Bitcoin Sentiment Enters Danger Zone: Investors Now Extremely Greedy

Data shows the Bitcoin investor sentiment has entered extreme greed territory following the asset’s surge to a new all-time high (ATH). Bitcoin Fear & Greed Index Is Now Pointing At ‘Extreme Greed’ The “Fear & Greed Index” is an indicator created by Alternative that tells us about the average sentiment among the traders in the Bitcoin and the wider cryptocurrency sectors. This index represents the sentiment as a score between zero and hundred. To calculate the score, the metric uses data from the following five factors: volatility, trading volume, market cap dominance, social media sentiment, and Google Trends. When the indicator’s value is greater than 53, it means the investors share a sentiment of greed right now. On the other hand, the metric being below 47 suggests the market is currently observing fear. Naturally, the index between these two regions implies a net neutral mentality. Related Reading: Dogecoin Descending Triangle Could Hint At Next Destination For DOGE Besides these three core sentiments, there are two special zones: extreme greed and fear. The former occurs at values above 75, while the latter is under 25. Now, here is what the Bitcoin Fear & Greed Index is like right now: As is visible above, the indicator is at a value of 77, which suggests the traders in the sector are currently holding a sentiment of extreme greed. This is a change from yesterday when the market was still inside the normal greed region. Here is a chart that shows how the index’s value has changed over the past year: Historically, the extreme sentiments have proven significant for Bitcoin, as major price tops and bottoms in the asset have tended to occur inside these zones. Thus, the relationship between sentiment and price has been an inverse one, however, meaning that extreme greed has led to tops, while extreme fear has paved the way for bottoms. From the above graph, it’s apparent that the Fear & Greed Index had surged high into the extreme greed territory when Bitcoin had topped out in the first quarter of this year. Related Reading: Bitcoin Records $75,000 All-Time High: Here’s If BTC Is ‘Overheated’ Now It’s possible that, with the market once again becoming too hyped about the cryptocurrency after the latest all-time high (ATH) break, another top could form for BTC. Generally, however, major tops only occur when the index hits particularly high levels. The top above, for instance, took place alongside a value of 88. Thus, it’s possible that sentiment could still have room to heat up, before the rally hits a major obstacle. BTC Price At the time of writing, Bitcoin is floating around $75,900, up 8% over the last seven days. Featured image from Dall-E, Alternative.me, chart from TradingView.com

Data shows the Bitcoin investor sentiment has entered extreme greed territory following the asset’s surge to a new all-time high (ATH).

Bitcoin Fear & Greed Index Is Now Pointing At ‘Extreme Greed’

The “Fear & Greed Index” is an indicator created by Alternative that tells us about the average sentiment among the traders in the Bitcoin and the wider cryptocurrency sectors.

This index represents the sentiment as a score between zero and hundred. To calculate the score, the metric uses data from the following five factors: volatility, trading volume, market cap dominance, social media sentiment, and Google Trends.

When the indicator’s value is greater than 53, it means the investors share a sentiment of greed right now. On the other hand, the metric being below 47 suggests the market is currently observing fear. Naturally, the index between these two regions implies a net neutral mentality.

Besides these three core sentiments, there are two special zones: extreme greed and fear. The former occurs at values above 75, while the latter is under 25.

Now, here is what the Bitcoin Fear & Greed Index is like right now:

As is visible above, the indicator is at a value of 77, which suggests the traders in the sector are currently holding a sentiment of extreme greed. This is a change from yesterday when the market was still inside the normal greed region.

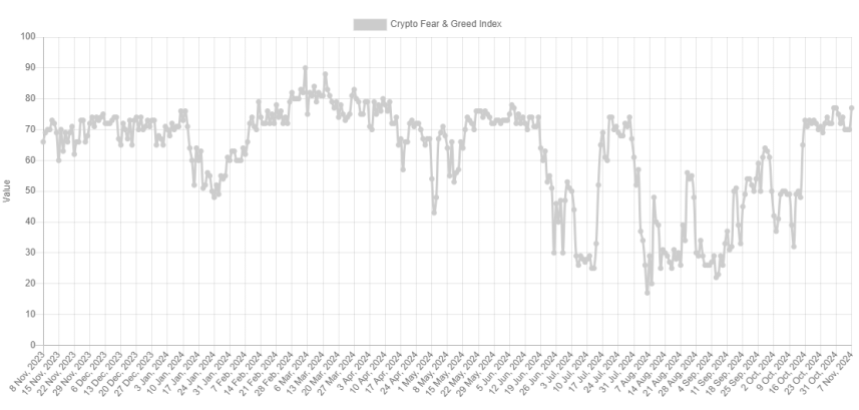

Here is a chart that shows how the index’s value has changed over the past year:

Historically, the extreme sentiments have proven significant for Bitcoin, as major price tops and bottoms in the asset have tended to occur inside these zones.

Thus, the relationship between sentiment and price has been an inverse one, however, meaning that extreme greed has led to tops, while extreme fear has paved the way for bottoms.

From the above graph, it’s apparent that the Fear & Greed Index had surged high into the extreme greed territory when Bitcoin had topped out in the first quarter of this year.

It’s possible that, with the market once again becoming too hyped about the cryptocurrency after the latest all-time high (ATH) break, another top could form for BTC.

Generally, however, major tops only occur when the index hits particularly high levels. The top above, for instance, took place alongside a value of 88. Thus, it’s possible that sentiment could still have room to heat up, before the rally hits a major obstacle.

BTC Price

At the time of writing, Bitcoin is floating around $75,900, up 8% over the last seven days.

What's Your Reaction?