Bitcoin’s Anticipated Retail Resurgence

Exploring the Potential Surge: When Will Retail Investors Return to Bitcoin and Drive Prices Higher?

Bitcoin's recent price action has been a rollercoaster of highs and lows. However, even though bitcoin has set a new all-time high and had two years of a near-constant positive trajectory, we're yet to see a consistent influx of retail investors. The potential for a surge in retail participation and the possibility of elevating the bitcoin price to unprecedented levels are prospects that many investors are anxiously anticipating. In this article, we're going to explore when we might see these retail investors dive back into the bitcoin pool and whether their return could indeed propel BTC to even greater heights.

Active Address Growth and its Impact

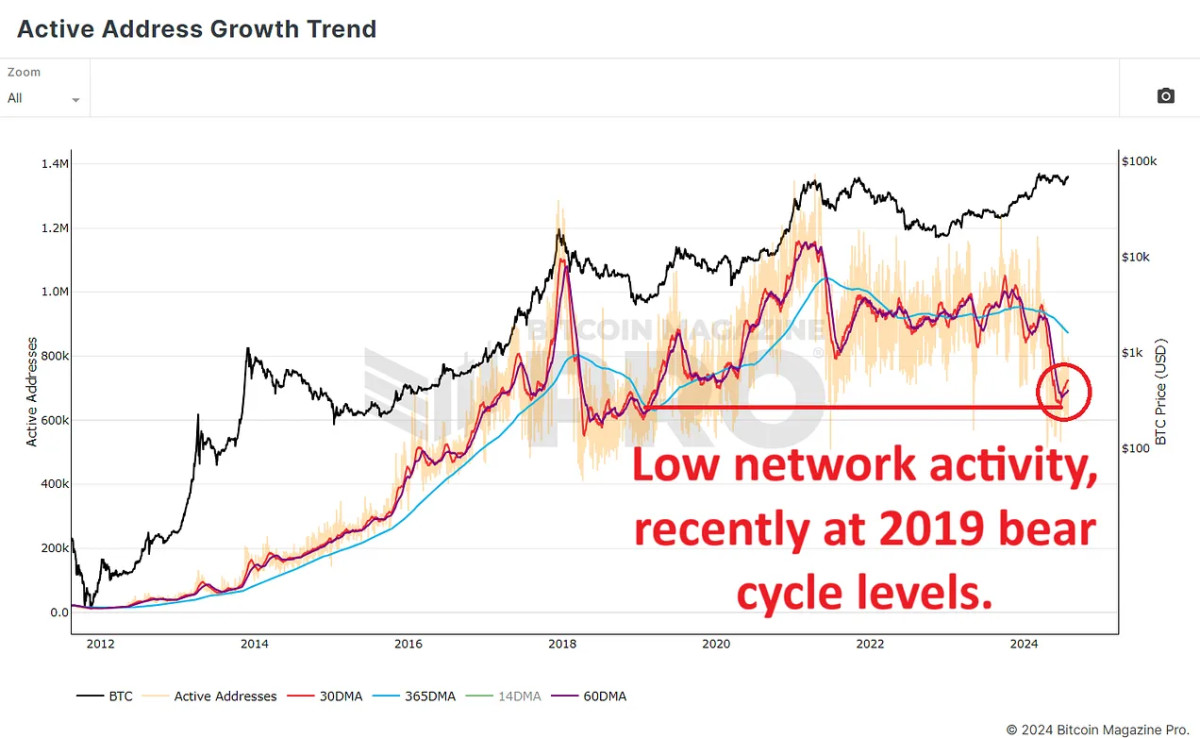

To anticipate this potential retail wave, it's important to scrutinize the trend of active address growth. Data sourced from Bitcoin Magazine Pro suggests a downward swing in the number of active network participants in recent months. The 365-day moving average (blue line), along with the 60-day (purple line) and 30-day averages (red line), tell a tale of decreased network activity. This drop takes the count of active users back to levels reminiscent of early 2019, following bitcoin's bear cycle, when prices hovered between $3,500 to $4,000.

This decline in active network users raises eyebrows about bitcoin's upside potential in the current cycle. Interestingly, despite bitcoin hitting a new record of roughly $74,000, there was no corresponding sustained uptick in network users, a stark departure from previous cycles.

What's Your Reaction?