Polkadot Developments Show Strength, Despite Coin’s 18% Loss

As the rebound in some sectors of the crypto market slows, Polkadot (DOT) has captured some momentum garnering the attention of some investors that grabbed it at a discount. According to CoinGecko, the token is up almost 6% today, with the rebound slowing to a mere 2% increase since yesterday. However, this has not deterred investors from keeping their eyes on DOT as it slowly makes its way upward. Related Reading: Bloody Monday: Cardano Not Spared From Bloodbath, Suffers 30% Loss This is partly due to Polkadot’s continuing on-chain developments that helped ease market anxieties after the broader sell-off that happened this week. We might see more positive movement in the coming days investors and traders are convinced that the sell-off is a one-of-event. Tuning In To On-Chain News For Polkadot On-chain, the Polkadot’s parachains are actively contributing to the network’s overall growth. Polkadotters, an X account dedicated to sharing Polkadot developments, shared several developments this week. Bifrost’s July report is among the developments that show incredible growth for the protocol. The monthly report shows that Bifrost grew by a substantial margin. By the end of July, Bifrost had a total of $80.8 million in total value locked (TVL) and over 8 million voucher DOT (vDOT) minted. vDOT is the protocol’s representation of DOT staked on the platform and according to this high number, DOT is an active token used in staking on Bifrost. Peaq, a parachain focused on decentralized physical infrastructure networks (DePIN), secured a partnership with Roam, a fellow DePIN-focused platform. The partnership covers Roam’s launch of its network and native token on the Peaq ecosystem, contributing to Polkadot’s growth through increasing activity on Peaq and its network. DOT Tries To Breach $4.61 DOT is currently attempting to break through the $4.61 ceiling, resuming yesterday’s action by trying to flip the ceiling to a solid support level. However, this maybe thwarted by the bears as the market currently favors the downward pressure felt by investors and traders in the short term. Despite this, positive developments can alleviate the shaken confidence brought by the market’s sharp decline this week. The only question remaining will be how big the gains can be if the rebound continues. If DOT bulls are successful in this breakthrough, the token will have the necessary foundation for future upward movement. Bulls can emulate DOT’s movement in late 2020 where they settled on $4.61 before the market’s bull run. However, market volatility will still be a huge problem for DOT’s performance. Related Reading: Aave Protocol Unfazed By Market Jitters, Surges 21% If the major cryptocurrencies continue their rebound to pre-overreaction levels, then there might be a chance for DOT to reclaim $6.16 in the long term. Until then, investors and traders should remain cautious of the token’s position and momentum as it can be susceptible to a swing downward. Featured image from MoneyWeb, chart from TradingView

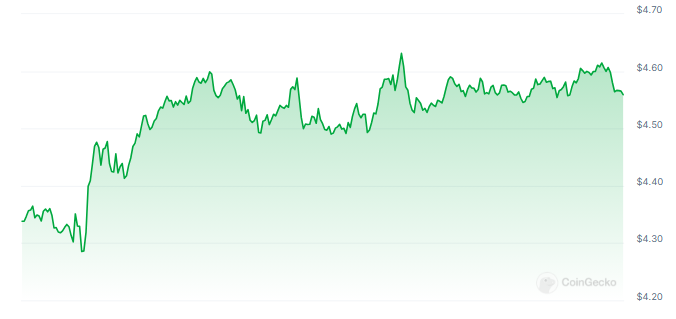

As the rebound in some sectors of the crypto market slows, Polkadot (DOT) has captured some momentum garnering the attention of some investors that grabbed it at a discount. According to CoinGecko, the token is up almost 6% today, with the rebound slowing to a mere 2% increase since yesterday. However, this has not deterred investors from keeping their eyes on DOT as it slowly makes its way upward.

This is partly due to Polkadot’s continuing on-chain developments that helped ease market anxieties after the broader sell-off that happened this week. We might see more positive movement in the coming days investors and traders are convinced that the sell-off is a one-of-event.

Tuning In To On-Chain News For Polkadot

On-chain, the Polkadot’s parachains are actively contributing to the network’s overall growth. Polkadotters, an X account dedicated to sharing Polkadot developments, shared several developments this week. Bifrost’s July report is among the developments that show incredible growth for the protocol.

The monthly report shows that Bifrost grew by a substantial margin. By the end of July, Bifrost had a total of $80.8 million in total value locked (TVL) and over 8 million voucher DOT (vDOT) minted. vDOT is the protocol’s representation of DOT staked on the platform and according to this high number, DOT is an active token used in staking on Bifrost.

Peaq, a parachain focused on decentralized physical infrastructure networks (DePIN), secured a partnership with Roam, a fellow DePIN-focused platform. The partnership covers Roam’s launch of its network and native token on the Peaq ecosystem, contributing to Polkadot’s growth through increasing activity on Peaq and its network.

DOT Tries To Breach $4.61

DOT is currently attempting to break through the $4.61 ceiling, resuming yesterday’s action by trying to flip the ceiling to a solid support level. However, this maybe thwarted by the bears as the market currently favors the downward pressure felt by investors and traders in the short term.

Despite this, positive developments can alleviate the shaken confidence brought by the market’s sharp decline this week. The only question remaining will be how big the gains can be if the rebound continues.

If DOT bulls are successful in this breakthrough, the token will have the necessary foundation for future upward movement. Bulls can emulate DOT’s movement in late 2020 where they settled on $4.61 before the market’s bull run. However, market volatility will still be a huge problem for DOT’s performance.

If the major cryptocurrencies continue their rebound to pre-overreaction levels, then there might be a chance for DOT to reclaim $6.16 in the long term. Until then, investors and traders should remain cautious of the token’s position and momentum as it can be susceptible to a swing downward.

Featured image from MoneyWeb, chart from TradingView

What's Your Reaction?