Ethereum DApps On Fire: Volume Soars Over 90% — Good For ETH Price?

Ethereum (ETH) has become a beacon in the sea of blockchains, boasting a staggering 92% surge in dApp (decentralized application) volume over the past week. This news, however, comes with a layer of complexity, revealing a landscape of both opportunity and potential setbacks for the leading blockchain. Related Reading: 36% Explosion! ENS Coin Steals The Spotlight In The Crypto Market Cheap Gas Fuels The Fire Analysts attribute the dApp volume explosion to the Dencun upgrade in March, which significantly reduced gas fees – the cost associated with processing transactions on the Ethereum network. Lower fees have historically enticed users, and this recent development seems to be no different. The surge in activity suggests a revitalized Ethereum, potentially attracting new projects and fostering a more vibrant dApp ecosystem. NFT Mania Drives The Numbers While the overall dApp volume (see chart below) paints a rosy picture, a closer look reveals a more nuanced story. The surge appears to be driven primarily by a surge in NFT (Non-Fungible Token) trading and staking activity. Applications like Blur and Uniswap’s NFT aggregator saw significant hikes, highlighting the booming NFT market on Ethereum. This trend indicates a thriving niche within the Ethereum dApp landscape, but raises questions about the platform’s diversification beyond NFTs. A Look At User Engagement A curious wrinkle emerges when examining user engagement metrics. Despite the impressive volume increase, the number of unique active wallets (UAW) on the Ethereum network has actually decreased. This disconnect suggests that the current activity might be driven by a smaller, more active user base. While high volume is certainly a positive indicator, it’s crucial to see broader user participation to ensure the sustainability of the dApp ecosystem. A Glimmer Of Hope? One positive long-term indicator for Ethereum is the trend of decreasing exchange holdings, as reported by Glassnode. This suggests ETH holders are moving their assets off exchanges, potentially reducing sell pressure and contributing to price stability. If this trend continues, ETH could potentially target reaching $4,000 this quarter or even surpass its all-time high. However, this price prediction remains speculative and depends on various market forces. Ethereum At A Crossroads Ethereum finds itself at a crossroads. The Dencun upgrade has demonstrably revitalized dApp activity, particularly in the NFT space. However, the uneven dApp performance and declining UAW raise concerns about the long-term viability of this growth. Network growth, measured by the number of new addresses joining the network, is also slowing down, according to Santiment, potentially hindering wider adoption. Related Reading: Avalanche On The Verge: Will AVAX Break Out And Reach $65? The short-term price outlook for ETH remains uncertain. While the long-term indicators, like decreasing exchange holdings, suggest potential for price appreciation, the network’s growth slowdown might lead to a short-term price dip. Looking Forward The coming months will be crucial for Ethereum. The platform needs to capitalize on the renewed interest in dApps by attracting a broader user base and fostering a more diverse dApp ecosystem beyond NFTs. Addressing scalability issues and ensuring user-friendly interfaces will also be key to sustaining growth. If Ethereum can navigate these challenges, it has the potential to solidify its position as the premier platform for decentralized applications. However, if it fails to adapt, other blockchains waiting in the wings might capitalize on its shortcomings. Featured image from Pexels, chart from TradingView

