Islamic State Demands Sharia Law-Compliant Crypto For Funding Terror Activities

In a surprising twist, the Islamic State (IS) group is now advocating for cryptocurrency use to support its terrorist operations as long as it follows the tenets of the Sharia law, a new report has disclosed. Related Reading: EDCON 2024: Ethereum Founder Buterin Proudly Announces He’s A ‘Dogecoin Hodler’ Compiled by the UN’s Analytical Support […]

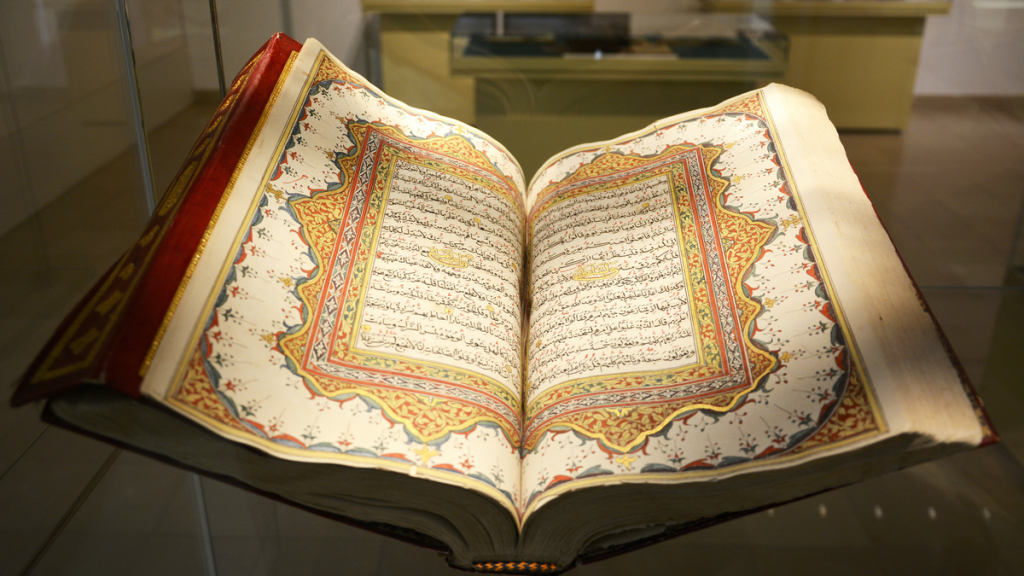

In a surprising twist, the Islamic State (IS) group is now advocating for cryptocurrency use to support its terrorist operations as long as it follows the tenets of the Sharia law, a new report has disclosed.

Compiled by the UN’s Analytical Support and Sanctions Monitoring Team, the research shows that IS associates are demanding Sharia compliance checks for the digital assets they depend on progressively to support their activities.

This is a major change as Sharia law has always been opposed to cryptocurrency. The UN report further emphasizes the thorough guidelines IS offers to its associates on crypto transfers. To enable these transactions, the terror group has even created specialist channels on the Telegram messaging service such CryptoHalal and Umma Crypto.

Sharia Compliance With Blockchain

Long in conflict with cryptocurrency is Sharia law, the religious law stemming from Islamic beliefs. Digital assets’ distributed character and its rampant use for gaming and other illicit activities have rendered them incompatible with Sharia values in the past.

The UN assessment, however, implies that IS is now looking for compromises to enable cryptocurrencies to be more Sharia-compliant. Stiffer rules and monitoring might help to guarantee that the money is not used for illegal activity or to support terrorism.

Ramifications For The Crypto Sector

The push of the Islamic State for Sharia-compliant crypto may have major effects on the whole bitcoin market. Greater demand for additional control and monitoring of the crypto ecosystem might arise if more terrorist groups and other illegal entities try to use digital assets.

A stronger know-your-customer (KYC) and anti-money laundering (AML) policies may be required of exchanges, wallet providers, and other cryptocurrency service providers to stop their platforms from being exploited for terrorism funding. This might result in higher compliance expenses and maybe restrict the availability of cryptocurrencies for legal consumers. A Concerning Development

The alarming growth of the Islamic State’s demand for Sharia law concessions for cryptocurrencies underlines the continuous attempts of terrorist groups to use digital resources for their nefarious intent. Regulators, law enforcement, and industry players will be especially important as the crypto sector develops in helping to reduce the hazards resulting from terrorist funding and other illegal activity.

The UN study reminds us of the need of preserving a strong and safe crypto environment resistant to bad actor misuse.

Featured image from Spiegel, chart from TradingView

What's Your Reaction?