Ethereum HODLing: Data Reveals Diamond Hands Own 78% Of Supply

On-chain data shows the Ethereum long-term holders have recently been increasing their total share of the cryptocurrency’s supply. Ethereum HODLers Currently Carry The Majority Of ETH Supply According to data shared by the market intelligence platform IntoTheBlock in a post on X, the Ethereum long-term holder supply has been on the rise recently. The “long-term […]

On-chain data shows the Ethereum long-term holders have recently been increasing their total share of the cryptocurrency’s supply.

Ethereum HODLers Currently Carry The Majority Of ETH Supply

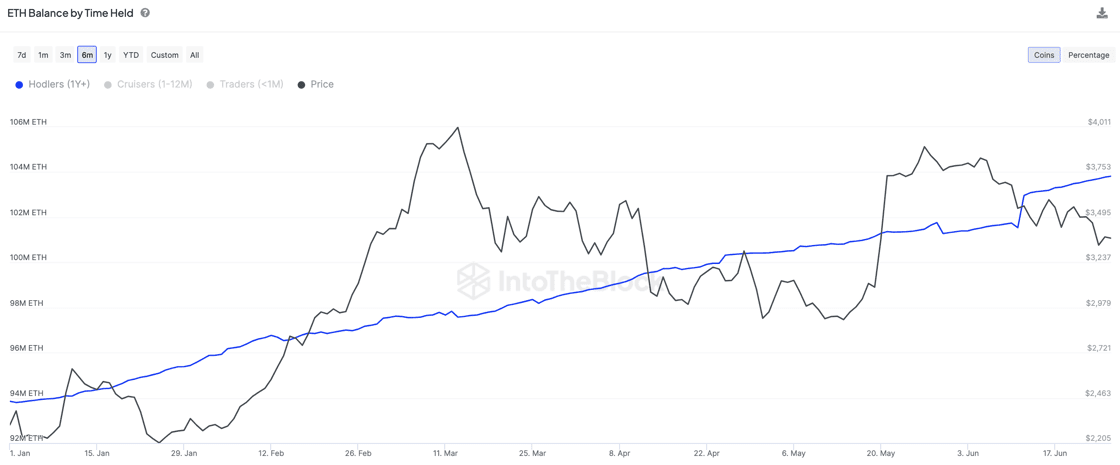

According to data shared by the market intelligence platform IntoTheBlock in a post on X, the Ethereum long-term holder supply has been on the rise recently. The “long-term holders” (LTHs), as defined by IntoTheBlock, refer to the ETH investors who bought their ETH more than a year ago.

Statistically, the longer an investor holds onto their coins, the less likely they become to sell at any point. As such, these LTHs, who tend to hold for long periods, include the investors least probable to sell in the market.

One way to keep track of the behavior of these HODLers is through the total amount of supply held by them. The below chart shows the trend in this supply for Ethereum since the start of the year 2024.

As is visible in the above graph, the Ethereum LTH supply has been riding an uptrend this year so far. This increase has continued in the last few weeks, with the metric even noticing a jump sharper than usual.

Something to note, though, is that when this indicator goes up, it doesn’t signify that these HODLers are buying in the present. Rather, it implies that some accumulation occurred a year ago and these coins have now matured enough to become a part of the cohort.

Nonetheless, an increase in the indicator is still naturally a bullish sign for the cryptocurrency, as it suggests that HODLing behavior is growing among the investors.

Following the latest rise, the Ethereum LTHs hold around 78% of the entire circulating supply of the asset. This means that a majority of the supply is currently locked in the hands of these holders who don’t easily sell.

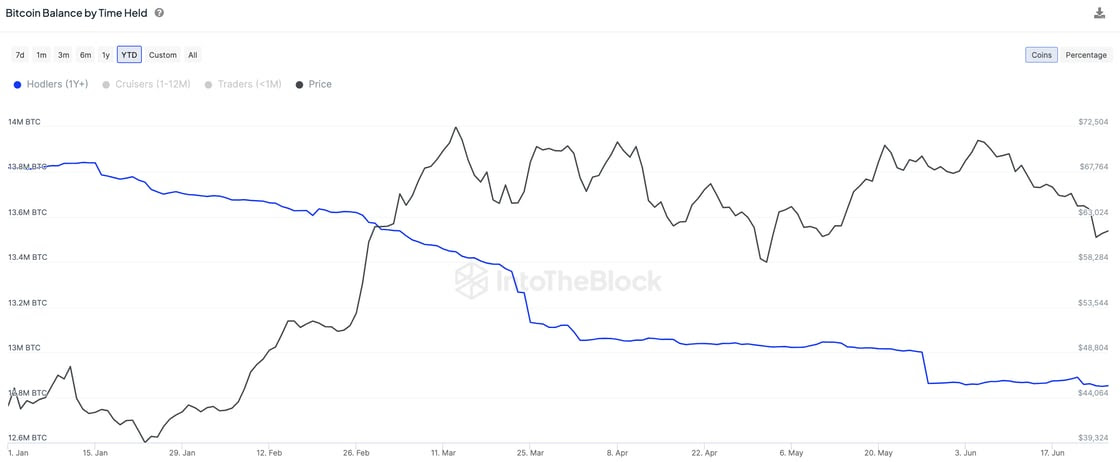

While ETH has been seeing this bullish development in terms of its LTHs, the same hasn’t been true for Bitcoin. As the analytics firm has pointed out in another X post, the BTC HODLers have been shedding their supply throughout the year.

Whereas buying has a one year delay, selling doesn’t have the same quirk attached to it. This is due to the fact that coins have their age reset to zero as soon as they are transferred on the blockchain, so they are instantly removed from the group.

In May, the Bitcoin LTHs sold around 160,000 BTC, worth a whopping $10.1 billion at the current exchange rate. Their selling did slow down last month, though, as they distributed about 40,000 BTC ($2.5 billion).

ETH Price

At the time of writing, Ethereum is floating around $3,500, up more than 5% over the last seven days.

What's Your Reaction?