Bitcoin Sell-Side Pressure Dominated By New Holders, Research Shows

Bitcoin (BTC) remains resilient, trading close to the $100,000 mark despite a recent correction that led to over $500 million in liquidations, predominantly from long positions. A recent report by Glassnode analyzes the cohorts driving the sell-side pressure during this ongoing bull run. Majority Of Sell-Side Pressure Coming From New Market Entrants According to Glassnode’s report titled “The Week Onchain,” while some long-term Bitcoin holders realize substantial profits – amounting to over $2 billion in a single day – not all are willing to part with their holdings. Related Reading: Bitcoin Price Closes Above Bull Channel, Crypto Analyst Reveals What’s Next The report highlights that the Long-Term Holder (LTH) cohort is capitalizing on the inflow of liquidity and strong demand to sell BTC near all-time high (ATH) price levels. Glassnode notes: Since the peak in LTH supply set in September, this cohort has now distributed a non-trivial 507k BTC. This is a sizeable volume; however, it is smaller in scale relative to the 934k BTC spent during the rally into the March 2024 ATH. The report breaks the LTH cohort into sub-cohorts based on realized profit metrics to understand the sell-side dynamics better. It reveals that holders who acquired BTC 6 months to 1 year ago contribute the most to sell-side pressure, realizing $12.6 billion in profits, accounting for 35.3% of all realized gains. Other sub-cohorts have realized comparatively smaller profits, including $7.2 billion by those holding BTC for 1 to 2 years, $4.8 billion by those with 2 to 3 years of holdings, $6.3 billion by 3 to 5-year holders, and $4.8 billion by investors holding for more than 5 years. The report adds: The dominance of coins aged 6m-1y highlights that the majority of spending has originated from coins acquired relatively recently, highlighting that more tenured investors are remaining measured and potentially waiting patiently for higher prices. This pattern suggests that heightened profit-taking among holders in the 6-month to 1-year range indicates the cohort is dominated by newer investors, many of whom likely entered the market following the launch of Bitcoin exchange-traded funds (ETF). Their strategy appears to involve short-term gains, riding the wave of the current market surge. Bitcoin Adoption Continues To Grow Around The Globe While the recent price pullback may have cautioned some investors, others opine that it was a healthy correction that gives the leading cryptocurrency some time for consolidation before the next leg up. Related Reading: Metaplanet To Expand Bitcoin Holdings With $11.3 Million Bond Sale Bitcoin’s unprecedented price has created a shared urgency among corporations and nations worldwide. Following MicroStrategy’s tactics, Canadian company Rumble recently announced it would use a portion of excess cash reserves to buy BTC. Most recently, CEO of Marathon Digital Holdings, Fred Thiel, said institutional interest in BTC has increased significantly since Donald Trump’s victory in the 2024 elections. BTC trades at $95,462 at press time, up 2% in the past 24 hours. Featured image from Unsplash, charts from Glassnode and Tradingview.com

Bitcoin (BTC) remains resilient, trading close to the $100,000 mark despite a recent correction that led to over $500 million in liquidations, predominantly from long positions. A recent report by Glassnode analyzes the cohorts driving the sell-side pressure during this ongoing bull run.

Majority Of Sell-Side Pressure Coming From New Market Entrants

According to Glassnode’s report titled “The Week Onchain,” while some long-term Bitcoin holders realize substantial profits – amounting to over $2 billion in a single day – not all are willing to part with their holdings.

