Navigating Bitcoin In September: Analyst Outlines Two Likely Scenarios

The Bitcoin price trajectory in September appears to be at a critical juncture, and it carries the potential to unfold in two very different directions. After closing August on a bearish note, the leading cryptocurrency has continued to exhibit signs of weakness after September began. The early days of the month have already seen Bitcoin edging […]

The Bitcoin price trajectory in September appears to be at a critical juncture, and it carries the potential to unfold in two very different directions. After closing August on a bearish note, the leading cryptocurrency has continued to exhibit signs of weakness after September began. The early days of the month have already seen Bitcoin edging further into bearish territory, a development that could potentially signal a prolonged period of capitulation throughout the rest of the month. However, keeping in mind this is BTC we’re talking about, and we’re only three days into September, we could see the crypto bounce back up sometime in the middle of the month.

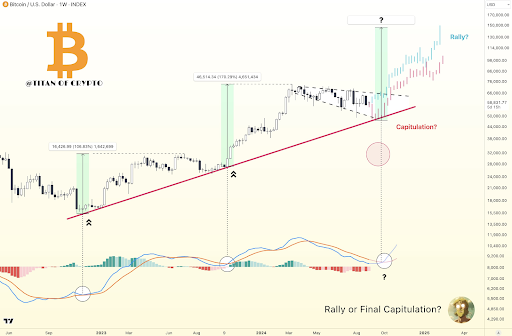

Adding to this speculation, a well-known crypto analyst who goes by the pseudonym Titan of Crypto (@Washigorira) on social media, recently shared his thoughts on the possible outcomes for Bitcoin this month.

Bitcoin Trajectory In September

According to his analysis, there are two primary scenarios that could play out for Bitcoin in September. The first scenario envisions a rally that defies the prevailing bearish expectations and will surprise the market with an unexpected surge. The second scenario, however, involves a final phase of capitulation, where Bitcoin could reach new lows before staging a significant recovery in the final quarter of 2024.

This analysis focuses on the Bitcoin/US Dollar (BTC/USD) chart observed on a weekly timeframe. According to the chart’s current setup by @Washigorira, BTC has been tracing a price pattern that closely resembles a bullish expanding triangle since reaching its all-time high of $73,737 in March 2024. This particular pattern is widely recognized for its bullish signals. Despite the current short-term volatility, the longer-term outlook for Bitcoin remains positive. As such, both scenarios noted by the analyst eventually end up with a bullish surge for Bitcoin.

In the first scenario, Bitcoin is expected to initiate a significant price surge in September. This surge would be strong enough to push the cryptocurrency above the upper trendline of the bullish expanding triangle that has served as a strong resistance level for months. If BTC successfully breaks through this resistance, the price could potentially achieve a complete breakout and set the stage for a new all-time high.

Related Reading: Crypto Analyst Predicts Shiba Inu Will Surge 1,000% To $0.00014

In terms of price target for this scenario, a complete breakout will see BTC reaching as high as $150,000 in Q1 2025. Interestingly, this mirrors the bullish rally experienced in Q4 2023, which ultimately ended with the latest all-time high in Q1 2024.

The second scenario presents a more cautious outlook, where Bitcoin continues to experience the current capitulation phase. This scenario envisions Bitcoin dipping further in September, potentially breaking below the $50,000 mark. Such a decline could see BTC retesting its August low of $49,800, which is a critical support level.

However, this scenario does not end on a bearish note. Following this potential dip, Bitcoin is expected to reverse its downward trend in the fourth quarter of 2024. This would then lead to a bullish rally with a slightly more conservative price target of $100,000.

At the time of writing, Bitcoin is trading at $56,716.

What's Your Reaction?