Bitcoin Takes A Beating: Another $630 Million Exits, Price Drops Lower

The once-sizzling crypto market continues to sputter, with Bitcoin, the undisputed king of the digital realm, leading the retreat. After a euphoric climb that saw it breach the $73,000 level earlier this year, Bitcoin has shed its royal cloak, plummeting to new lows and dragging the entire crypto ecosystem into a period of frosty uncertainty. Related Reading: Solana Slides 13% – Can It Recover Despite Analyst’s $1,000 Prediction? Exodus From The Empire: Investors Pull Billions The past weeks have been marked by a mass exodus from Bitcoin. Investors, spooked by the prolonged price slump, have been fleeing the flagship cryptocurrency in droves. A recent report by CoinShares paints a bleak picture, revealing a staggering $630 million outflow from Bitcoin just last week. This follows a similarly hefty outflow of $631 million the week prior, marking a brutal two-week stretch for Bitcoin. The hemorrhaging extends beyond Bitcoin, with other prominent cryptocurrencies like Ethereum experiencing their own investor flight. The sell-off isn’t confined to individual holdings. Bitcoin exchange-traded funds (ETFs), which allow traditional investors to dabble in crypto without directly owning it, have also been hit hard. Major issuers like Fidelity and Grayscale have witnessed a six-day consecutive outflow, with hundreds of millions of dollars vanishing from their coffers. This mass exodus from both Bitcoin and Bitcoin ETFs paints a clear picture: investors are losing faith, seeking shelter from the crypto storm. A Chink In The Armor? Not Quite While the overall sentiment is undeniably bearish, there are a few glimmers of hope amidst the gloom. Short positions, which essentially bet on a price decrease, have seen a surprising decline of $1.2 million. This could be interpreted as a decrease in bearish bets, hinting at a potential shift in investor sentiment. Additionally, some altcoins like Solana, Litecoin, and Polygon have defied the downward trend, registering healthy gains. This suggests that not all bets are off the table, and some investors might be seeking opportunities in other corners of the crypto market. A Crypto Winter Thaw Or Avalanche? The crypto market is no stranger to dramatic fluctuations. Bitcoin itself has a history of epic boom-and-bust cycles. However, the current downturn raises concerns about a prolonged “crypto winter” – a period of sustained decline. Related Reading: Toncoin On Fire: Crypto Explodes To All-Time High – Can It Hit $10? Meanwhile, the much-anticipated approval of an Ethereum ETF, initially viewed as a potential market catalyst, seems to be doing little to dispel the current chill. Will investors regain their appetite for digital assets, leading to a Bitcoin-fueled thaw? Or will the current outflow snowball into a full-blown avalanche, burying the crypto market under a blanket of red? The unfolding of this crypto winter remains to be seen. Featured image from Silktide, chart from TradingView

The once-sizzling crypto market continues to sputter, with Bitcoin, the undisputed king of the digital realm, leading the retreat.

After a euphoric climb that saw it breach the $73,000 level earlier this year, Bitcoin has shed its royal cloak, plummeting to new lows and dragging the entire crypto ecosystem into a period of frosty uncertainty.

Exodus From The Empire: Investors Pull Billions

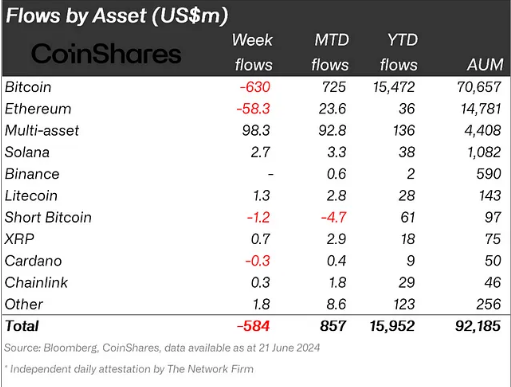

The past weeks have been marked by a mass exodus from Bitcoin. Investors, spooked by the prolonged price slump, have been fleeing the flagship cryptocurrency in droves. A recent report by CoinShares paints a bleak picture, revealing a staggering $630 million outflow from Bitcoin just last week.

This follows a similarly hefty outflow of $631 million the week prior, marking a brutal two-week stretch for Bitcoin. The hemorrhaging extends beyond Bitcoin, with other prominent cryptocurrencies like Ethereum experiencing their own investor flight.

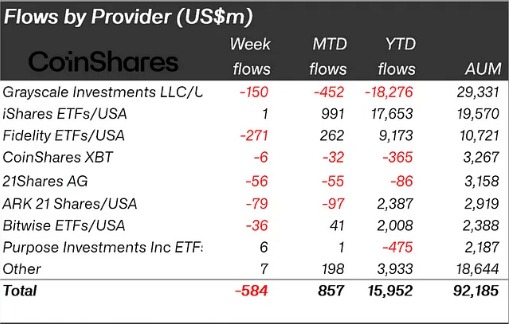

The sell-off isn’t confined to individual holdings. Bitcoin exchange-traded funds (ETFs), which allow traditional investors to dabble in crypto without directly owning it, have also been hit hard.

Major issuers like Fidelity and Grayscale have witnessed a six-day consecutive outflow, with hundreds of millions of dollars vanishing from their coffers. This mass exodus from both Bitcoin and Bitcoin ETFs paints a clear picture: investors are losing faith, seeking shelter from the crypto storm.

A Chink In The Armor? Not Quite

While the overall sentiment is undeniably bearish, there are a few glimmers of hope amidst the gloom. Short positions, which essentially bet on a price decrease, have seen a surprising decline of $1.2 million.

This could be interpreted as a decrease in bearish bets, hinting at a potential shift in investor sentiment. Additionally, some altcoins like Solana, Litecoin, and Polygon have defied the downward trend, registering healthy gains. This suggests that not all bets are off the table, and some investors might be seeking opportunities in other corners of the crypto market. A Crypto Winter Thaw Or Avalanche?

The crypto market is no stranger to dramatic fluctuations. Bitcoin itself has a history of epic boom-and-bust cycles. However, the current downturn raises concerns about a prolonged “crypto winter” – a period of sustained decline.

Meanwhile, the much-anticipated approval of an Ethereum ETF, initially viewed as a potential market catalyst, seems to be doing little to dispel the current chill.

Will investors regain their appetite for digital assets, leading to a Bitcoin-fueled thaw? Or will the current outflow snowball into a full-blown avalanche, burying the crypto market under a blanket of red? The unfolding of this crypto winter remains to be seen.

Featured image from Silktide, chart from TradingView

What's Your Reaction?