Why Is Bitcoin Price Down Today? Key Reasons Explained

While Bitcoin was trading at $59,076 yesterday, it dropped to as low as $57,127 during the early Asian trading session today. BTC closed the week at $57,565, once again losing important ground needed to create a bullish reversal. The trajectory is impacted by several factors. #1: Macro Fears Of A Recession The looming threat of a US recession is causing palpable tension in financial markets. This is especially pertinent for Bitcoin, which has not yet weathered a full economic downturn since its inception. As the Federal Reserve gears up for its Federal Open Market Committee (FOMC) meeting on September 17-18, 2024, the discourse around monetary policy has intensified. The anticipation of a rate cut has been cemented by Jerome Powell’s comments at the Jackson Hole Symposium, with the CME FedWatch tool indicating a unanimous expectation of a rate adjustment. Related Reading: How Will The US Upcoming Fed Rate Cut Impact Bitcoin? QCP Analysts Weigh In The breakdown of expectations reveals a 69% inclination towards a 25 basis points cut, while a significant minority of 31% predicts a more aggressive 50 basis points reduction. According to Tom Capital, a crypto analyst, such drastic cuts could be interpreted as signs of an economic crisis rather than mere adjustments, which complicates the investment outlook for Bitcoin. “50 bps cut by the FED is an emergency cut, there is simply no other way to look at it. If your current bullish thesis for crypto rallying is predicated on large rate cuts, you might want to reconsider,” Tom Capital noted through X. This sentiment was echoed by another analyst, Skew (@52kskew), who highlighted the importance of upcoming US economic data releases, particularly the BLS jobs report due on September 6. Tom Capital added: “Needs to be real shitty jobs data in lead up to NFP on Friday, then a shocker NFP itself to get 50 bps (which isn’t out of the question given unreliability of data). However, I reckon the sticker shock of a terrible NFP is a higher probability risk off move, starting in Nas.” #2: Bitcoin Seasonality Rekt Capital, another crypto analyst, provided insights into the seasonal patterns affecting Bitcoin. Historical data since 2013 shows a mixed performance for Bitcoin in September, with gains in some years offset by losses in others. Related Reading: Bitcoin Continues To Exit Exchanges As Supply Drops To New 2024 Low “Is September really a down month for BTC? Since 2013, BTC saw monthly returns of +2.35%, +6.04%, and +3.91% across three Septembers. And across 6 Septembers, BTC saw negative monthly returns ranging between -1% to -7.5%, with only two instances of double-digit downside (i.e., -19.01% and -13.38%). Macro-wise, however, September is typically a month of consolidation,” Rekt Capital analyzed. #3: Low Bitcoin Sentiment Ali Martinez, by analyzing exchange-related on-chain data, pinpointed a sustained decline in investor interest and network utilization. “The Exchange Volume Momentum indicator shows a sustained drop in exchange-related on-chain activity, which usually points to lower investor interest in Bitcoin and decreased network usage,” Martinez stated, suggesting that the enthusiasm for using Bitcoin has cooled somewhat, potentially affecting its price negatively. Martinez added, “Bitcoin miners sold 2,655 BTC over the weekend, worth around $154 million!” #4: Technical Trading Conditions The technical outlook for Bitcoin is bleak as well, with the cryptocurrency failing to secure a strong weekly close. “Bitcoin needs to Weekly Close above ~$58,450 to protect the Channel Bottom and secure it as support on this retest. Price is at this support right now. An ideal close would even be ~$59,000 to get BTC above the blue Higher Low dating back to early July,” remarked Rekt Capital. At press time, BTC traded at $58,036. Featured image from iStock, chart from TradingView.com

While Bitcoin was trading at $59,076 yesterday, it dropped to as low as $57,127 during the early Asian trading session today. BTC closed the week at $57,565, once again losing important ground needed to create a bullish reversal. The trajectory is impacted by several factors.

#1: Macro Fears Of A Recession

The looming threat of a US recession is causing palpable tension in financial markets. This is especially pertinent for Bitcoin, which has not yet weathered a full economic downturn since its inception.

As the Federal Reserve gears up for its Federal Open Market Committee (FOMC) meeting on September 17-18, 2024, the discourse around monetary policy has intensified. The anticipation of a rate cut has been cemented by Jerome Powell’s comments at the Jackson Hole Symposium, with the CME FedWatch tool indicating a unanimous expectation of a rate adjustment.

The breakdown of expectations reveals a 69% inclination towards a 25 basis points cut, while a significant minority of 31% predicts a more aggressive 50 basis points reduction. According to Tom Capital, a crypto analyst, such drastic cuts could be interpreted as signs of an economic crisis rather than mere adjustments, which complicates the investment outlook for Bitcoin.

“50 bps cut by the FED is an emergency cut, there is simply no other way to look at it. If your current bullish thesis for crypto rallying is predicated on large rate cuts, you might want to reconsider,” Tom Capital noted through X. This sentiment was echoed by another analyst, Skew (@52kskew), who highlighted the importance of upcoming US economic data releases, particularly the BLS jobs report due on September 6.

