Solana Likely To Target $200 ‘If It Holds Current Support’ – What To Expect

Solana (SOL) is currently trading at a crucial demand level near $163, following a retrace from local highs around $183. This price is a critical support area that could determine the direction of SOL’s upcoming price action. Losing this level could signal a deeper correction, which would intensify selling pressure and potentially push SOL to retest lower support levels. However, top analyst Daan shared a technical analysis suggesting that if SOL can hold this “green zone” around $160, it could pave the way for a rebound. Daan notes that in the most optimistic scenario, SOL could hold this support and start a gradual climb, ultimately aiming to test the downtrend line that has kept it in check. This setup would keep SOL’s bullish structure intact, creating a potential entry point for investors eyeing a bounce. Related Reading: Bitcoin On-Chain Indicator Signals Panic Selling At Current Levels – Time To HODL? With the broader crypto market showing volatility and Solana facing this pivotal level, the next few days will be crucial. Traders and investors are closely watching to see if this demand zone can support a reversal, potentially leading SOL back toward recent highs. Solana Holding Strong Despite Uncertainty Solana (SOL) has managed to hold above the key support level around $160, despite the recent market volatility and uncertainty. This level is crucial for SOL’s price structure, as it’s a strong demand zone that could act as a foundation for the next upward move. Crypto analyst Daan recently shared his perspective on X, revealing that SOL’s “most bullish case” would be for it to hold this “green zone” around $160, allowing it to gradually grind back up toward the descending trendline that has capped recent gains. In Daan’s view, the next attempt at this trendline could likely result in a successful breakout, with the potential to push SOL’s price above $200. He suggests that waiting for confirmation of this breakout could be a sound strategy for cautious investors, as there is still ample room for upside even after a confirmed reversal. His analysis highlights a confident outlook on SOL’s potential recovery, seeing this accumulation zone as a promising buying opportunity. However, Daan also acknowledges that there’s still a degree of downside risk. If SOL fails to hold above this $160 level, a deeper correction could follow, potentially driving SOL to test lower support levels. Related Reading: Analyst Exposes Ethereum Ascending Support At $2,400 – Best Chance To Accumulate ETH? For now, the market will watch this support level closely as a critical indicator of SOL’s short-term trend. Holding above it would signal strength and open the door for a potential rally, while a breakdown could lead to a more extended bearish phase. As the overall market sentiment remains mixed, Solana’s next moves will be critical for traders and investors alike. SOL Price Action Solana is currently trading at $163 after tagging the 4-hour 200 exponential moving average (EMA), a critical indicator of short-term strength. Holding above this EMA signals a bullish outlook for SOL, suggesting that buyers are stepping in to support the price at this level. If SOL can maintain momentum above the 200 EMA, it could build a foundation for a potential rally to new local highs, possibly challenging the recent peak around $183. However, the $160 level remains a crucial support area. Losing this support would likely trigger significant selling pressure, potentially driving SOL down to the $150 range, where further demand may emerge. This zone would be closely watched by investors looking for potential accumulation opportunities, as a dip could provide favorable entry points for long-term holders. Related Reading: Bitcoin Open Interest Reduced By $2.1 Billion In 24 Hours – Time For Spot To Push The Price? In contrast, a strong push above the current demand level would confirm renewed bullish momentum, paving the way for SOL to target and possibly surpass recent highs. As SOL hovers around this key technical zone, traders will be watching for any decisive movement that could signal the next direction, whether it be a continued uptrend or a retracement to lower demand levels. Featured image from Dall-E, chart from TradingView

