Bitcoin Wallet Wakes Up After 10.8 Years: How Much Profit Did It Make?

On-chain data shows a Bitcoin wallet has suddenly moved coins dormant for 10.8 years. Here’s how much profit it made on its investment. Bitcoin Wallet With 24 BTC In Balance Has Come Alive After 10.8 Years According to data from the cryptocurrency transaction tracker service Whale Alert, a BTC address has just moved out coins […]

On-chain data shows a Bitcoin wallet has suddenly moved coins dormant for 10.8 years. Here’s how much profit it made on its investment.

Bitcoin Wallet With 24 BTC In Balance Has Come Alive After 10.8 Years

According to data from the cryptocurrency transaction tracker service Whale Alert, a BTC address has just moved out coins after a long wait of 10.8 years. The wallet had a balance of around 24 BTC and cleared itself out with its latest transaction.

Below are the details related to this transfer.

The wallet’s first transaction dates back to November 16, 2013, and it’s only now that the investor has decided to move the 24 BTC they deposited into it.

The address received these coins when Bitcoin traded around $438.83, meaning the holder would have bought the stack for $10,915. Today, Bitcoin’s value magnifies more, so the same 24 BTC stack is now worth a whopping $1.46 million.

This represents a massive increase of 13,245%, or $1.45 million. The investor has won big, but whether this resulted from HODLing is uncertain.

Statistically, coins that age past the seven-year mark will likely have done so by being lost, either through misplaced keys or by simply forgetting their existence.

Thus, it’s possible that this wallet, carrying tokens older than ten years, had become lost for at least a good portion of this time before being rediscovered by the original investor or someone else.

If the investor were sitting on these coins of their own volition for all this time, they would indeed be diamond hands among diamond hands.

It’s unclear why the holder has moved these coins out of the wallet, but given the large scale of profits the investment has amassed, they may be cashing out.

Selling from this investor should be of no consequence to the market, however, as the amount, while not too small in absolute terms, is still just a drop in the ocean compared to the total amount of capital invested into Bitcoin.