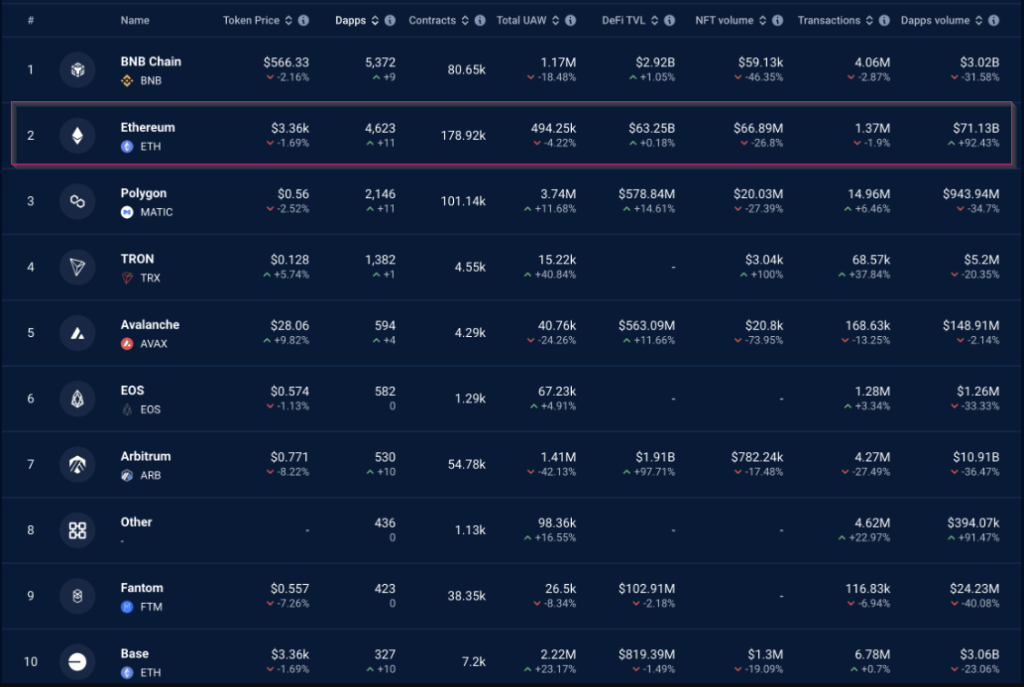

Ethereum (ETH) has become a beacon in the sea of blockchains, boasting a staggering 92% surge in dApp (decentralized application) volume over the past week. This news, however, comes with a layer of complexity, revealing a landscape of both opportunity and potential setbacks for the leading blockchain.

Cheap Gas Fuels The Fire

Analysts attribute the dApp volume explosion to the Dencun upgrade in March, which significantly reduced gas fees – the cost associated with processing transactions on the Ethereum network.

Lower fees have historically enticed users, and this recent development seems to be no different. The surge in activity suggests a revitalized Ethereum, potentially attracting new projects and fostering a more vibrant dApp ecosystem.

NFT Mania Drives The Numbers

While the overall dApp volume (see chart below) paints a rosy picture, a closer look reveals a more nuanced story. The surge appears to be driven primarily by a surge in NFT (Non-Fungible Token) trading and staking activity.

Applications like Blur and Uniswap’s NFT aggregator saw significant hikes, highlighting the booming NFT market on Ethereum. This trend indicates a thriving niche within the Ethereum dApp landscape, but raises questions about the platform’s diversification beyond NFTs. A Look At User Engagement

A curious wrinkle emerges when examining user engagement metrics. Despite the impressive volume increase, the number of unique active wallets (UAW) on the Ethereum network has actually decreased.

This disconnect suggests that the current activity might be driven by a smaller, more active user base. While high volume is certainly a positive indicator, it’s crucial to see broader user participation to ensure the sustainability of the dApp ecosystem. A Glimmer Of Hope?

One positive long-term indicator for Ethereum is the trend of decreasing exchange holdings, as reported by Glassnode. This suggests ETH holders are moving their assets off exchanges, potentially reducing sell pressure and contributing to price stability.

If this trend continues, ETH could potentially target reaching $4,000 this quarter or even surpass its all-time high. However, this price prediction remains speculative and depends on various market forces.

Ethereum At A Crossroads

Ethereum At A Crossroads

Ethereum finds itself at a crossroads. The Dencun upgrade has demonstrably revitalized dApp activity, particularly in the NFT space. However, the uneven dApp performance and declining UAW raise concerns about the long-term viability of this growth. Network growth, measured by the number of new addresses joining the network, is also slowing down, according to Santiment, potentially hindering wider adoption.

The short-term price outlook for ETH remains uncertain. While the long-term indicators, like decreasing exchange holdings, suggest potential for price appreciation, the network’s growth slowdown might lead to a short-term price dip. Looking Forward

The coming months will be crucial for Ethereum. The platform needs to capitalize on the renewed interest in dApps by attracting a broader user base and fostering a more diverse dApp ecosystem beyond NFTs. Addressing scalability issues and ensuring user-friendly interfaces will also be key to sustaining growth.

If Ethereum can navigate these challenges, it has the potential to solidify its position as the premier platform for decentralized applications. However, if it fails to adapt, other blockchains waiting in the wings might capitalize on its shortcomings.

Featured image from Pexels, chart from TradingView

What's Your Reaction?