Tom Capital added: “Needs to be real shitty jobs data in lead up to NFP on Friday, then a shocker NFP itself to get 50 bps (which isn’t out of the question given unreliability of data). However, I reckon the sticker shock of a terrible NFP is a higher probability risk off move, starting in Nas.”

#2: Bitcoin Seasonality

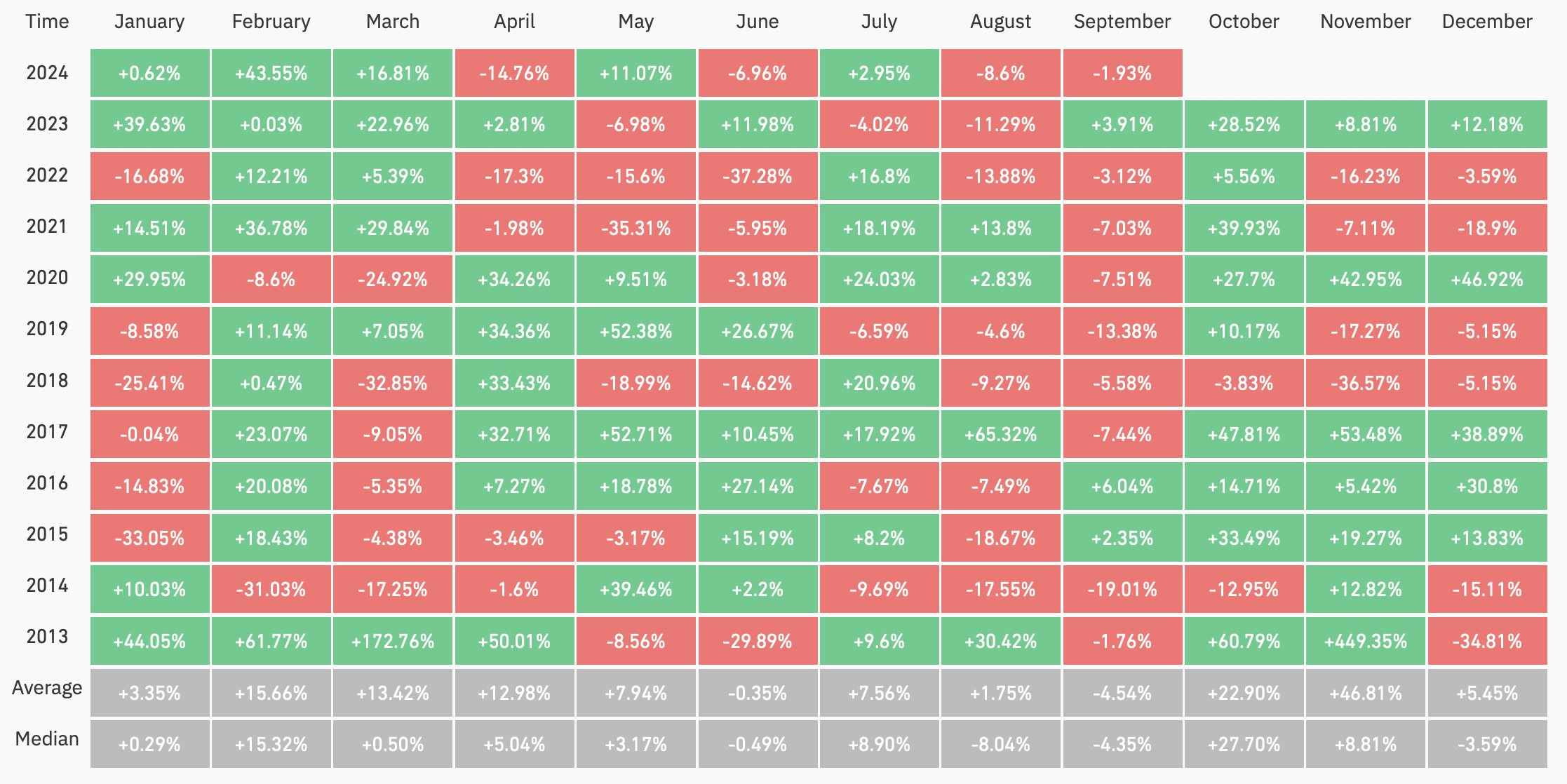

Rekt Capital, another crypto analyst, provided insights into the seasonal patterns affecting Bitcoin. Historical data since 2013 shows a mixed performance for Bitcoin in September, with gains in some years offset by losses in others.

“Is September really a down month for BTC? Since 2013, BTC saw monthly returns of +2.35%, +6.04%, and +3.91% across three Septembers. And across 6 Septembers, BTC saw negative monthly returns ranging between -1% to -7.5%, with only two instances of double-digit downside (i.e., -19.01% and -13.38%). Macro-wise, however, September is typically a month of consolidation,” Rekt Capital analyzed.

