Solana Mirroring 2021 Bullish Pattern, Crypto Analyst Reveals

An analyst has explained how Solana (SOL) is currently mirroring the same pattern that led to a bullish breakout for its price back in 2021. Solana Appears To Be Showing Similar Trend To 2021 Right Now In a new post on X, analyst Ali Martinez has discussed about how the pattern recently forming in SOL has been reminiscent of what the cryptocurrency showed back in the July of three years ago. Related Reading: Bitcoin MVRV Ratio At Make-Or-Break Test: Will Support Hold? Below is the chart shared by the analyst, that highlights the similarity between the two periods: As is visible in the graph, the Solana 3-day price has so far shown a trajectory that has been similar to the one in 2021. Not only that, the current Relative Strength Index (RSI) is also at around the same level as the one back then. The RSI refers to an indicator in technical analysis (TA) that basically measures the speed as well as the magnitude of the recent changes occurring in SOL’s price. This momentum indicator is generally used for determining whether the asset’s price is fair or not. When the indicator has a value greater than 70, it’s a potential sign that the cryptocurrency is becoming overvalued as its price is growing too quickly. As such, corrections can become more likely in this region. On the other hand, the metric being under 30 implies a possible oversold condition is forming in the asset, meaning that a bottom could be probable to form in its price. From the chart, it’s visible that the RSI is at around 40 for Solana currently, suggesting that the asset is slightly leaning towards being undervalued. Interestingly, back in 2021, this same RSI level led to a big bullish breakout for the cryptocurrency. Given that the coin’s price has shown a similar trajectory as back then, and its RSI has also been pretty much the same, it’s possible that another surge might start for Solana from here. It now remains to be seen if past pattern will repeat for the asset or if it will follow a new path entirely. Related Reading: Bitcoin ‘Extreme Greed’ Is Almost Here: Price Bottom Now Close? In some other news, a SOL whale made a massive move on the blockchain just a couple of days ago, according to data from the cryptocurrency transaction tracker service Whale Alert. The move, which involved the transfer of 287,019 SOL (equivalent to over $40.3 million at the time the transaction was executed), travelled from an unknown wallet, likely to be the whale’s personal address, to an exchange: Binance. Thus, given the direction, it’s possible that this humongous holder had made the deposit for selling purposes. Soon after the move had come, the asset’s price had seen a dip towards the $128 mark, suggesting that the whale had played a role or had at least anticipated the drop. Whatever the case be, though, Solana has already made recovery from the drawdown. SOL Price At the time of writing, Solana is trading around $141, down more than 8% over the past week. Featured image from Shutterstock.com, whale-alert.io, charts from TradingView.com

An analyst has explained how Solana (SOL) is currently mirroring the same pattern that led to a bullish breakout for its price back in 2021.

Solana Appears To Be Showing Similar Trend To 2021 Right Now

In a new post on X, analyst Ali Martinez has discussed about how the pattern recently forming in SOL has been reminiscent of what the cryptocurrency showed back in the July of three years ago.

Below is the chart shared by the analyst, that highlights the similarity between the two periods:

As is visible in the graph, the Solana 3-day price has so far shown a trajectory that has been similar to the one in 2021. Not only that, the current Relative Strength Index (RSI) is also at around the same level as the one back then.

The RSI refers to an indicator in technical analysis (TA) that basically measures the speed as well as the magnitude of the recent changes occurring in SOL’s price. This momentum indicator is generally used for determining whether the asset’s price is fair or not.

When the indicator has a value greater than 70, it’s a potential sign that the cryptocurrency is becoming overvalued as its price is growing too quickly. As such, corrections can become more likely in this region.

On the other hand, the metric being under 30 implies a possible oversold condition is forming in the asset, meaning that a bottom could be probable to form in its price.

From the chart, it’s visible that the RSI is at around 40 for Solana currently, suggesting that the asset is slightly leaning towards being undervalued. Interestingly, back in 2021, this same RSI level led to a big bullish breakout for the cryptocurrency.

Given that the coin’s price has shown a similar trajectory as back then, and its RSI has also been pretty much the same, it’s possible that another surge might start for Solana from here. It now remains to be seen if past pattern will repeat for the asset or if it will follow a new path entirely.

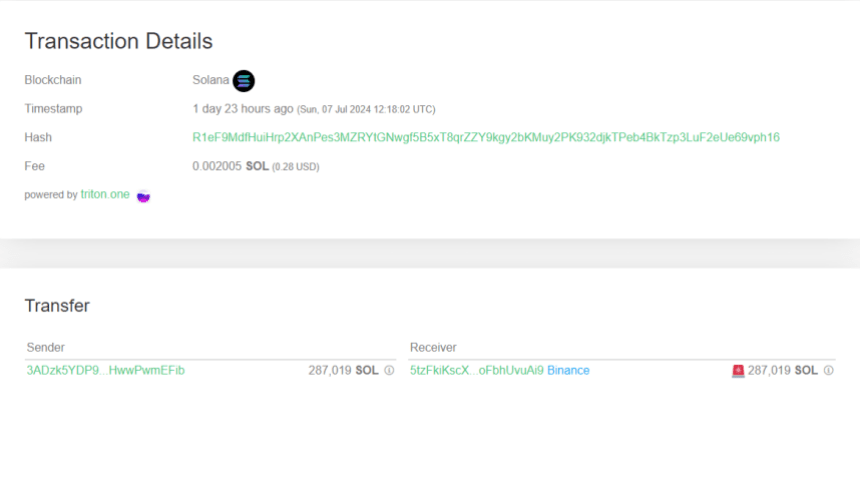

In some other news, a SOL whale made a massive move on the blockchain just a couple of days ago, according to data from the cryptocurrency transaction tracker service Whale Alert.

The move, which involved the transfer of 287,019 SOL (equivalent to over $40.3 million at the time the transaction was executed), travelled from an unknown wallet, likely to be the whale’s personal address, to an exchange: Binance.

Thus, given the direction, it’s possible that this humongous holder had made the deposit for selling purposes. Soon after the move had come, the asset’s price had seen a dip towards the $128 mark, suggesting that the whale had played a role or had at least anticipated the drop. Whatever the case be, though, Solana has already made recovery from the drawdown.

SOL Price

At the time of writing, Solana is trading around $141, down more than 8% over the past week.

What's Your Reaction?