Crypto Carnage: Nearly $200 Million Liquidated as Bitcoin Slips Below $61,000

In a turbulent 24-hour trading session, the cryptocurrency market saw nearly $200 million wiped out in liquidations as Bitcoin price dropped below $61,000. This sharp decline triggered a wave of liquidations, affecting many investors and traders. Market Meltdown And Crypto Liquidation The total market valuation has plunged by approximately 2.7% to around $2.34 trillion, underscoring heightened volatility and market stress. Related Reading: Bitcoin Price Drops Below $60,000: Key Reason Explained Bitcoin, leading the downturn, shed 1.3% over the week, with a steep 2.8% drop recorded in the last day. This downturn has not only decreased the value of many investors’ portfolios but has also led to substantial losses for traders via liquidations. Data from Coinglass highlights the extent of the carnage, with 59,816 traders liquidated and total liquidations amounting to $170.72 million. The liquidations were predominantly from long positions, suggesting that many traders expected the market to rally. Bitcoin traders faced approximately $45.76 million liquidations, with Ethereum and Solana traders experiencing $44.55 million and $11.09 million, respectively. The arena for these liquidations was on major exchanges like Binance, OKX, Huobi, and Bybit, with Binance traders bearing the brunt at $74.77 million. While other exchanges such as OKX, Huobi, and Bybit also experienced significant liquidations, amounting to $54.29 million, $19.28 million, and $12.93 million, respectively. Despite also facing liquidations, the smaller exchanges had a comparatively minor impact. Analysts’ Viewpoint On Bitcoin Current Performance Despite the current downturn, some market analysts remain optimistic about Bitcoin’s prospects. PlanB, a respected figure in the crypto community, reaffirmed that the bull market is still ongoing, suggesting that underlying on-chain metrics do not show any abnormalities that would indicate a prolonged bear market. Related Reading: Buckle Up: Here Is Why Bitcoin Might Just Be Gearing Up For a 200% Surge Additionally, crypto analyst Ali recently suggested on Elon Musk’s social media, X, that now might be an opportune time to buy Bitcoin, anticipating a market rebound. The TD Sequential, which told us to buy #Bitcoin at $60,000 on June 28 and sell at $63,200 on July 1, is telling us to buy $BTC again! pic.twitter.com/JJzQtVJcBh — Ali (@ali_charts) July 3, 2024 Furthermore, vocal Bitcoin advocate Samson Mow has emphasized the importance of Bitcoin in addressing fundamental economic issues, suggesting that fixing monetary systems could be the key to broader economic recovery. Governments, you can’t fix the economy because the money is broken. You must fix the money first. #Bitcoin — Samson Mow (@Excellion) July 3, 2024 His views highlight the potential of Bitcoin not only to recover but also to reach new heights in the financial landscape. Featured image created with DALL-E, Chart from TradingView

In a turbulent 24-hour trading session, the cryptocurrency market saw nearly $200 million wiped out in liquidations as Bitcoin price dropped below $61,000. This sharp decline triggered a wave of liquidations, affecting many investors and traders.

Market Meltdown And Crypto Liquidation

The total market valuation has plunged by approximately 2.7% to around $2.34 trillion, underscoring heightened volatility and market stress.

Bitcoin, leading the downturn, shed 1.3% over the week, with a steep 2.8% drop recorded in the last day. This downturn has not only decreased the value of many investors’ portfolios but has also led to substantial losses for traders via liquidations.

Data from Coinglass highlights the extent of the carnage, with 59,816 traders liquidated and total liquidations amounting to $170.72 million.

The liquidations were predominantly from long positions, suggesting that many traders expected the market to rally. Bitcoin traders faced approximately $45.76 million liquidations, with Ethereum and Solana traders experiencing $44.55 million and $11.09 million, respectively.

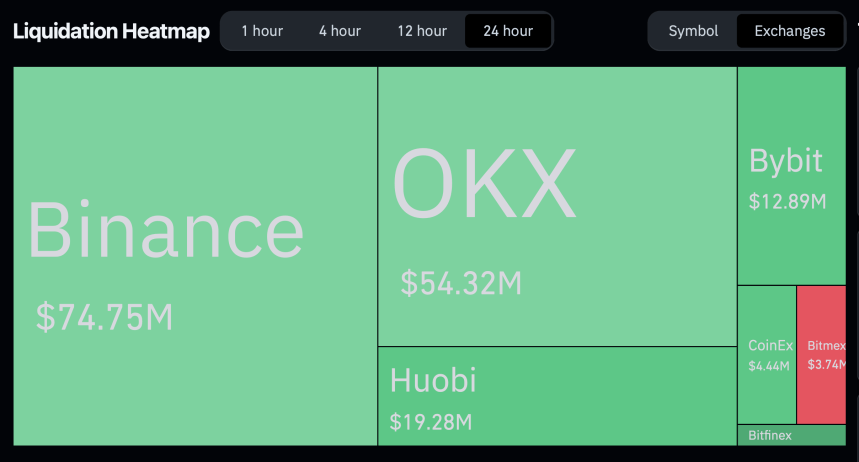

The arena for these liquidations was on major exchanges like Binance, OKX, Huobi, and Bybit, with Binance traders bearing the brunt at $74.77 million.

While other exchanges such as OKX, Huobi, and Bybit also experienced significant liquidations, amounting to $54.29 million, $19.28 million, and $12.93 million, respectively. Despite also facing liquidations, the smaller exchanges had a comparatively minor impact.

Analysts’ Viewpoint On Bitcoin Current Performance

Despite the current downturn, some market analysts remain optimistic about Bitcoin’s prospects. PlanB, a respected figure in the crypto community, reaffirmed that the bull market is still ongoing, suggesting that underlying on-chain metrics do not show any abnormalities that would indicate a prolonged bear market.

Additionally, crypto analyst Ali recently suggested on Elon Musk’s social media, X, that now might be an opportune time to buy Bitcoin, anticipating a market rebound.

The TD Sequential, which told us to buy #Bitcoin at $60,000 on June 28 and sell at $63,200 on July 1, is telling us to buy $BTC again! pic.twitter.com/JJzQtVJcBh

— Ali (@ali_charts) July 3, 2024

Furthermore, vocal Bitcoin advocate Samson Mow has emphasized the importance of Bitcoin in addressing fundamental economic issues, suggesting that fixing monetary systems could be the key to broader economic recovery.

Governments, you can’t fix the economy because the money is broken. You must fix the money first. #Bitcoin

— Samson Mow (@Excellion) July 3, 2024

His views highlight the potential of Bitcoin not only to recover but also to reach new heights in the financial landscape.

Featured image created with DALL-E, Chart from TradingView

What's Your Reaction?