Exploring Six On-Chain Indicators to Understand the Bitcoin Market Cycle

Explore key Bitcoin metrics like the Puell Multiple and MVRV Z-Score to understand this cycle’s progress, anticipate price peaks, and prepare for Bitcoin’s potential path toward $200K.

With Bitcoin now making six-figure territory feel normal and higher prices a seeming inevitability, the analysis of key on-chain data provides valuable insights into the underlying health of the market. By understanding these metrics, investors can better anticipate price movements and prepare for potential market peaks or even any upcoming retracements.

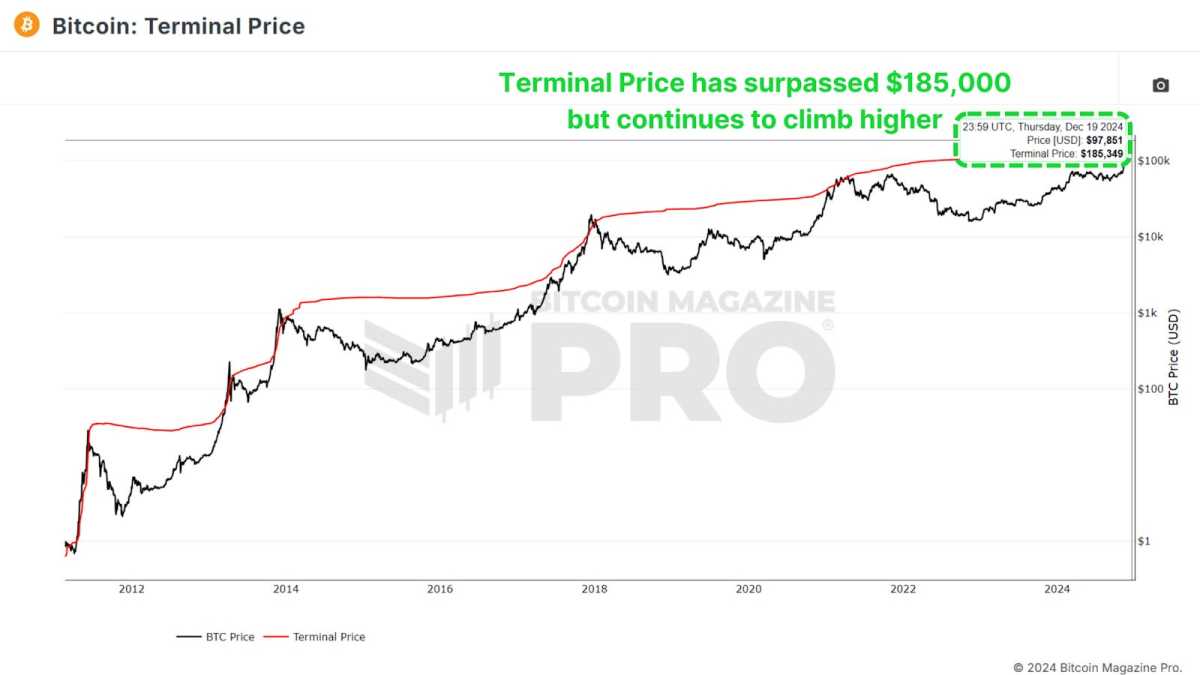

Terminal Price

The Terminal Price metric, which incorporates the Coin Days Destroyed (CDD) while factoring in Bitcoin’s supply, has historically been a reliable indicator for predicting Bitcoin cycle peaks. Coin Days Destroyed measures the velocity of coins being transferred, considering both the holding duration and the quantity of Bitcoin moved.

What's Your Reaction?