Hong Kong’s Crypto Exchanges Hit Roadblocks In License Quest

Hong Kong is in a pretty challenging situation, trying to be one of the most prominent crypto hubs. Even with the city’s efforts to create a favorable regulatory environment, more than a dozen exchanges struggle to get full licenses from the Securities and Futures Commission. This situation, according to a Bloomberg report, shows the challenges […]

Hong Kong is in a pretty challenging situation, trying to be one of the most prominent crypto hubs. Even with the city’s efforts to create a favorable regulatory environment, more than a dozen exchanges struggle to get full licenses from the Securities and Futures Commission.

This situation, according to a Bloomberg report, shows the challenges lying ahead for Hong Kong’s crypto ambitions.

Crypto: Closer Regulatory Scrutiny

The SFC is looking hard at crypto exchanges, and preliminary results from those aforementioned inspections are sounding the alarm on poor practices.

Reports in this respect have come out, indicating that 11 exchanges maintained unsatisfactory practices, which the powers that be regarded as proximal to the point at which they would be licensed.

They range from poor cybercrime protection to over-reliance on a few top executives managing client resources. Crypto.com and Bullish are under investigation. Because of this, their Hong Kong activities lag.

Only OSL and HashKey have full city licences. Though compliance has been difficult, the SFC hopes to issue more licenses by 2024.

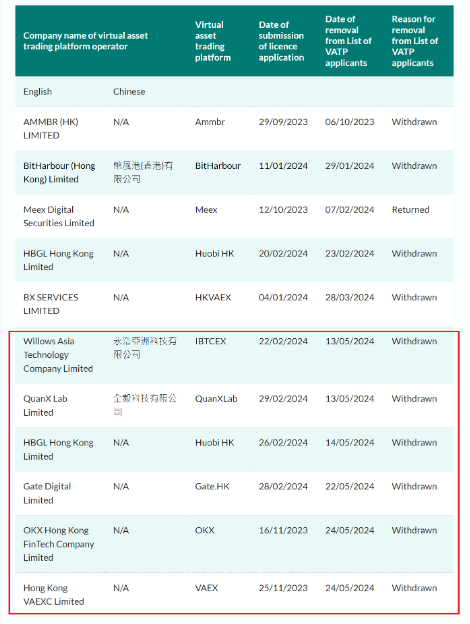

Lawyers said 12 have withdrew their petitions, including Bybit and Huobi HK, which are well-known. These enterprises increasingly fear that the SFC’s strict rules may conflict with their business practices.

The Impact Of JPEX Scandal

Heightened regulatory scrutiny over the industry follows the JPEX scandal, where thousands of investors lost a combined total of more than $200 million when an unlicensed platform was accused of defrauding 2,600 victims.

The incident has further accelerated the SFC’s push for strict compliance measures across the board. The regulator is zeroing in on client-asset protection and assurance of robust know-your-customer arrangements.

The JPEX case clearly depicts that the SFC is not going to do anything which would endanger the integrity of the crypto market in Hong Kong.

It is putting exchanges that hope for a share of the lucrative Hong Kong market in a dilemma. Most of these companies had ambitions to serve customers in the mainland, where trading in cryptocurrency is banned.

Complications arise under the framework of One Country, Two Systems, where exchanges are now realizing that they can’t service the much larger mainland market from Hong Kong. This could ward off potential investors and firms from setting up shop in the city. Competing With Other Jurisdictions

This puts Hong Kong’s ambitions at odds with its aspirations to be a crypto hub and the growing competition from Singapore. Although Hong Kong has made some positive steps toward having a regulatory framework that is open and safe, the slow pace of licensing has attracted criticism.

Some observers now wonder if Hong Kong would be able to provide a friendly environment to crypto firms compared to other areas with more clarified and encouraging regulations.

Prospects aren’t that bleak yet, and industry insiders are still hopeful. If properly regulated, Hong Kong can regain its former glory as one of the prominent crypto hubs in the world.

Featured image from Getty Images, chart from TradingView

What's Your Reaction?