#3: Low Bitcoin Sentiment

#3: Low Bitcoin Sentiment

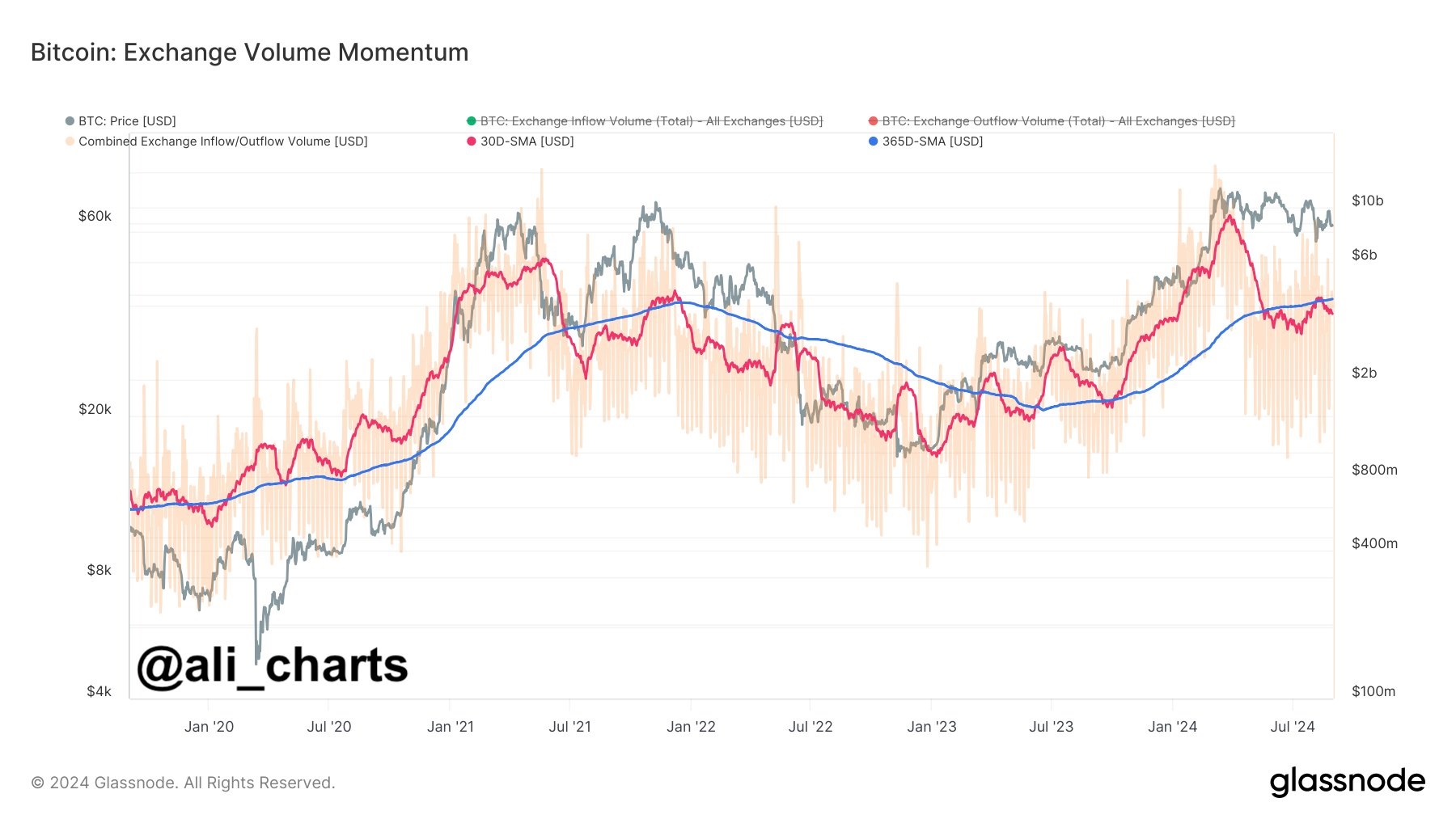

Ali Martinez, by analyzing exchange-related on-chain data, pinpointed a sustained decline in investor interest and network utilization. “The Exchange Volume Momentum indicator shows a sustained drop in exchange-related on-chain activity, which usually points to lower investor interest in Bitcoin and decreased network usage,” Martinez stated, suggesting that the enthusiasm for using Bitcoin has cooled somewhat, potentially affecting its price negatively.

Martinez added, “Bitcoin miners sold 2,655 BTC over the weekend, worth around $154 million!” #4: Technical Trading Conditions

The technical outlook for Bitcoin is bleak as well, with the cryptocurrency failing to secure a strong weekly close. “Bitcoin needs to Weekly Close above ~$58,450 to protect the Channel Bottom and secure it as support on this retest. Price is at this support right now. An ideal close would even be ~$59,000 to get BTC above the blue Higher Low dating back to early July,” remarked Rekt Capital.

At press time, BTC traded at $58,036.

What's Your Reaction?