Bitcoin Profitability Index Hits 221% – Bullish Data Reveals It’s Far From Past Cycle Peaks

Bitcoin has smashed through its all-time highs for the second day in a row, fueled by the recent US election results and a Federal Reserve interest rate cut of 25 basis points. Donald Trump’s victory has brought fresh optimism among investors, with many seeing his pro-business stance as a catalyst for Bitcoin’s ongoing rally. The […]

Bitcoin has smashed through its all-time highs for the second day in a row, fueled by the recent US election results and a Federal Reserve interest rate cut of 25 basis points. Donald Trump’s victory has brought fresh optimism among investors, with many seeing his pro-business stance as a catalyst for Bitcoin’s ongoing rally.

The recent rate cut, aimed at stimulating the economy, has also encouraged more capital to flow into risk assets like BTC, propelling its momentum.

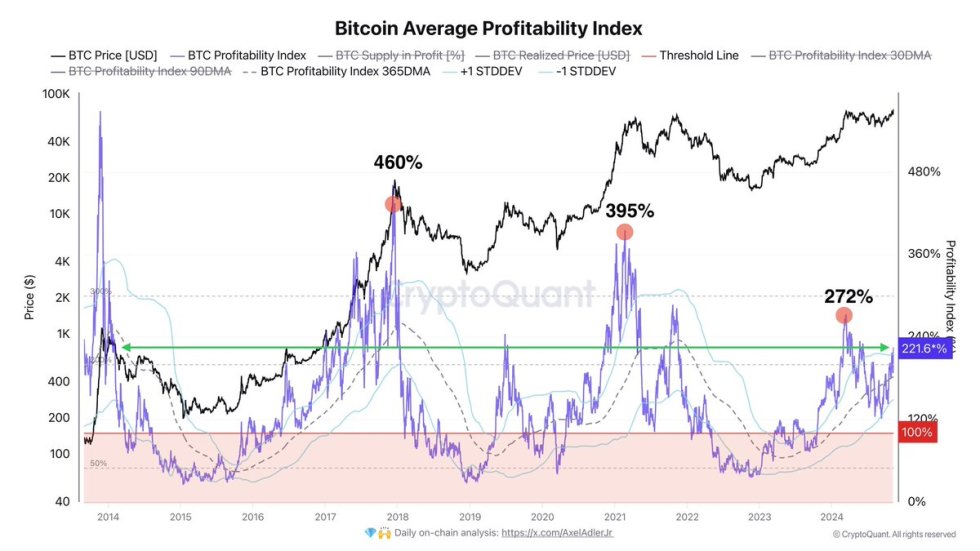

Data from CryptoQuant reveals that the Bitcoin Profitability Index is now at 221%—a striking figure, though still notably below the peaks in previous cycles. This suggests significant room for further upside, especially as bullish sentiment grows.

Investors and analysts are closely monitoring this metric, with many speculating that Bitcoin could continue climbing in the coming weeks. The next phase will be critical as BTC approaches uncharted territory, and investor optimism signals the potential for sustained gains this cycle.

Bitcoin Entering Bullish Phase

Bitcoin has entered a new bullish phase following a prolonged 7-month accumulation period, marked by a breakout to new all-time highs. This phase is underscored by insightful data from CryptoQuant analyst Axel Adler, who highlighted the Bitcoin Profitability Index’s current level of 221%.

While this is a strong profitability level, it’s still well below previous cycle peaks, which reached highs of 460% and 395%, and the most recent peak of 272%. This suggests that, despite Bitcoin’s profitability, there remains significant potential for further gains before hitting a cycle top.

Adler notes that, on average, BTC holders are seeing profitability at 121% above their initial investments, a promising sign for those expecting sustained growth. Historically, phases like this in Bitcoin’s market cycle tend to be aggressive but relatively short-lived, often lasting just a few months before reaching exhaustion.

Given this historical pattern, Adler believes that we may only be entering the initial stages of this bullish run, with considerable room left for price appreciation.

This current environment, supported by fundamental and on-chain metrics, paints an optimistic picture of Bitcoin’s potential. As BTC continues to attract investor interest, many will be watching closely to see if it can repeat the momentum of past cycles and drive toward new highs before this bullish phase peaks.

BTC Testing Price Discovery Levels

Bitcoin is trading at $76,200 after breaking above its all-time highs, confirming a strong bullish trend. Bulls are firmly in control as the price consistently holds above the $73,800 mark, the level of the previous all-time high.

This price level has proven crucial, as it has provided solid support during the recent rally, signaling strong buying interest. BTC is now only 1% away from the $77,000 mark, a key level many investors see as a significant supply zone.

The $77,000 level is important because analysts suggest it could act as a resistance point, with many investors expecting strong selling pressure around this price. A failure to break and hold above $77,000 could lead to a consolidation phase or a pullback, as BTC would likely test lower demand zones to gather the necessary fuel for the next move higher.

However, if the bulls push the price above this level and sustain it, the upward momentum could continue, potentially reaching new highs in the coming days or weeks. The market remains optimistic, but the next few days will be crucial in determining whether Bitcoin can sustain its bullish trend or face a period of consolidation.

Featured image from Dall-E, chart from TradingView

What's Your Reaction?