Bitcoin Sharks & Whales Unfazed By Sub-$60,000 Crash, Data Reveals

On-chain data shows the Bitcoin sharks and whales have continued to hold strong despite the asset’s price surge. Bitcoin Sharks & Whales Have Been Increasing Their Holdings Recently According to data from the on-chain analytics firm Santiment, the BTC sharks and whales have been participating in accumulation during the past month. The indicator of relevance […]

On-chain data shows the Bitcoin sharks and whales have continued to hold strong despite the asset’s price surge.

Bitcoin Sharks & Whales Have Been Increasing Their Holdings Recently

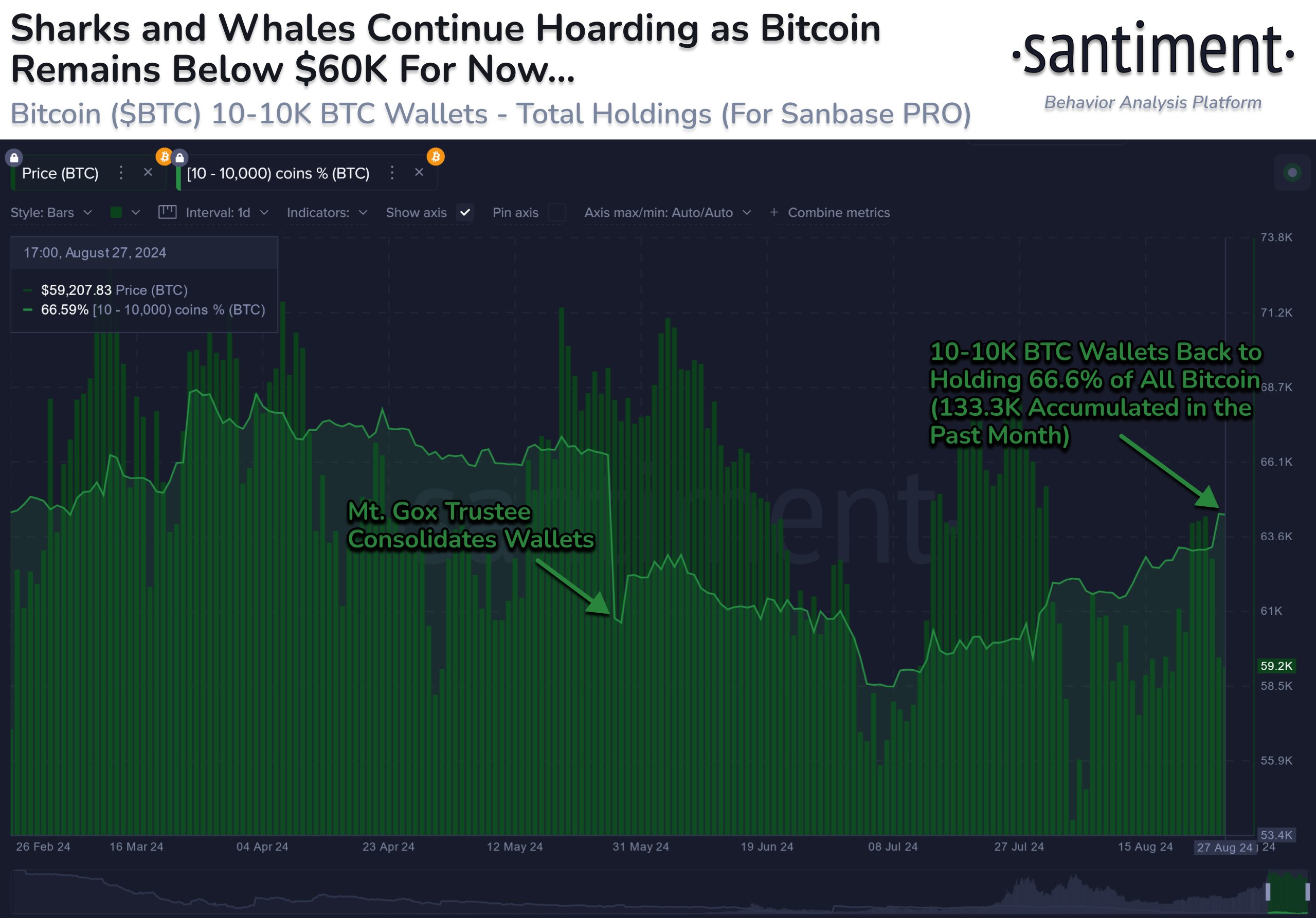

According to data from the on-chain analytics firm Santiment, the BTC sharks and whales have been participating in accumulation during the past month. The indicator of relevance here is the “Supply Distribution,” which tells us about the percentage of the total Bitcoin supply that a given wallet group is holding.

The addresses or investors are divided into these groups based on the number of coins they have in their balance right now. For instance, the 1 to 10 coins cohort includes all wallets holding between 1 and 10 BTC.

In the context of the current topic, the combined group holding in the 10 to 10,000 coins range is of interest. At the current exchange rate, the lower end converts to $598,000, and the upper one to $598 million.

This range includes some key investor groups, like sharks and whales, who are considered to be influential entities in the market because of the scale of their holdings. Naturally, the whales are the more powerful of the two, as they are larger than the sharks.

Given their position on the network, the behavior of these entities can be worth monitoring, as it may affect the asset’s price. One way to do so is through Supply Distribution.

Below is the chart shared by the analytics firm for the supply distribution of Bitcoin investors, which is between 10 and 10,000 BTC.

As the above graph shows, the Bitcoin supply held by investors like sharks and whales has been on the rise recently. Over the past month, these investors have added around 133,300 tokens to their holdings.

This accumulation has also not been broken by the latest BTC plunge, as the Supply Distribution for the 10 to 10,000 coins cohort has still been registering a net increase. This would suggest that the large investors aren’t particularly worried about the bearish price action.

The coins that these holders have been buying must have come from somewhere. According to Santiment, the source of the tokens is the smaller investors (less than 10 BTC) impatiently selling to the large hands.

The recent confidence from sharks and whales is naturally a positive sign for Bitcoin, but the indicator can still be monitored in the coming days. A reversal in its value could lead to a bearish outcome instead, as it would imply that the key holders have decided to sell the asset.

BTC Price

At the time of writing, Bitcoin is trading at around $60,100, down 2% over the past week.

What's Your Reaction?