Is $73,000 The Top For Bitcoin? Analyst Identifies Where BTC Is In This Cycle

In March, Bitcoin hit an all-time high above $73,000, sparking debates amongst market watchers and analysts about whether the cryptocurrency has hit its top this cycle. However, a crypto analyst has provided an in-depth analysis of Bitcoin’s recent price movements and future outlook, suggesting that the pioneer cryptocurrency still has substantial upside momentum ahead. Analyst Says Bitcoin Has Reached Second Early Cycle Top On July 11, a crypto analyst identified as ‘CryptoCon,’ took to X (formerly Twitter) to share insights into Bitcoin’s price movements based on the Relative Strength Index (RSI) Bollinger Band % phases. The analyst disclosed that Bitcoin’s RSI Bollinger % Band phases were one of the few technical indicators which offer unparalleled accuracy in identifying truecycle tops for Bitcoin’s price. Related Reading: Analyst says Ethereum Will Reach $8,000 ATH, But This Needs To Happen First The RSI Bollinger % Band is a unique technical tool used to confirm a trend’s relative strength and determine the direction of a current trend. In his post, CryptoCon disclosed that the RSI Bollinger % Band phases had successfully distinguished the initial April double tops of 2013 and 2021, pinpointing the final true top for both bull cycles. Sharing a price chart of Bitcoin’s historical price movements from 2010 to 2015, CryptoCon highlighted several phases in each bull cycle that led to a true price cycle top for Bitcoin. The analyst indicated five distinct phases for Bitcoin – the bear market breakout, the first cycle breakdown recovery, the second early top, the time High (ATH) break and the cycle top phase. Based on these phases, CryptoCon believes that Bitcoin has completed the third phase of its current market cycle which is the “second early top.” The analyst revealed that the cryptocurrency achieved this phase by crossing the red 0.99 value-line for the third time in March 2024 when Bitcoin rose to a new all-time high above $73,700. CryptoCon noted that Bitcoin’s rise to the second early top phase suggests that the cryptocurrency’s recent price movements will not be able to firmly push it above new all-time highs. He highlighted that this significant move to rise above ATHs is expected to occur in phase four, where Bitcoin will hit its “all-time high break.” BTC Nears Cycle Top With Two Phases Left Looking ahead, CryptoCon has disclosed that despite Bitcoin’s rise to a second early top in March and its recent downward price movements, the cryptocurrency still has two phases left to witness the best price action in this market cycle. The analyst disclosed that the market has already hit critically low levels of RSI Bollinger % Bands, typically seen at each cycle bottom, and even the 2020 Bitcoin crash. Related Reading: Forbes Says Shiba Inu Price Will Rise 1,700% To Reach $0.0003 ATH, Here’s When With just two phases left, Bitcoin could break into its highest level, potentially surpassing its initial $73,700 all-time high. In another insightful post, CryptoCon forecasts that Bitcoin could reach its anticipated cyclic top by April 2025. Featured image created with Dall.E, chart from Tradingview.com

In March, Bitcoin hit an all-time high above $73,000, sparking debates amongst market watchers and analysts about whether the cryptocurrency has hit its top this cycle. However, a crypto analyst has provided an in-depth analysis of Bitcoin’s recent price movements and future outlook, suggesting that the pioneer cryptocurrency still has substantial upside momentum ahead.

Analyst Says Bitcoin Has Reached Second Early Cycle Top

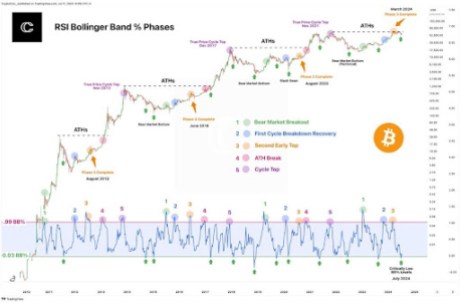

On July 11, a crypto analyst identified as ‘CryptoCon,’ took to X (formerly Twitter) to share insights into Bitcoin’s price movements based on the Relative Strength Index (RSI) Bollinger Band % phases. The analyst disclosed that Bitcoin’s RSI Bollinger % Band phases were one of the few technical indicators which offer unparalleled accuracy in identifying truecycle tops for Bitcoin’s price.

The RSI Bollinger % Band is a unique technical tool used to confirm a trend’s relative strength and determine the direction of a current trend. In his post, CryptoCon disclosed that the RSI Bollinger % Band phases had successfully distinguished the initial April double tops of 2013 and 2021, pinpointing the final true top for both bull cycles.

Sharing a price chart of Bitcoin’s historical price movements from 2010 to 2015, CryptoCon highlighted several phases in each bull cycle that led to a true price cycle top for Bitcoin. The analyst indicated five distinct phases for Bitcoin – the bear market breakout, the first cycle breakdown recovery, the second early top, the time High (ATH) break and the cycle top phase.

Based on these phases, CryptoCon believes that Bitcoin has completed the third phase of its current market cycle which is the “second early top.” The analyst revealed that the cryptocurrency achieved this phase by crossing the red 0.99 value-line for the third time in March 2024 when Bitcoin rose to a new all-time high above $73,700.

CryptoCon noted that Bitcoin’s rise to the second early top phase suggests that the cryptocurrency’s recent price movements will not be able to firmly push it above new all-time highs. He highlighted that this significant move to rise above ATHs is expected to occur in phase four, where Bitcoin will hit its “all-time high break.”

BTC Nears Cycle Top With Two Phases Left

Looking ahead, CryptoCon has disclosed that despite Bitcoin’s rise to a second early top in March and its recent downward price movements, the cryptocurrency still has two phases left to witness the best price action in this market cycle. The analyst disclosed that the market has already hit critically low levels of RSI Bollinger % Bands, typically seen at each cycle bottom, and even the 2020 Bitcoin crash.

With just two phases left, Bitcoin could break into its highest level, potentially surpassing its initial $73,700 all-time high. In another insightful post, CryptoCon forecasts that Bitcoin could reach its anticipated cyclic top by April 2025.

What's Your Reaction?