MicroStrategy’s ‘Intelligent Leverage Strategy’ Ideal For Bitcoin Exposure, Report Says

MicroStrategy’s (MSTR) Bitcoin (BTC) play garners attention as Canaccord recently dubbed its ‘intelligent leverage strategy’ ideal for investors to gain exposure to BTC. MicroStrategy Stock Ideal For Gaining Bitcoin Exposure In a research report published yesterday, financial services firm Canaccord reiterated that buying MicroStrategy stocks remains one of the best ways for investors to gain […]

MicroStrategy’s (MSTR) Bitcoin (BTC) play garners attention as Canaccord recently dubbed its ‘intelligent leverage strategy’ ideal for investors to gain exposure to BTC.

MicroStrategy Stock Ideal For Gaining Bitcoin Exposure

In a research report published yesterday, financial services firm Canaccord reiterated that buying MicroStrategy stocks remains one of the best ways for investors to gain exposure to BTC.

The firm acknowledged MicroStrategy’s overall Bitcoin acquisition strategy, including its latest ‘21/21 plan’, which involves a $42 billion capital inflow split evenly between At The Market (ATM) equity offerings and fixed-income securities.

The amount above will finance future BTC purchases and continue bolstering MicroStrategy’s reserves. It will also increase MicroStrategy’s BTC yield to an average target of 8% over the next three years.

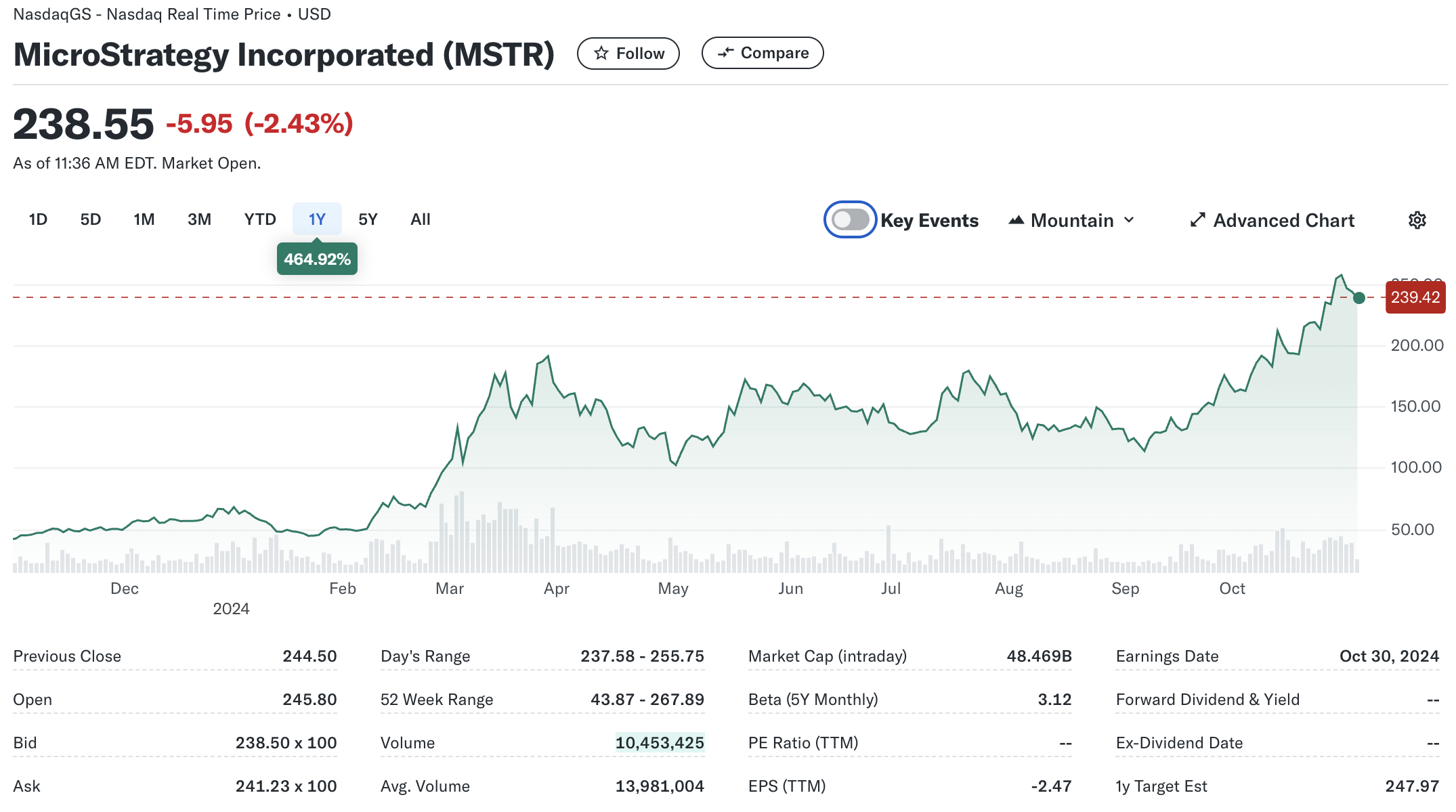

Notably, Canaccord has raised MSTR’s price target from $173 to $300, an increase of approximately 73%, while keeping a ‘buy’ rating on the stock. MSTR trades at $238.55 at press time, down 2.43% during trading hours.

Canaccord noted that since MicroStrategy adopted its trademark Bitcoin accumulation strategy in 2020, it has outperformed both the stock market and BTC. The report reads:

If stock price is the true test for any business model, then in our view MSTR is hard to beat. MicroStrategy’s leverage strategy provides the potential for additional premium to spot to re-emerge in MSTR shares.

Furthermore, the financial services firm displayed optimism toward BTC’s price, stating that the premier digital asset has benefited from the US Securities and Exchange Commission’s (SEC) approval of Bitcoin-based exchange-traded funds (ETF).

The firm also emphasized the impact of the supply scarcity created by Bitcoin halving the digital asset’s price. Notably, BTC underwent its halving on April 20, 2024. At the time, it was trading slightly above $64,000.

While halving has historically acted as a bullish catalyst, leading to extraordinary price appreciation, its effects typically materialize about 6-12 months. That said, some crypto analysts and research firms have displayed skepticism about the impact of this year’s halving.

More Firms Following In MicroStrategy’s Footsteps

An increasing number of firms around the globe are replicating MicroStrategy’s Bitcoin genius. For instance, recently, the Japanese firm Metaplanet concluded a stock sale to raise $68 million in BTC purchases.

In September 2024, Nasdaq-listed Semler Scientific revealed a purchase of 83 BTC worth about $5 million. The acquisition increased the firm’s total BTC reserves to 1,012 BTC.

Similarly, Samara Asset Group, a German investment firm, recently shared plans to raise close to $33 million to increase its BTC holdings. BTC trades at $69,678 at press time, down 1.4% in the past 24 hours.

What's Your Reaction?