Solana Dominating Ethereum: SOL Analyst Now Targets $1,000

Following Bitcoin and other altcoins like Ethereum, Solana is edging higher, clawing its way back after sharp losses in June. Even though the buyers are yet to reclaim the $155 support level, the expansion over the last few days has seen the coin add 25% after plunging in early July. Is SOL Preparing For $1,000? These encouraging gains over the last few days have seen traders project major gains in the coming days and weeks. Taking to X, one analyst said the coin would easily be more than 6X from spot rates, rallying to as high as $1,000 in the next bull cycle. As things stand, it is evident that SOL is already in an uptrend. At the depth of the bear run in 2022, the collapse of FTX and Alameda Research saw SOL plunge to as low as $8. The coin rallied over the last few months, especially from H2 2023, reaching $210 in March 2023. Related Reading: Solana Bullish Run: SOL’s 5% Surge Brings $160 Within Reach Nonetheless, the cool-off of the past three months hasn’t canceled out the primary uptrend. If anything, buyers are still in the driving seat, and even with recent losses, SOL is still up roughly 8X from October 2023. Several factors could propel Solana higher, even above the $220 recorded in the last bull cycle of 2021. A big part of this will be driven by the spike in adoption and the rise of Solana as the third most valuable smart contracts platform, only tracking Ethereum and the BNB Chain. As the home of meme coins, Solana is emerging as a choice platform for developers and traders. Most point to its high scalability and low transaction fees. At the same time, because there is no need to use off-chain solutions, some argue that Solana could be more secure than Ethereum layer-2 platforms like Base. Solana Dominating Ethereum, Spot ETF Hopes The spike in meme coins has pushed Solana’s on-chain activity higher, reading from the swelling DEX volumes. DeFiLlama data shows that Solana dominates Ethereum in daily and monthly DEX volume. On average, these DEXes process over $13 billion every week. If meme coin prices recover, exceeding the $65 billion peak registered in the last few months, reading from CoinMarketCap data, Solana will likely stretch Ethereum, cementing its position. Like BOME, WIF, BONK, and other Solana meme coins are among the most active and valuable. Related Reading: XRP Price Confirms Bullish Reversal: Crypto Analyst Forecasts ‘God Candles’ Ahead Even though the United States Securities and Exchange Commission (SEC) previously alleged that SOL is an unregistered security, some changes could challenge this preview. Recently, VanEck and 21Shares applied with the regulator to approve spot Solana exchange-traded funds (ETFs). The application is still in the early stages, but the final decision will be made before the end of Q1 2025. Feature image from DALLE, chart from TradingView

Following Bitcoin and other altcoins like Ethereum, Solana is edging higher, clawing its way back after sharp losses in June. Even though the buyers are yet to reclaim the $155 support level, the expansion over the last few days has seen the coin add 25% after plunging in early July.

Is SOL Preparing For $1,000?

These encouraging gains over the last few days have seen traders project major gains in the coming days and weeks. Taking to X, one analyst said the coin would easily be more than 6X from spot rates, rallying to as high as $1,000 in the next bull cycle.

As things stand, it is evident that SOL is already in an uptrend. At the depth of the bear run in 2022, the collapse of FTX and Alameda Research saw SOL plunge to as low as $8. The coin rallied over the last few months, especially from H2 2023, reaching $210 in March 2023.

Nonetheless, the cool-off of the past three months hasn’t canceled out the primary uptrend. If anything, buyers are still in the driving seat, and even with recent losses, SOL is still up roughly 8X from October 2023.

Several factors could propel Solana higher, even above the $220 recorded in the last bull cycle of 2021. A big part of this will be driven by the spike in adoption and the rise of Solana as the third most valuable smart contracts platform, only tracking Ethereum and the BNB Chain.

As the home of meme coins, Solana is emerging as a choice platform for developers and traders. Most point to its high scalability and low transaction fees.

At the same time, because there is no need to use off-chain solutions, some argue that Solana could be more secure than Ethereum layer-2 platforms like Base.

Solana Dominating Ethereum, Spot ETF Hopes

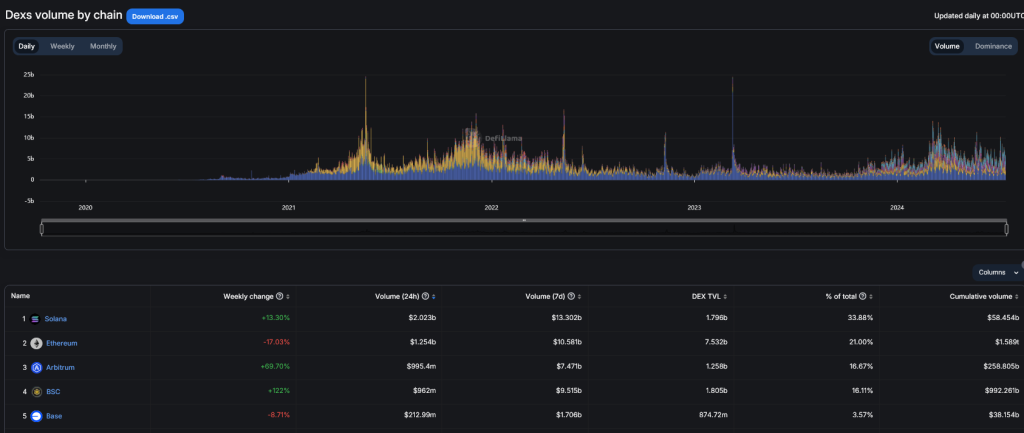

The spike in meme coins has pushed Solana’s on-chain activity higher, reading from the swelling DEX volumes.

DeFiLlama data shows that Solana dominates Ethereum in daily and monthly DEX volume. On average, these DEXes process over $13 billion every week.

If meme coin prices recover, exceeding the $65 billion peak registered in the last few months, reading from CoinMarketCap data, Solana will likely stretch Ethereum, cementing its position. Like BOME, WIF, BONK, and other Solana meme coins are among the most active and valuable.

Even though the United States Securities and Exchange Commission (SEC) previously alleged that SOL is an unregistered security, some changes could challenge this preview.

Recently, VanEck and 21Shares applied with the regulator to approve spot Solana exchange-traded funds (ETFs). The application is still in the early stages, but the final decision will be made before the end of Q1 2025.

What's Your Reaction?