Bitcoin Whales Load Their Bags: $1.7 Billion In BTC Flow Out Of Exchanges

The price of Bitcoin — and the general market — started the week with one of the largest declines they have seen in 2024. While this broad market downturn resulted in widespread fear and panic amongst crypto enthusiasts, it appears that many investors took the opportunity to amass more digital assets at low prices. According […]

The price of Bitcoin — and the general market — started the week with one of the largest declines they have seen in 2024. While this broad market downturn resulted in widespread fear and panic amongst crypto enthusiasts, it appears that many investors took the opportunity to amass more digital assets at low prices.

According to the latest on-chain data, significant amounts of Bitcoin have moved out of cryptocurrency exchanges. The question here is — what does this mean and how does it affect the BTC price?

Are Investors Backing The Bull Run To Continue?

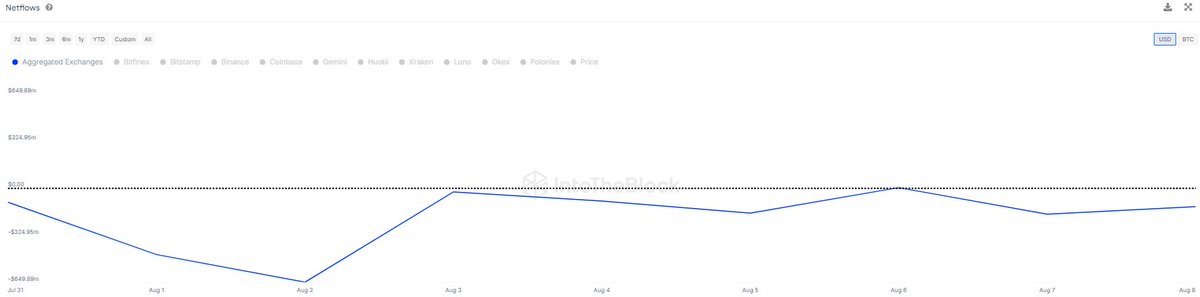

According to recent data from IntoTheBlock, more than 28,000 BTC (worth over $1.7 Billion) were transferred out of crypto exchanges in the past week. This on-chain revelation is based on changes in the Netflows metric, which monitors the amount of a particular cryptocurrency sent in and out of centralized exchanges.

An increase in the Netflows’ value (or when it is positive) signals that more funds are entering than leaving crypto exchanges. On the other hand, when the metric’s value falls below, it implies that more crypto assets are flowing out of than into trading platforms.

As shown in the chart above, the Netflows metric for Bitcoin has been on a decline over the past few days, implying that large investors have been transferring their assets from centralized exchanges. According to IntoTheBlock, the $1.7 billion in BTC withdrawn in the last seven-day period is the largest outflow seen within this timeframe so far in 2024.

Although it is difficult to tell the rationale behind this massive exodus, crypto movements of this magnitude away from centralized exchanges typically indicate a shift in investor sentiment. It suggests a change in holding strategy or even fresh accumulation by large investors, showing their faith in the long-term promise of Bitcoin.

Moreover, the decline in the availability of the premier cryptocurrency on trading platforms could result in a supply crunch. Ultimately, this fall in BTC’s exchange reserve may trigger a surge in the Bitcoin price.

Bitcoin Price At A Glance

Following a steep decline from above $64,000 to $48,000 on Monday, August 5, the price of Bitcoin has shown great resilience in the past week, fighting its way back above the $62,000 level.

As of this writing, the premier cryptocurrency stands at around $60,400, reflecting a 1% price decline in the last 24 hours. Meanwhile, data from CoinGecko shows that BTC is still down by over 3% this week.

What's Your Reaction?