Bitcoin Price Surges Above $64,000 — Here’s The Resistance Level To Watch

The Bitcoin price performance has been uninspiring in the past week, mirroring the broader cryptocurrency market climate. However, the premier cryptocurrency seems to be ending the week on a high note following an unexpected Friday rally. The price of BTC appears to have received a breath of fresh air following Federal Reserve Chairman Jerome Powell’s Jackson Hole speech, finding its way above the $64,000 mark — again — with an almost 7% surge. The question now is — how far can the Bitcoin price climb? Here’s Why $66,250 Is A Crucial Level For BTC Prominent crypto analyst Ali Martinez took to the X platform to share an interesting prognosis for the Bitcoin price over the next few days. The relevant indicator here is the Glassnode “UTXO Realized Price Distribution” (URPD) metric, which monitors the amount of a particular cryptocurrency that was purchased at a given price level. Related Reading: Is A Bitcoin (BTC) Negative Correlation With Stocks A Bullish Signal? Analyst Reveals Typically, the likelihood for a price level to act as an on-chain support or resistance zone depends on the number of coins that have their cost basis at the specific level. For context, the cost basis of an investor refers to the original price (including the transaction fees) at which they acquired a coin or token. Price levels beneath the current spot value with substantial buying activity will likely act as support zones. On the other hand, levels above the current price could prove to be significant resistance areas. The chart below depicts the distribution of Bitcoin at different price levels surrounding the recent spot price of the coin. Based on data from the highlighted chart, $64,045 and $66,250 seem to be the next crucial resistance levels to watch. While it appears that the Bitcoin price has flipped the $64,045 resistance wall, the $66,250 zone remains to be breached. According to data from Glassnode, nearly 382,000 coins were moved within the $66,250 price area. The last time BTC climbed above the $66,250 level, it traveled as high as the $70,000 mark before it encountered some resistance. It would be interesting to see how far the price of the premier cryptocurrency would go this time, especially considering that there is no major resistance wall above the $66,250 area based on the URPD indicator. Bitcoin Price At A Glance As of this writing, the price of Bitcoin is around the $64,000 mark, reflecting an almost 7% increase in the past 24 hours. This single-day performance has also shown on the weekly timeframe, with the flagship cryptocurrency climbing by nearly 10% in the past week. Related Reading: Crypto Analyst Predicts 42,263% Breakout For XRP Price To $280, Here’s The Roadmap Featured image from iStock, chart from TradingView

The Bitcoin price performance has been uninspiring in the past week, mirroring the broader cryptocurrency market climate. However, the premier cryptocurrency seems to be ending the week on a high note following an unexpected Friday rally.

The price of BTC appears to have received a breath of fresh air following Federal Reserve Chairman Jerome Powell’s Jackson Hole speech, finding its way above the $64,000 mark — again — with an almost 7% surge. The question now is — how far can the Bitcoin price climb?

Here’s Why $66,250 Is A Crucial Level For BTC

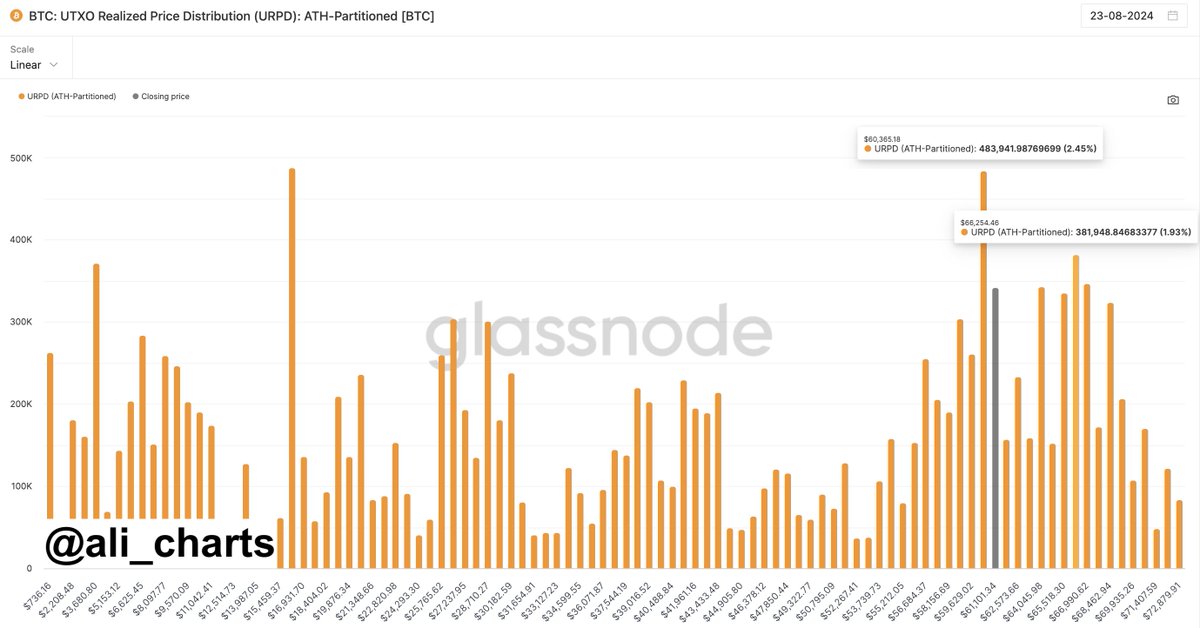

Prominent crypto analyst Ali Martinez took to the X platform to share an interesting prognosis for the Bitcoin price over the next few days. The relevant indicator here is the Glassnode “UTXO Realized Price Distribution” (URPD) metric, which monitors the amount of a particular cryptocurrency that was purchased at a given price level.

Typically, the likelihood for a price level to act as an on-chain support or resistance zone depends on the number of coins that have their cost basis at the specific level. For context, the cost basis of an investor refers to the original price (including the transaction fees) at which they acquired a coin or token.

Price levels beneath the current spot value with substantial buying activity will likely act as support zones. On the other hand, levels above the current price could prove to be significant resistance areas. The chart below depicts the distribution of Bitcoin at different price levels surrounding the recent spot price of the coin.

Based on data from the highlighted chart, $64,045 and $66,250 seem to be the next crucial resistance levels to watch. While it appears that the Bitcoin price has flipped the $64,045 resistance wall, the $66,250 zone remains to be breached. According to data from Glassnode, nearly 382,000 coins were moved within the $66,250 price area.

The last time BTC climbed above the $66,250 level, it traveled as high as the $70,000 mark before it encountered some resistance. It would be interesting to see how far the price of the premier cryptocurrency would go this time, especially considering that there is no major resistance wall above the $66,250 area based on the URPD indicator.

Bitcoin Price At A Glance

As of this writing, the price of Bitcoin is around the $64,000 mark, reflecting an almost 7% increase in the past 24 hours. This single-day performance has also shown on the weekly timeframe, with the flagship cryptocurrency climbing by nearly 10% in the past week.

What's Your Reaction?