Uniswap Revenue Flies To All-Time Highs: Is UNI Undervalued?

UNI, the native token of Uniswap, one of the top decentralized exchanges (DEXes), is under immense selling pressure. From the daily chart of the UNIUSDT, the token is down 62% from March highs, though prices have stabilized in the past few trading weeks. To put in the numbers, chart data shows that it is up nearly 35% from August lows, absorbing selling pressure. UNI Is Down But Uniswap Generates $50 Million In Revenue So Far Though UNI is far off from all-time highs, shaving nearly 85% from 2021 peaks, other exciting developments might help prices in the long term. Token Terminal data on August 25 shows that the DEX has generated $50 million in revenue so far. Related Reading: Toncoin Tumbles To $4.6 As Bears Eye Further Decline, Will Support Hold? Uniswap allows traders to trustless swap tokens on multiple platforms and blockchains. Originally, it launched on Ethereum in November 2018 before being deployed on the BNB Chain and various layer-2 platforms for Ethereum, including Arbitrum and Optimism. Unlike Binance, which is custodial, Uniswap users only need a non-custodial wallet to connect and swap. All trades are smart contracts-led and without an intermediary. At the same time, there is a broader pool of tokens, some of which are unavailable on top centralized exchanges like Binance. The advantages offered by Uniswap have seen the protocol expand the assets under management to over $4.73 billion, according to DeFiLlama. As of August 26, Uniswap is available on over ten platforms, but the protocol manages over $3.8 billion on Ethereum. Cumulatively, DeFiLlama data has generated over $2.3 billion in fees. All these fees are from swaps on Ethereum and all other platforms. In the last 24 hours, Uniswap has generated over $854,000 in fees. Is The Future Bright, Developers Prepare For V4 As crypto prices expand, it is also highly likely that DeFi activity will rise. Since the recovery from mid-October 2023 to the March 2024 high, DeFi total value locked (TVL) more than doubled. This expansion reflects rising interest and confidence from the community. According to DeFiLlama, DeFi TVL across all networks stood at around $40 billion in October but rose to over $106 billion by March 2024. As DeFi TVL rises, Uniswap will enable more swaps, increasing its fees. Moreover, the DEX will be a go-to platform as it enhances its protocol. Related Reading: XRP Set To Explode? Top Analyst Predicts $33 Rally Earlier this month, Uniswap Labs, which is developing the protocol, announced a $2.35 million prize pool for developers. The fund aims to reward developers who pick out flaws on Uniswap v4 before rollout. Once live, the new version of the DEX will offer new features, including custom oracles and Hooks for even more flexibility. Feature image from Adobe Stock, chart from TradingView

UNI, the native token of Uniswap, one of the top decentralized exchanges (DEXes), is under immense selling pressure. From the daily chart of the UNIUSDT, the token is down 62% from March highs, though prices have stabilized in the past few trading weeks.

To put in the numbers, chart data shows that it is up nearly 35% from August lows, absorbing selling pressure.

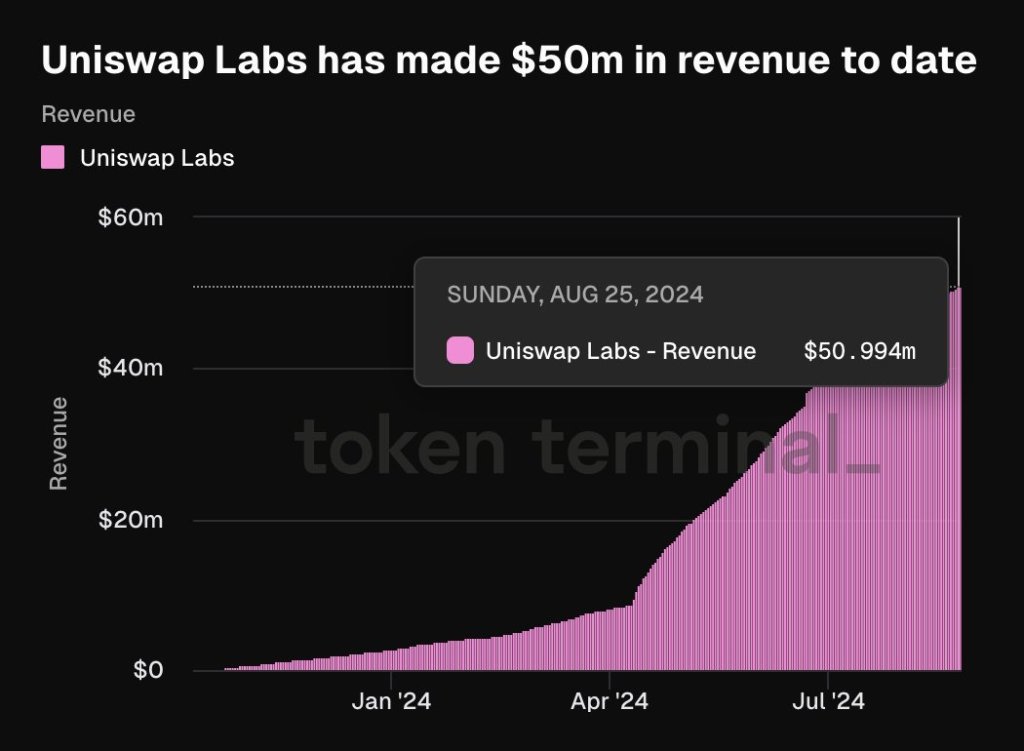

UNI Is Down But Uniswap Generates $50 Million In Revenue So Far

Though UNI is far off from all-time highs, shaving nearly 85% from 2021 peaks, other exciting developments might help prices in the long term. Token Terminal data on August 25 shows that the DEX has generated $50 million in revenue so far.

Uniswap allows traders to trustless swap tokens on multiple platforms and blockchains. Originally, it launched on Ethereum in November 2018 before being deployed on the BNB Chain and various layer-2 platforms for Ethereum, including Arbitrum and Optimism.

Unlike Binance, which is custodial, Uniswap users only need a non-custodial wallet to connect and swap. All trades are smart contracts-led and without an intermediary. At the same time, there is a broader pool of tokens, some of which are unavailable on top centralized exchanges like Binance.

The advantages offered by Uniswap have seen the protocol expand the assets under management to over $4.73 billion, according to DeFiLlama. As of August 26, Uniswap is available on over ten platforms, but the protocol manages over $3.8 billion on Ethereum.

Cumulatively, DeFiLlama data has generated over $2.3 billion in fees. All these fees are from swaps on Ethereum and all other platforms. In the last 24 hours, Uniswap has generated over $854,000 in fees.

Is The Future Bright, Developers Prepare For V4

As crypto prices expand, it is also highly likely that DeFi activity will rise. Since the recovery from mid-October 2023 to the March 2024 high, DeFi total value locked (TVL) more than doubled. This expansion reflects rising interest and confidence from the community. According to DeFiLlama, DeFi TVL across all networks stood at around $40 billion in October but rose to over $106 billion by March 2024.

As DeFi TVL rises, Uniswap will enable more swaps, increasing its fees. Moreover, the DEX will be a go-to platform as it enhances its protocol.

Earlier this month, Uniswap Labs, which is developing the protocol, announced a $2.35 million prize pool for developers. The fund aims to reward developers who pick out flaws on Uniswap v4 before rollout. Once live, the new version of the DEX will offer new features, including custom oracles and Hooks for even more flexibility.

What's Your Reaction?