Bitcoin SV: Altcoin Boasts 10% Gains As Rest Of The Market Falters – Details

As the market rebound slows, Bitcoin SV captured some momentum and gaining some ground against the bears today, August 8. The coin has been up more than 10% since last month, a huge advantage in the market’s hostile environment. Related Reading: Aave Protocol Unfazed By Market Jitters, Surges 21% Bitcoin SV is a hard fork of Bitcoin Cash which is also a fork of Bitcoin itself. BSV, however, has traits unique to itself, unlike its close cousins that make it more attractive to businesses. Solving Real World Problems With On-Chain Solutions President of the Blockchain Association Uganda Reginald Tumusiime discussed his organization’s project, the KitePesa, a stablecoin backed by the Ugandan shilling. According to him, most of the countries in Subsaharan Africa have been exploring central bank digital currency (CBDC) projects as a form of currency. This institutional interest in blockchain tech and stablecoins are the factors that KitePesa will leverage for further development. The project has its merits. The Ugandan people have been switching to digital banking which offers the same features as traditional banks but with convenience as mobile phones become more and more prevalent. In 2023, customers of mobile money providers reached 42.9 million with the figure expected to rise in the coming decades. KitePesa will leverage institutional interest to build a reliable blockchain infrastructure that operates and functions much better than traditional mobile money networks. With Uganda’s robust regulatory framework regarding payments and the technologies involved, KitePesa has regulatory backing to operate in a legal environment. The project will be launched on the BSV Blockchain, integrating the somewhat local project into the international market which may invest as they see potential in KitePesa. Continuation Rally Might Happen At These Levels BSV could be faced with a breakthrough and is attempting to settle between $40.29 and $45.30. If the bulls are successful in taking this position, we might see further upward movement in the coming days or weeks. However, the market still has its doubts with the total market cap of the crypto market seeing a measly 0.2% gain in the past 24 hours as Bitcoin and Ethereum recover at a snail’s pace. In private equity, indices, futures, and commodities are experiencing hiccups as the market expects more volatility ahead and after the release of several macro indicators. Related Reading: Polkadot Developments Show Strength, Despite Coin’s 18% Loss This will hamper BSV’s short term to long-term gain as the coin moves with the broader market. The current movement is part of the outlying group of cryptocurrencies that outpaced the whole crypto market. If BSV can stabilize at the $40.29-$45.30 price range, we might see a continuation rally in the long term. But this move is still highly dependent on the broader market’s movement that is currently grinding to a halt. Investors and traders should still treat BSV with caution as it can be susceptible to any market swing both upward and downward. Featured image from Pexels, chart from TradingView

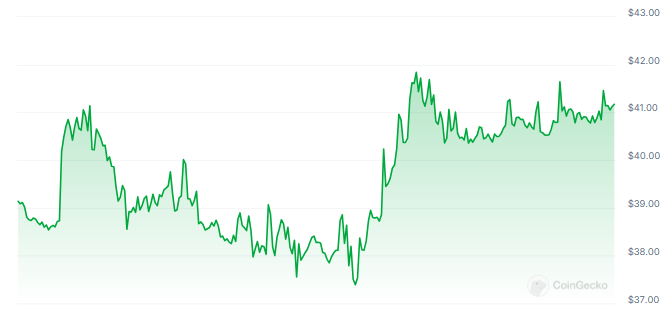

As the market rebound slows, Bitcoin SV captured some momentum and gaining some ground against the bears today, August 8. The coin has been up more than 10% since last month, a huge advantage in the market’s hostile environment.

Bitcoin SV is a hard fork of Bitcoin Cash which is also a fork of Bitcoin itself. BSV, however, has traits unique to itself, unlike its close cousins that make it more attractive to businesses.

Solving Real World Problems With On-Chain Solutions

President of the Blockchain Association Uganda Reginald Tumusiime discussed his organization’s project, the KitePesa, a stablecoin backed by the Ugandan shilling. According to him, most of the countries in Subsaharan Africa have been exploring central bank digital currency (CBDC) projects as a form of currency. This institutional interest in blockchain tech and stablecoins are the factors that KitePesa will leverage for further development.

The project has its merits. The Ugandan people have been switching to digital banking which offers the same features as traditional banks but with convenience as mobile phones become more and more prevalent. In 2023, customers of mobile money providers reached 42.9 million with the figure expected to rise in the coming decades.

KitePesa will leverage institutional interest to build a reliable blockchain infrastructure that operates and functions much better than traditional mobile money networks. With Uganda’s robust regulatory framework regarding payments and the technologies involved, KitePesa has regulatory backing to operate in a legal environment.

The project will be launched on the BSV Blockchain, integrating the somewhat local project into the international market which may invest as they see potential in KitePesa.

Continuation Rally Might Happen At These Levels

BSV could be faced with a breakthrough and is attempting to settle between $40.29 and $45.30. If the bulls are successful in taking this position, we might see further upward movement in the coming days or weeks.

However, the market still has its doubts with the total market cap of the crypto market seeing a measly 0.2% gain in the past 24 hours as Bitcoin and Ethereum recover at a snail’s pace. In private equity, indices, futures, and commodities are experiencing hiccups as the market expects more volatility ahead and after the release of several macro indicators.

This will hamper BSV’s short term to long-term gain as the coin moves with the broader market. The current movement is part of the outlying group of cryptocurrencies that outpaced the whole crypto market.

If BSV can stabilize at the $40.29-$45.30 price range, we might see a continuation rally in the long term. But this move is still highly dependent on the broader market’s movement that is currently grinding to a halt.

Investors and traders should still treat BSV with caution as it can be susceptible to any market swing both upward and downward.

Featured image from Pexels, chart from TradingView

What's Your Reaction?