation opportunities for investors looking to capitalize on price corrections. Related Reading: Solana Analyst Expects A Retrace Before It Breaks ATH – Targets Revealed As Bitcoin approaches this historic level, the next few days will determine whether the market sustains its bullish trend or enters a consolidation phase. Traders and investors should remain vigilant as BTC navigates this critical juncture. Featured image from Dall-E, chart from TradingView

Bitcoin has reached new all-time highs for four consecutive days, hitting $99,500 just hours ago. The relentless surge has fueled extreme bullish sentiment in the market, with investors eagerly anticipating Bitcoin’s historic breakthrough of the $100,000 mark. However, on-chain data suggests that the rally may face challenges as signs of profit-taking emerge.

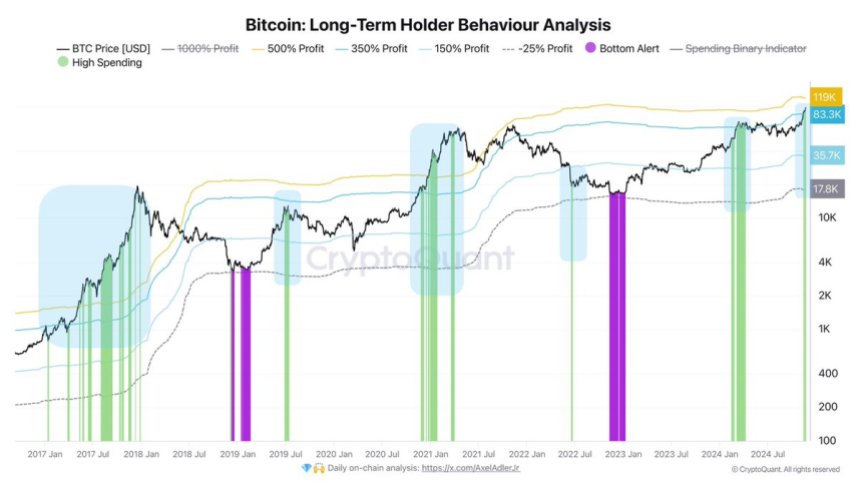

Key insights from CryptoQuant reveal that Long-Term Holders (LTHs) are actively spending their Bitcoin, capitalizing on profits exceeding 350%. This behavior indicates that some seasoned investors are beginning to lock in gains after the aggressive uptrend. Whale activity and profit-taking by LTHs could temporarily slow the rally, potentially triggering a consolidation phase before the next leg up.

While Bitcoin remains shy of the six-figure milestone, the market closely examines whether it can sustain its momentum or if a pullback is imminent. Consolidation at these levels could provide the foundation for BTC to reclaim its bullish trend and break through the psychological $100,000 barrier.

Bitcoin Rally Seems Unstoppable

Bitcoin has surged an impressive 45% since November 5, displaying relentless upward momentum that appears unstoppable. Despite increasing selling activity, demand continues to support the price, driving Bitcoin to new highs and maintaining its bullish trajectory. Market participants are now closely watching for potential signals of a slowdown or correction as BTC pushes deeper into uncharted territory.

CryptoQuant analyst Axel Adler recently shared X data highlighting a significant trend among Long-Term Holders (LTHs). According to Adler, LTHs are actively spending their Bitcoin, capitalizing on profits exceeding 350%. This marks a critical juncture, as these holders are often regarded as market stabilizers, and their selling activity could indicate potential shifts in sentiment.

Adler further notes that if Bitcoin’s price surpasses $119,000, LTH profits would soar to over 500%. Such extraordinary profit levels could trigger a wave of selling pressure, potentially leading to the first major correction after this unprecedented rally. However, he emphasizes that predicting an exact price point for a correction remains speculative, as no definitive threshold exists to determine when LTHs might overwhelmingly exit their positions.

While the rally shows no signs of slowing down, this dynamic between demand and LTH profit-taking underscores the importance of monitoring market behavior. Traders should remain cautious as Bitcoin’s rapid ascent unfolds.

BTC About To Reach $100K

Bitcoin trades at $98,600, less than 2% from the highly anticipated $100,000 mark. This psychological level is expected to be a significant supply zone, with many investors closely watching price movements around this milestone. Recent “only up” price action has left little room for traders to buy at lower levels, frustrating those who hoped to accumulate during dips.

If Bitcoin holds above the crucial $93,500 support level in the coming days, market sentiment suggests a powerful surge above $100,000 could follow. Breaking this barrier would likely usher in further bullish momentum, pushing Bitcoin into uncharted territory and fueling optimism for additional gains.

However, failure to maintain support at $93,500 could trigger selling pressure, leading to a price pullback. In such a scenario, Bitcoin might test lower demand zones, with $85,000 and $80,000 identified as key levels to watch. These zones could provide new accumulation opportunities for investors looking to capitalize on price corrections.

As Bitcoin approaches this historic level, the next few days will determine whether the market sustains its bullish trend or enters a consolidation phase. Traders and investors should remain vigilant as BTC navigates this critical juncture.

Featured image from Dall-E, chart from TradingView

What's Your Reaction?