Is This The Perfect Time To Buy Bitcoin? Here’s What History Says

Bitcoin is encouragingly firm at press time, finding its footing above $58,000 and inches away from the critical $60,000 psychological level. After a volatile week, the stability is a massive boost for bulls. While there are pockets of strength, sellers are still in control. For the uptrend to take shape and buyers to build momentum, […]

Bitcoin is encouragingly firm at press time, finding its footing above $58,000 and inches away from the critical $60,000 psychological level.

After a volatile week, the stability is a massive boost for bulls. While there are pockets of strength, sellers are still in control. For the uptrend to take shape and buyers to build momentum, bulls must reverse July 4 and 5 gains.

Is This The Right Time To Buy Bitcoin?

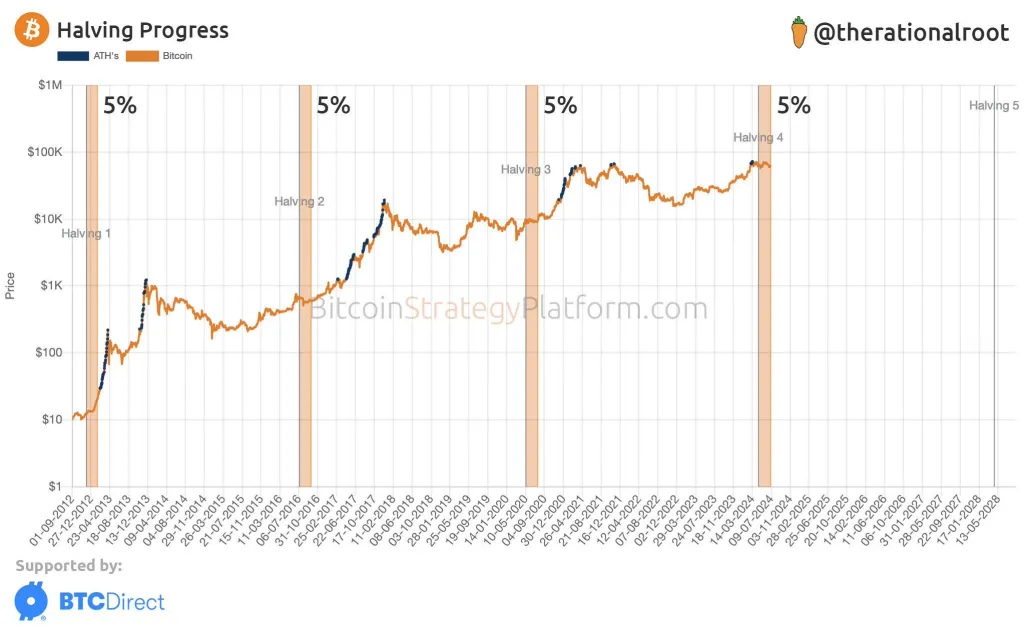

Amid this bullish optimism, one analyst on X said BTC is at the perfect point if price action post-Halving over the years is anything to go by. In the post, the analyst said Bitcoin usually tends to print higher highs, resuming the uptrend 80 days after Halving.

On April 20, the world’s most valuable network Halved its miner rewards, reducing them from 6.25 to 3.125 BTC. However, even though traders expected prices to expand immediately, that wasn’t the case.

If anything, the correction from March 2024 highs continued, with prices closing at around $56,500 in May. The downtrend continued in June, with bears even further in the first half of July, when BTC crashed to as low as $53,500.

It has been precisely 80 days between the Halving date in late April and July 9. Bulls tend to accumulate during this time in preparation for a parabolic bull run.

The re-accumulation phase the analyst picks out is also strategic, especially for intelligent BTC investors. Following Halving and amid reduced rewards, weak miners tend to capitulate. As they exit, selling their stash, prices fall in tandem.

Is The Bitcoin Miner Capitulation Over?

Data reveals that weak miners tend to shut down within six to ten weeks after Halving event. Their capitulation, as explained, coincides with sharp price gains.

By the end of last week, it marked the end of the 10th week of miner capitulation, the longest since the 2012 Halving event. If price action rhymes with historical performances, then the dumping phase is likely over, and Bitcoin is in the early phases of a parabolic surge.

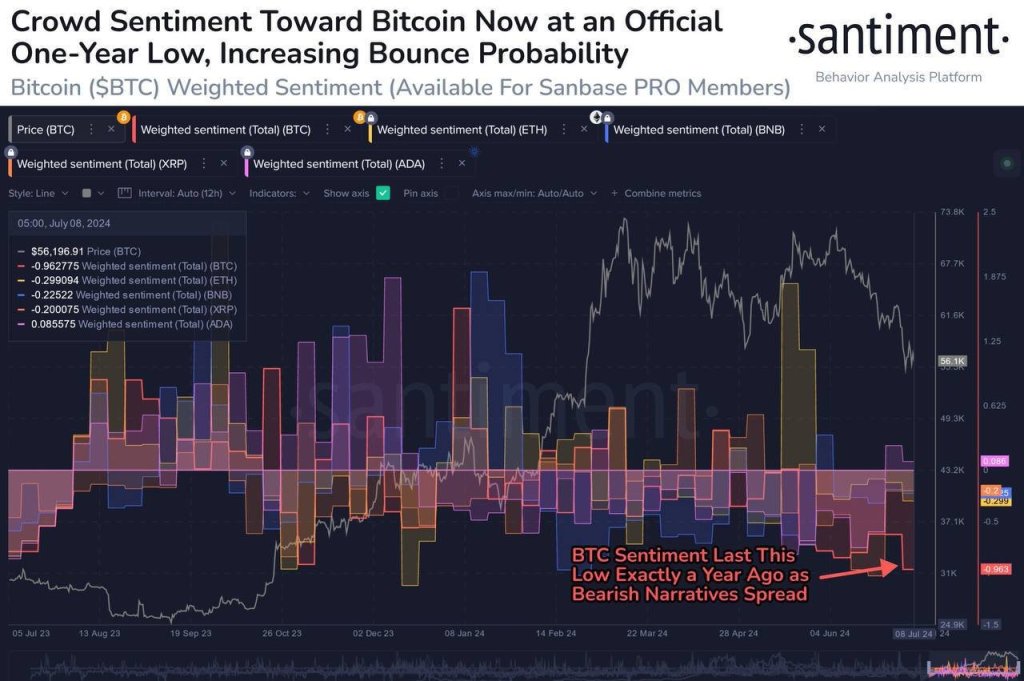

Santiment data shows that bearish sentiment among Bitcoin traders across leading social media platforms like X and Telegram is highest in over a year. Aggressive traders can take a contrarian position, loading on every dip at these extreme fear, uncertainty, and doubt (FUD) levels.

What's Your Reaction?