Bitcoin Shrugs Mt. Gox Fears: Why Is Daily BTC Exchange Inflow So Low?

Bitcoin defies gravity and is surprisingly resilient against a wave of selling pressure from the Mt. Gox distribution. As of writing, not only is BTC firm above $60,000 but has managed to stand above $62,500, a level of interest especially by traders. So far, Bitcoin remains in an uptrend, and upbeat traders are looking at […]

Bitcoin defies gravity and is surprisingly resilient against a wave of selling pressure from the Mt. Gox distribution.

As of writing, not only is BTC firm above $60,000 but has managed to stand above $62,500, a level of interest especially by traders. So far, Bitcoin remains in an uptrend, and upbeat traders are looking at $66,000 and $72,000 in the coming sessions.

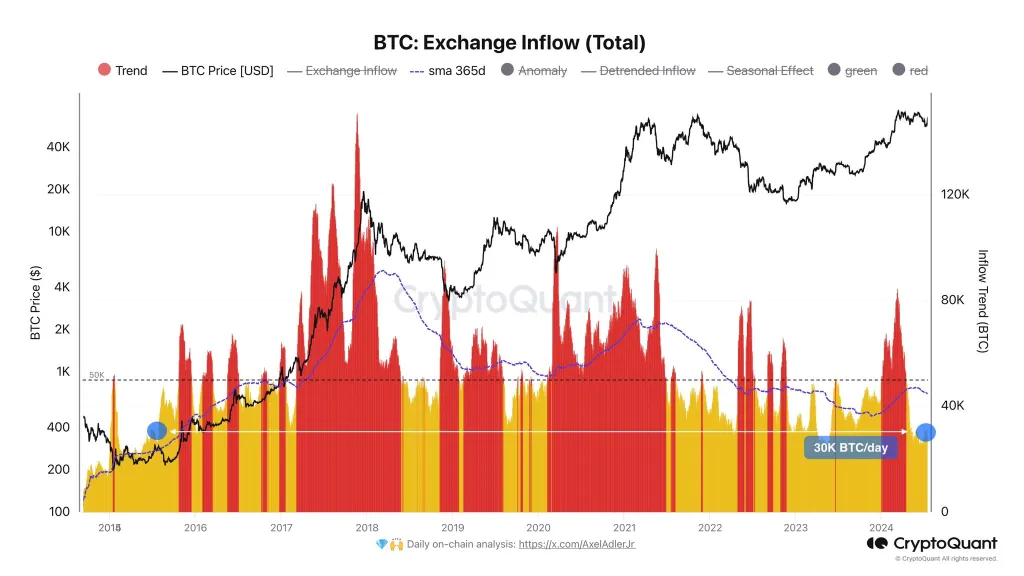

Bitcoin Daily Flow Is Very Low As Retail Activity Remains Suppressed

While Mt. Gox creditors are distributing coins to victims of the 2014 hack via exchanges like Kraken, one analyst is picking out another development.

From on-chain data, it appears that the daily BTC exchange inflow is at unusually low levels, averaging around 30,000 BTC. Interestingly, this comes as reports show that Mt. Gox has successfully reimbursed roughly 65% of victims.

The low daily inflow of BTC means that even if Mt. Gox is moving coins to victims, it is highly likely that their impact won’t fall in the markets. Subsequently, Bitcoin would continue edging higher, potentially breaking above immediate liquidation lines.

At the same time, other data show that retail activity is low, not as expected now that there was fear of Mt. Gox wreaking the market. This means that retailers risk missing out on buying Mt. Gox victims.

Instead, large institutions, including spot Bitcoin ETF issuers, could take advantage and scoop coins from willing sellers.

Crypto Market Has Matured, Mt. Gox BTC Distribution Will Be Absorbed

Nonetheless, others attribute the low retail activity to the resilience of Mt. Gox victims and their unwillingness to sell. These BTC holders were among the early adopters of BTC and other crypto assets.

Accordingly, they are more likely to be driven by the coin’s value proposition and what holding BTC means. Most of these entities would prefer to HODL and not look to sell immediately, propping up buyers.

Beyond this preview, Ki Young Ju is convinced the impact of Mt. Gox distribution is overblown. In a post on X, the CEO of CryptoQuant said the Bitcoin market cap has been growing rapidly, outpacing the realized cap over the years.

This development points to high demand. To illustrate this fact, prices are up 3.5X from 2023, though over $224 billion of BTC was sold. The CEO observed that markets are maturing and can sufficiently absorb huge selling pressure, regardless of source.

What's Your Reaction?