Ethereum Eyeing $3,000 But There Is This Big Supply Problem

Ethereum fell to as low as $2,100 this week before bouncing, adding an impressive 25% from August 2024 lows. While there is confidence that prices will continue expanding, breaching $2,800 and even the psychological round number at $3,000, other market-related events might slow down bulls. Ethereum Network Unlocking Over 143,000 ETH According to Token Unlocks […]

Ethereum fell to as low as $2,100 this week before bouncing, adding an impressive 25% from August 2024 lows. While there is confidence that prices will continue expanding, breaching $2,800 and even the psychological round number at $3,000, other market-related events might slow down bulls.

Ethereum Network Unlocking Over 143,000 ETH

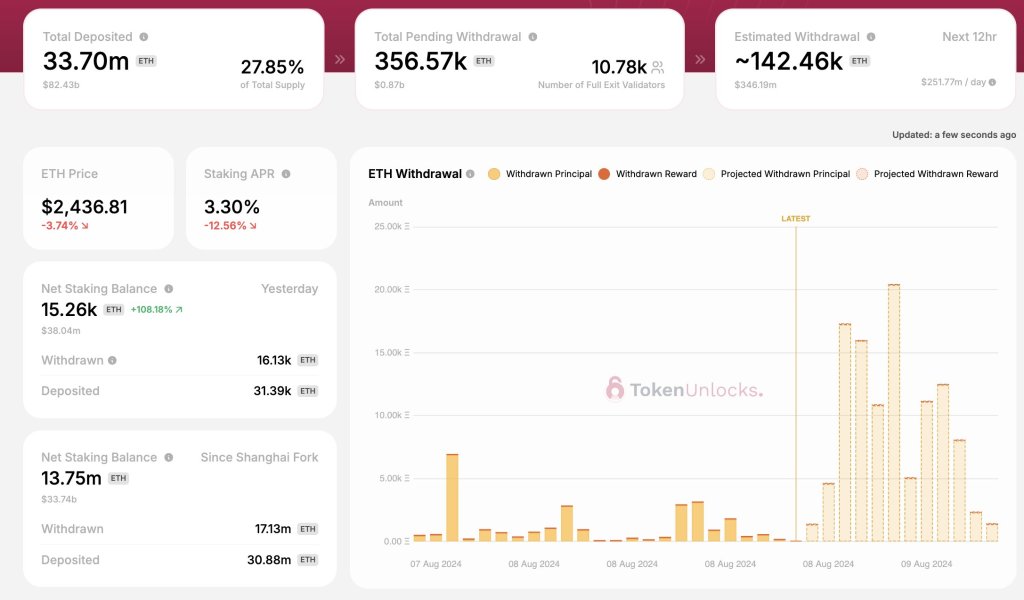

According to Token Unlocks data, hundreds of thousands of ETH are in the queue and are set for withdrawal today. On-chain data reveals that validators are preparing to withdraw 143,000 ETH worth nearly $350 million. Another batch of 212,000 ETH will be available for trading in the coming days, which could heap more pressure on prices.

As of August 9, Ethereum has a circulating supply of over 120 million, according to CoinMarketCap data. Since Dencun, the network has been inflationary, meaning more coins are not burnt like before.

Validators must stake at least 32 ETH and ensure their nodes maintain a high uptime of nearly 100%. At the same time, according to the network’s consensus rules, validators should not engage in outlawed activities such as banding to approve invalid transactions.

Failure can lead to slashing, where a portion of their stake is taken as a penalty. However, because they must commit to keeping the network decentralized, they receive a portion of the annual staking yield. At the same time, they get a chance to approve a block of transactions, receiving rewards as a result.

The ETH expected to hit the market will be the yield from their staking activities. This unlock is different from block rewards distributed roughly every 13 seconds.

Even as the market expects a supply spike, Token Unlocks analysts note that these withdrawals won’t necessarily mean they will be liquidated. However, if they are sold, the recovery will likely be slow.

Will Bulls Take Over And Force Prices Above $3,000?

There is a cause for concern. Historically, Token Unlocks analysts observe that prices tend to cool off whenever the Ethereum network unlocks such a large amount of tokens over a short period. In the last three months, unlocks between 150,000 and 220,000 ETH coincided with price drops.

Looking at the daily chart, Ethereum is recovering. Though the downtrend remains following the unexpected dip to as low as $2,100 early this week, the bounce has been decent.

The immediate liquidation line is around $2,600. If buyers push on, confirming gains of August 8, ETH prices might rally, soaking on the expected deluge, and retest $3,000.

What's Your Reaction?