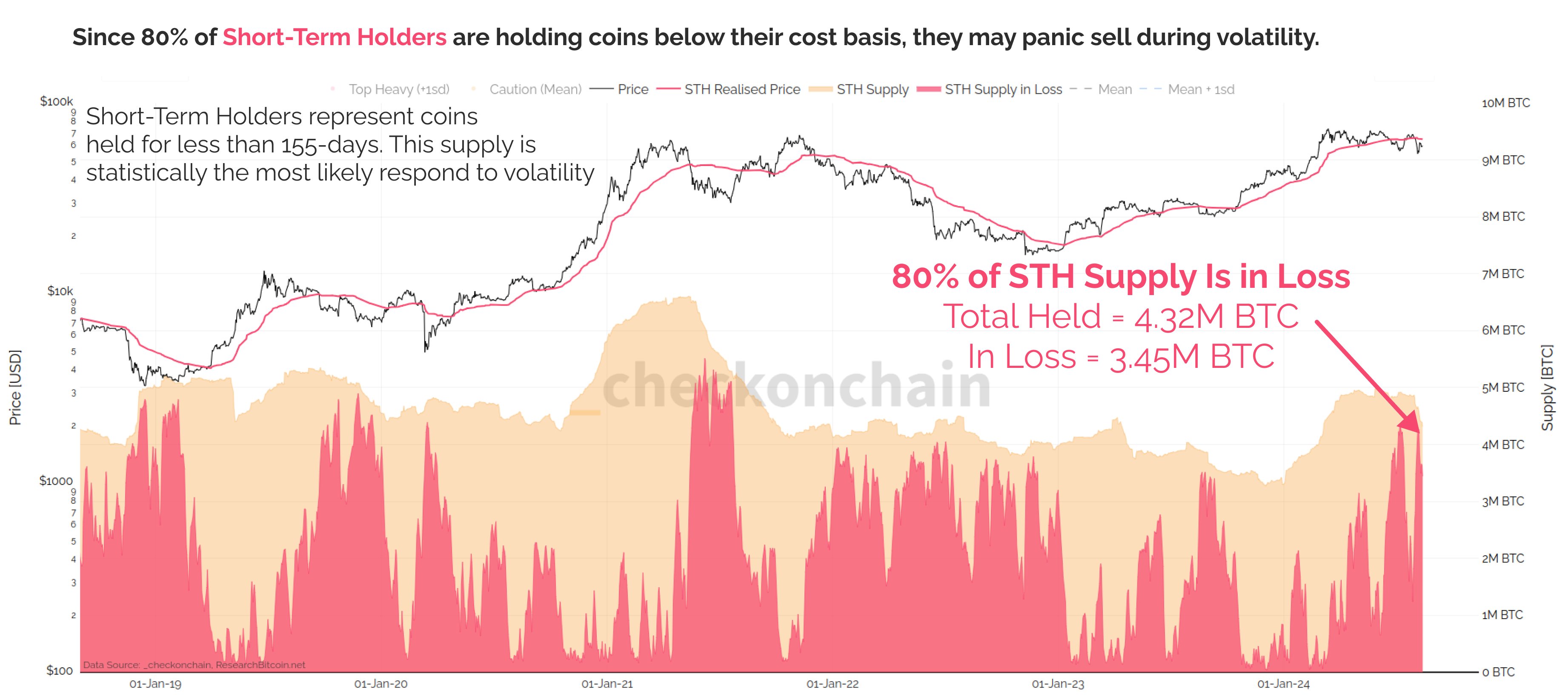

In some other news, as on-chain analyst Checkmate pointed out in an X post, around 80% of the Bitcoin short-term holder supply is being held at a loss.

The short-term holders here are the Bitcoin investors who bought their coins within the past 155 days. These investors are generally the opposite of HODLers, so when many of them are in the red, they can be prone to participate in a panic selloff.

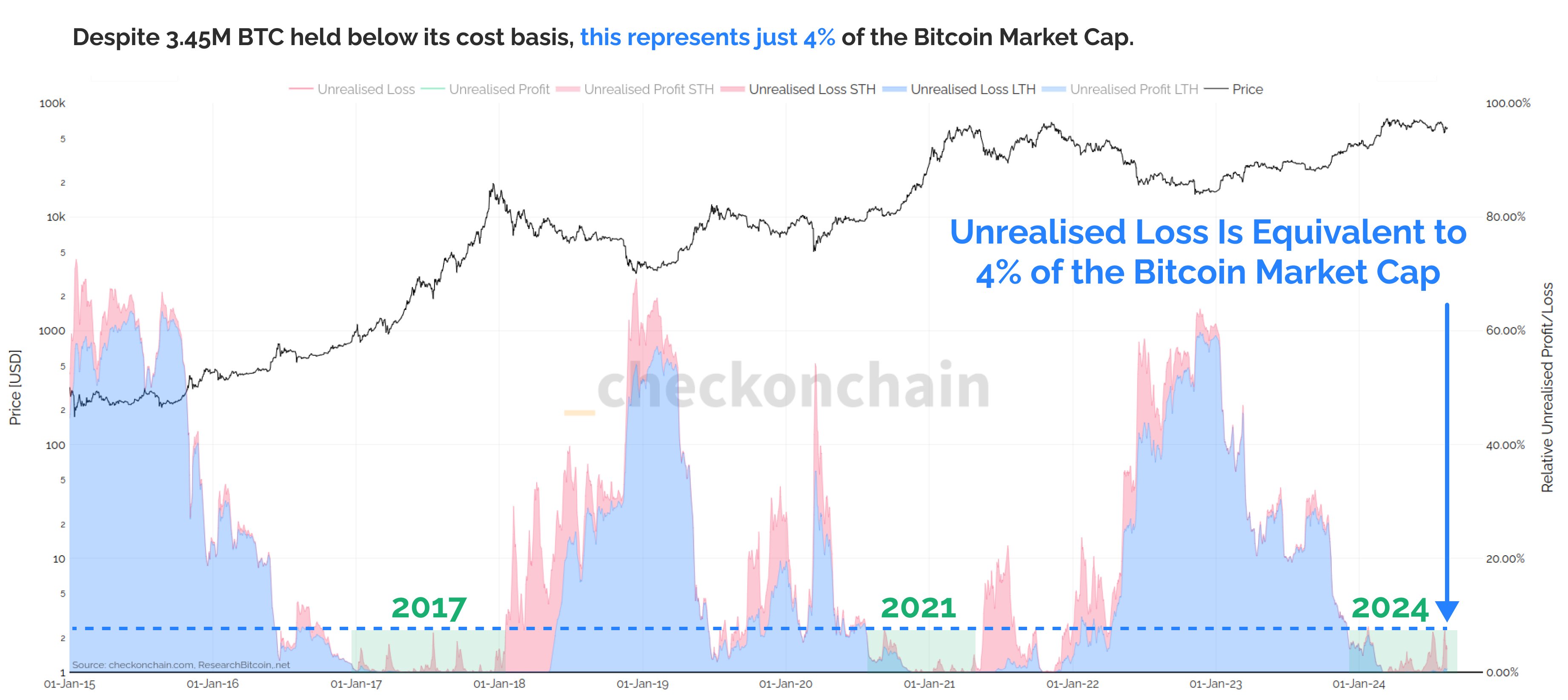

Checkmate has noted, though, that despite a large amount of them being underwater, the magnitude of the unrealized loss isn’t that much, equivalent to only 4% of the cryptocurrency’s market cap.

BTC Price

At the time of writing, Bitcoin is floating around $58,300, down almost 3% over the past 24 hours.

What's Your Reaction?