CRV Dumps 50% In 1 Year: Founder’s Forced Liquidations A Pain For Holders

CRV, the native token of Curve, a stablecoin decentralized exchange (DEX), is under immense selling pressure. After the hack of July 2023, CRV has never been the same again. However, the painful liquidations of Michael Erogov’s loans have worsened the situation for holders. Curve Founder Forced To Sell $677,000 Of CRV, Token Falling After the forced liquidation in mid-June, which pushed prices below $0.30, data showed that the founder was also forced to sell CRV in the market to repay part of his loan. Yesterday, on July 25, Lookonchain data showed that Erogov was liquidated for $677,000 worth of CRV. Currently, CRV continues to print, discouraging lower lows. Even though the dump has not been as rapid as in June, the token is weak and could plunge below crucial support levels. For now, this level is at the double bottom at $0.21. On the upper end, resistance lies at $0.30. Interestingly, this resistance level served as support in June when prices slammed through the floor, accelerated by Erogov’s loans being liquidated. Then, due to the amount in the picture, there was fear across the crypto board that the founder’s loans would further destabilize the protocol, negatively impacting CRV holders. On-chain data shows that Erogov had borrowed roughly $100 million in stablecoins using $140 million in CRV as collateral. Some claim the founder bought prime real estate with this loan. Related Reading: Solana Set For 900% Rally With Breakout From This Pattern — Analyst However, what’s known is that the series of forced liquidations and the scramble by the founder to offload CRV, which allowed him to be liquidated after the hack, forced prices even lower. Hopes On Spot Ethereum ETFs And Community Initiatives Since the hack on July 30, CRV has cratered by over 50%. Holders are facing it rough now that crypto prices are also sliding, retracing from their March 2024 peaks. Selling pressure has since eased after most of the CRV collateral posted by Erogov was reclaimed by lending protocols—including Frax and Aave. However, the token is still struggling for momentum. This weakness is a concern, especially considering the positive developments this week. As an Ethereum-based DEX, the approval and trading of spot Ethereum ETFs would benefit the protocol in the long run. Beyond the derivative product opening up institutions to Ethereum, Curve is also growing in strength. Recently, the community okayed a proposal to further boost CRV liquidity by bridging the gap between Solana and Ethereum via USDT. Related Reading: Wall Street Expert Sees 20x Potential In Ripple Via XRP And IPO Through this initiative floated by Picasso Network, a pool of USDT on Solana and USDT on Ethereum was launched. The goal is to encourage cross-chain activity and provide even more incentives for liquidity providers. Feature image from Canva, chart from TradingView

CRV, the native token of Curve, a stablecoin decentralized exchange (DEX), is under immense selling pressure. After the hack of July 2023, CRV has never been the same again. However, the painful liquidations of Michael Erogov’s loans have worsened the situation for holders.

Curve Founder Forced To Sell $677,000 Of CRV, Token Falling

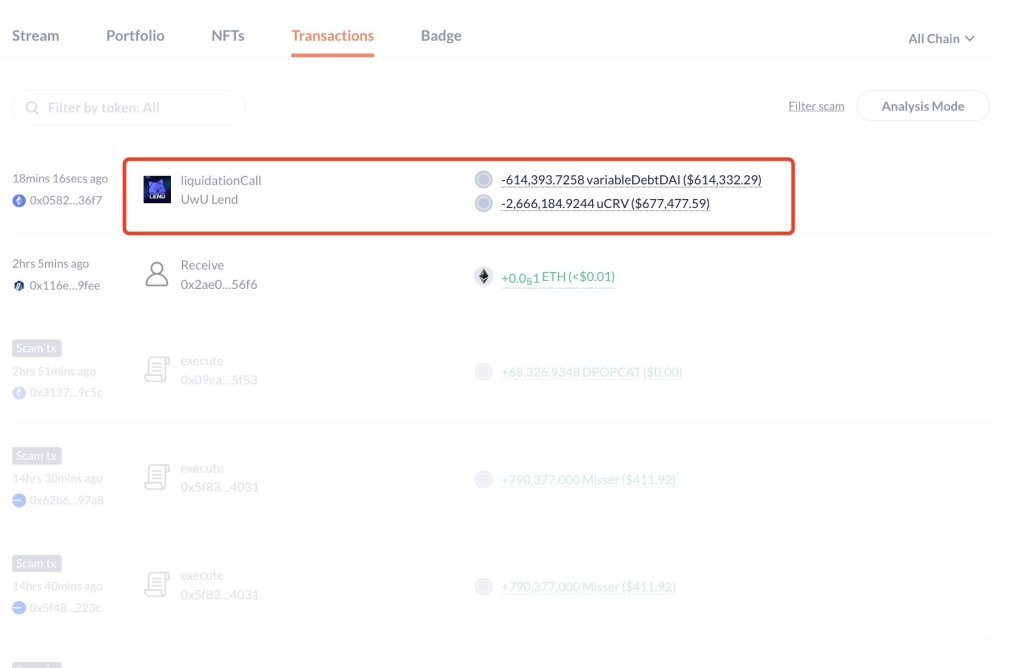

After the forced liquidation in mid-June, which pushed prices below $0.30, data showed that the founder was also forced to sell CRV in the market to repay part of his loan. Yesterday, on July 25, Lookonchain data showed that Erogov was liquidated for $677,000 worth of CRV.

Currently, CRV continues to print, discouraging lower lows. Even though the dump has not been as rapid as in June, the token is weak and could plunge below crucial support levels. For now, this level is at the double bottom at $0.21. On the upper end, resistance lies at $0.30.

Interestingly, this resistance level served as support in June when prices slammed through the floor, accelerated by Erogov’s loans being liquidated. Then, due to the amount in the picture, there was fear across the crypto board that the founder’s loans would further destabilize the protocol, negatively impacting CRV holders.

On-chain data shows that Erogov had borrowed roughly $100 million in stablecoins using $140 million in CRV as collateral. Some claim the founder bought prime real estate with this loan.

However, what’s known is that the series of forced liquidations and the scramble by the founder to offload CRV, which allowed him to be liquidated after the hack, forced prices even lower.

Hopes On Spot Ethereum ETFs And Community Initiatives

Since the hack on July 30, CRV has cratered by over 50%. Holders are facing it rough now that crypto prices are also sliding, retracing from their March 2024 peaks.

Selling pressure has since eased after most of the CRV collateral posted by Erogov was reclaimed by lending protocols—including Frax and Aave. However, the token is still struggling for momentum.

This weakness is a concern, especially considering the positive developments this week. As an Ethereum-based DEX, the approval and trading of spot Ethereum ETFs would benefit the protocol in the long run.

Beyond the derivative product opening up institutions to Ethereum, Curve is also growing in strength. Recently, the community okayed a proposal to further boost CRV liquidity by bridging the gap between Solana and Ethereum via USDT.

Through this initiative floated by Picasso Network, a pool of USDT on Solana and USDT on Ethereum was launched. The goal is to encourage cross-chain activity and provide even more incentives for liquidity providers.

What's Your Reaction?