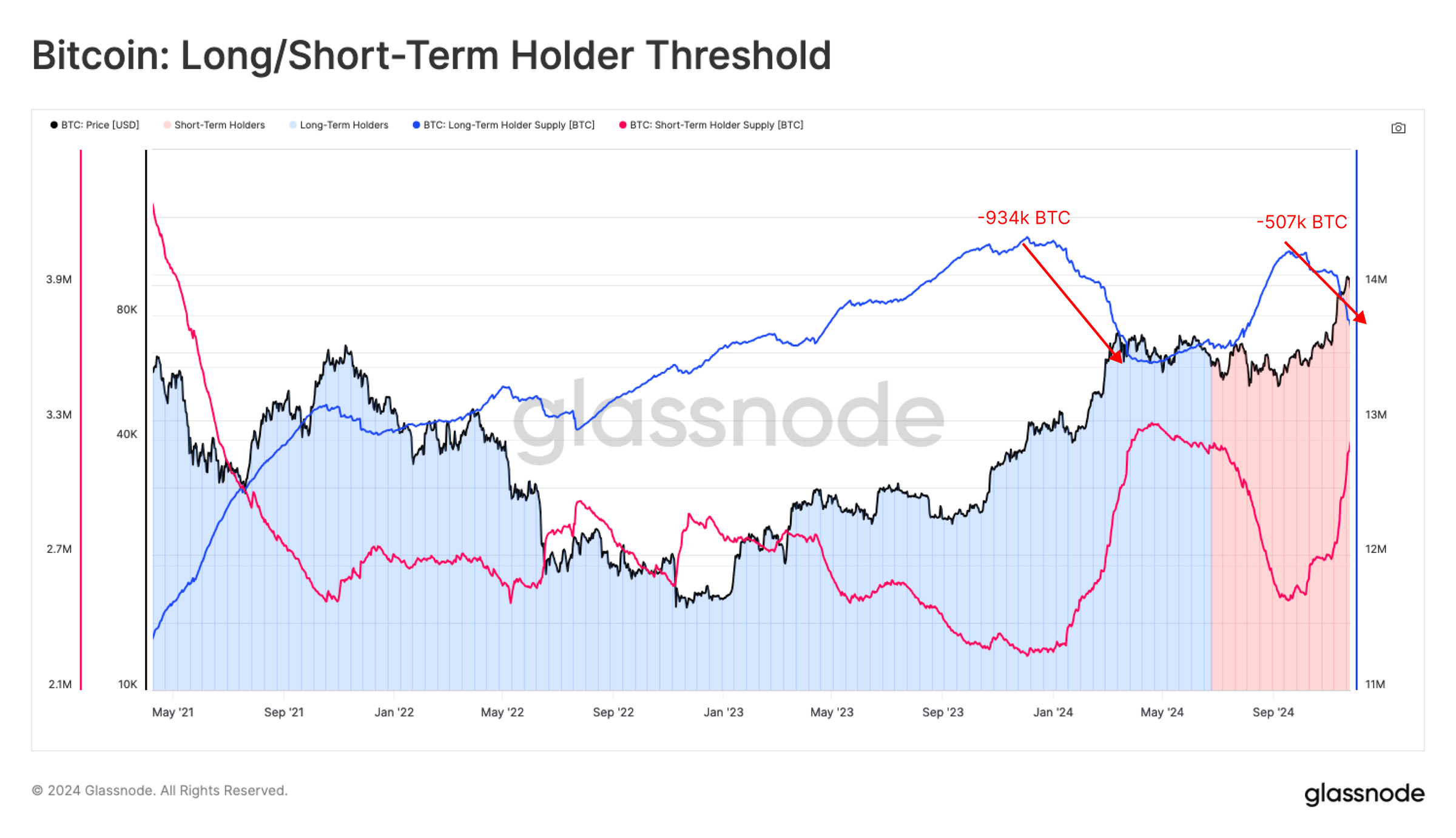

The report highlights that the Long-Term Holder (LTH) cohort is capitalizing on the inflow of liquidity and strong demand to sell BTC near all-time high (ATH) price levels. Glassnode notes:

Since the peak in LTH supply set in September, this cohort has now distributed a non-trivial 507k BTC. This is a sizeable volume; however, it is smaller in scale relative to the 934k BTC spent during the rally into the March 2024 ATH.

The report breaks the LTH cohort into sub-cohorts based on realized profit metrics to understand the sell-side dynamics better. It reveals that holders who acquired BTC 6 months to 1 year ago contribute the most to sell-side pressure, realizing $12.6 billion in profits, accounting for 35.3% of all realized gains.

Other sub-cohorts have realized comparatively smaller profits, including $7.2 billion by those holding BTC for 1 to 2 years, $4.8 billion by those with 2 to 3 years of holdings, $6.3 billion by 3 to 5-year holders, and $4.8 billion by investors holding for more than 5 years. The report adds:

The dominance of coins aged 6m-1y highlights that the majority of spending has originated from coins acquired relatively recently, highlighting that more tenured investors are remaining measured and potentially waiting patiently for higher prices.

This pattern suggests that heightened profit-taking among holders in the 6-month to 1-year range indicates the cohort is dominated by newer investors, many of whom likely entered the market following the launch of Bitcoin exchange-traded funds (ETF). Their strategy appears to involve short-term gains, riding the wave of the current market surge.

Bitcoin Adoption Continues To Grow Around The Globe

While the recent price pullback may have cautioned some investors, others opine that it was a healthy correction that gives the leading cryptocurrency some time for consolidation before the next leg up.

Bitcoin’s unprecedented price has created a shared urgency among corporations and nations worldwide. Following MicroStrategy’s tactics, Canadian company Rumble recently announced it would use a portion of excess cash reserves to buy BTC.

Most recently, CEO of Marathon Digital Holdings, Fred Thiel, said institutional interest in BTC has increased significantly since Donald Trump’s victory in the 2024 elections. BTC trades at $95,462 at press time, up 2% in the past 24 hours.

What's Your Reaction?