On-Chain Indicator Sets Bitcoin Cycle Top Price At $141K – Details

Bitcoin has experienced a record-breaking bullish breakout, shattering all-time highs almost daily over the past three weeks. After an impressive rally, the price is less than 2% away from the $100,000 mark—a critical psychological level that could become a turning point for the entire crypto market. Investors and analysts alike are closely watching this milestone, […]

Bitcoin has experienced a record-breaking bullish breakout, shattering all-time highs almost daily over the past three weeks. After an impressive rally, the price is less than 2% away from the $100,000 mark—a critical psychological level that could become a turning point for the entire crypto market. Investors and analysts alike are closely watching this milestone, as breaking it may fuel a new wave of market momentum and broader adoption.

On-chain data shared by CryptoQuant CEO Ki Young Ju suggests that Bitcoin’s current rally may still have room to grow. Ju highlights that the market appears too early to call a bubble, as the overall market cap has not risen significantly compared to cumulative on-chain capital inflows. This metric indicates that the price action is supported by real demand rather than speculative hype, reinforcing confidence in Bitcoin’s sustained bullish trajectory.

With Bitcoin leading the charge, its approach to $100,000 could set the tone for the rest of the crypto market. Whether it breaks through or faces resistance, the outcome will likely influence market sentiment, offering a glimpse into what lies ahead for the world’s largest cryptocurrency and the digital asset space as a whole.

Bitcoin Metrics Set High Expectations

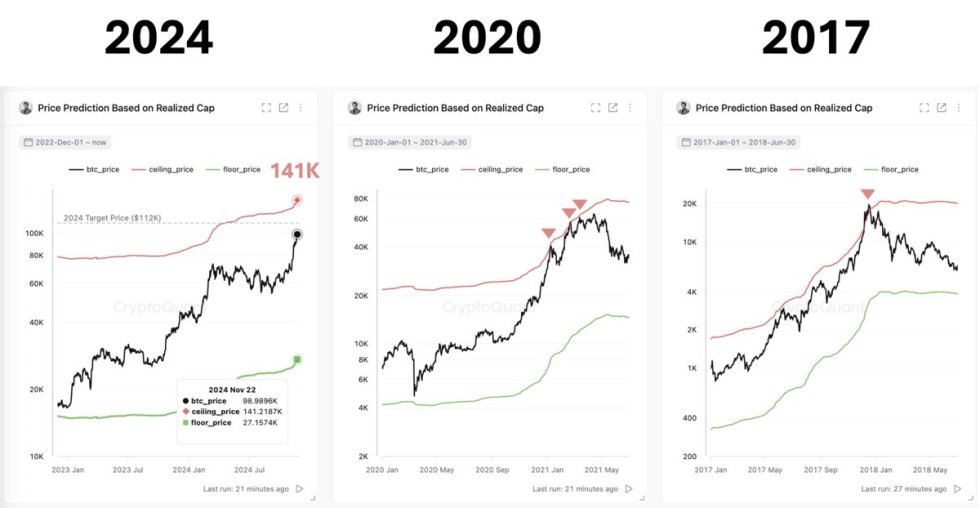

Bitcoin has been setting record highs, yet it “struggles” to break the critical $100,000 barrier. Despite this, the overall market sentiment remains bullish, with analysts predicting that the price could continue to rise. CryptoQuant CEO Ki Young Ju has shared valuable insights on X, revealing that the Bitcoin cycle top could potentially exceed $141,000.

According to Ju’s analysis, the current market dynamics suggest that BTC is still in the early stages of its bull market, making it premature to call the rally a bubble. A key piece of data Ju highlights is the realized cap, which has been increasing steadily every day. The realized cap, calculated by summing the value of all BTC at the price at which they were last moved on-chain, serves as an indicator of the total capital inflows into the BTC market.

Ju points out that historically, Bitcoin’s market cap tends to exceed its realized cap during bull markets, with the market cap peaking as retail investors enter. During bear markets, the market cap often falls below the realized cap.

As the realized cap continues to rise, it supports the argument for a continued upward trajectory in BTC’s price, with the potential to reach or even surpass $141,000 before the market peaks. This analysis reinforces that, despite Bitcoin’s near struggle to break $100,000, the market still holds significant room for growth before a potential top is reached.

BTC Growing Demand Pushing Price Up

Bitcoin is on the verge of having its highest weekly close in history as it approaches the $100,000 mark, currently holding strong above $98,000. The price action has confirmed the bullish accumulation pattern, a cup and handle, that started forming in November 2021.

This pattern suggests that BTC is building a strong base, and a confirmed breakout above $98,000 could set the stage for a surge past the psychological $100,000 level as early as Monday. A strong close today could signal a continuation of the bullish trend, with potential for further upward momentum.

However, there is some caution around the potential for a weak breakout. If the price struggles to hold above $100,000 after a breakout, it could trigger a pullback, leading to a correction before the next phase of the rally.

A failure to sustain above $98,000 today would also raise the risk of a short-term retrace, with support levels below this mark becoming key in determining the strength of the current rally. Despite the possibility of a minor correction, the overall market sentiment remains bullish, with many analysts anticipating continued gains if the $100,000 level is broken decisively.

Featured image from Dall-E, chart from TradingView

What's Your Reaction?