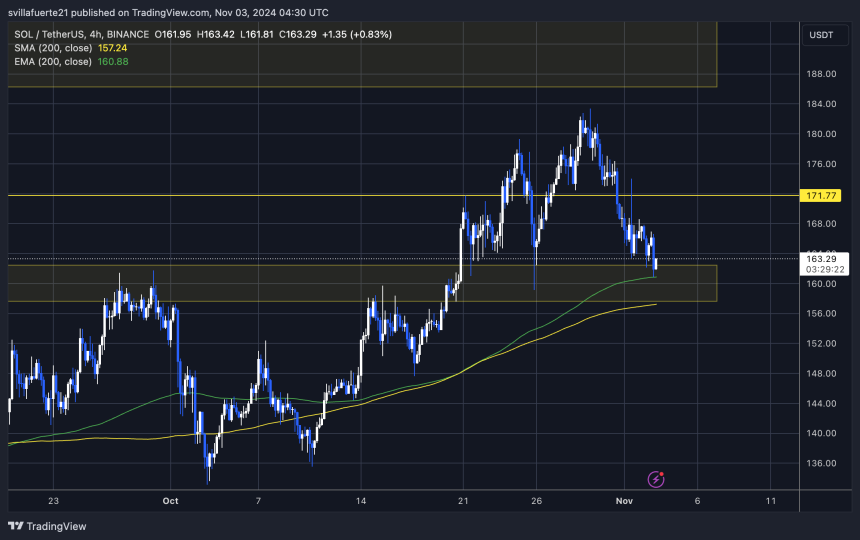

Solana (SOL) is currently trading at a crucial demand level near $163, following a retrace from local highs around $183. This price is a critical support area that could determine the direction of SOL’s upcoming price action. Losing this level could signal a deeper correction, which would intensify selling pressure and potentially push SOL to retest lower support levels.

However, top analyst Daan shared a technical analysis suggesting that if SOL can hold this “green zone” around $160, it could pave the way for a rebound. Daan notes that in the most optimistic scenario, SOL could hold this support and start a gradual climb, ultimately aiming to test the downtrend line that has kept it in check. This setup would keep SOL’s bullish structure intact, creating a potential entry point for investors eyeing a bounce.

With the broader crypto market showing volatility and Solana facing this pivotal level, the next few days will be crucial. Traders and investors are closely watching to see if this demand zone can support a reversal, potentially leading SOL back toward recent highs.

Solana Holding Strong Despite Uncertainty

Solana (SOL) has managed to hold above the key support level around $160, despite the recent market volatility and uncertainty. This level is crucial for SOL’s price structure, as it’s a strong demand zone that could act as a foundation for the next upward move.

Crypto analyst Daan recently shared his perspective on X, revealing that SOL’s “most bullish case” would be for it to hold this “green zone” around $160, allowing it to gradually grind back up toward the descending trendline that has capped recent gains.

In Daan’s view, the next attempt at this trendline could likely result in a successful breakout, with the potential to push SOL’s price above $200. He suggests that waiting for confirmation of this breakout could be a sound strategy for cautious investors, as there is still ample room for upside even after a confirmed reversal. His analysis highlights a confident outlook on SOL’s potential recovery, seeing this accumulation zone as a promising buying opportunity.

However, Daan also acknowledges that there’s still a degree of downside risk. If SOL fails to hold above this $160 level, a deeper correction could follow, potentially driving SOL to test lower support levels.

For now, the market will watch this support level closely as a critical indicator of SOL’s short-term trend. Holding above it would signal strength and open the door for a potential rally, while a breakdown could lead to a more extended bearish phase. As the overall market sentiment remains mixed, Solana’s next moves will be critical for traders and investors alike.

SOL Price Action

Solana is currently trading at $163 after tagging the 4-hour 200 exponential moving average (EMA), a critical indicator of short-term strength. Holding above this EMA signals a bullish outlook for SOL, suggesting that buyers are stepping in to support the price at this level. If SOL can maintain momentum above the 200 EMA, it could build a foundation for a potential rally to new local highs, possibly challenging the recent peak around $183.

However, the $160 level remains a crucial support area. Losing this support would likely trigger significant selling pressure, potentially driving SOL down to the $150 range, where further demand may emerge. This zone would be closely watched by investors looking for potential accumulation opportunities, as a dip could provide favorable entry points for long-term holders.

In contrast, a strong push above the current demand level would confirm renewed bullish momentum, paving the way for SOL to target and possibly surpass recent highs. As SOL hovers around this key technical zone, traders will be watching for any decisive movement that could signal the next direction, whether it be a continued uptrend or a retracement to lower demand levels.

Featured image from Dall-E, chart from TradingView

What's Your Reaction?