Spot Ethereum ETFs FOMO: Tron Founder Justin Sun Drops $5 Million On ETH

Justin Sun, the founder of Tron, a decentralized blockchain-based operating system, has found himself joining the Spot Ethereum ETFs FOMO with a new $5 million investment in Ethereum (ETH), the world’s second-largest cryptocurrency. Tron Founder Buys $5 Million Worth Of ETH In an X (formerly Twitter) post on July 11, Spot On Chain, an AI-driven on-chain analytics platform, uncovered a new Ethereum transaction allegedly executed by Sun. According to the analytics platform, the Tron founder had supposedly spent $5 million to buy 1,614 ETH tokens at an approximate price of $3,097 per ETH. Related Reading: Forbes Says Shiba Inu Price Will Rise 1,700% To Reach $0.0003 ATH, Here’s When Spot On Chain revealed that since February 8, 2024, Sun has purportedly purchased a total of 362,751 ETH tokens at an estimated cost of more than $1.11 billion, with an average price of $3,047 per ETH. This massive ETH transaction was executed via three crypto wallet addresses. Additionally, the analytics platform noted that the Tron founder recently deposited 45 million USDT to Binance, a major crypto exchange, suggesting the possibility of new intentions to buy more Ethereum soon. The crypto founder has often received ETH coins from Binance right after depositing his stablecoin into the exchange. Interestingly, Sun’s newest ETH purchase comes as the FOMO surrounding Spot Ethereum ETFs is growing stronger in the crypto market. Previously in June, Gary Gensler, the Chair of the United States Securities and Exchange Commission (SEC) announced that Spot Ethereum ETF trading will officially launch in the summer. As a result, the broader crypto market has been looking forward to the debut of a digital asset that could potentially trigger a major rally for ETH. Before his $5 million ETH purchase, Sun had supposedly recorded a major loss after Ethereum declined by 10% on July 7. Spot On Chain disclosed that the Tron founder may have lost $66 million in the volatile market, erasing the initial $58 million profit he had gained just a day earlier. Ethereum Whales Enter Accumulation Phase Despite the recent declines experienced by Ethereum, the FOMO and excitement surrounding Spot Ethereum ETFs may have triggered a change in market sentiment and investors’ demand for the cryptocurrency. According to prominent crypto analyst, Ali Martinez, Ethereum whales are back to accumulating ETH. The analyst disclosed that the cryptocurrency had witnessed a brief distribution period, potentially triggered by Ethereum’s low market performance and subsequent drop to $3,055 as of writing. In addition to ETH, Bitcoin (BTC) has also declined significantly, plummeting by more than 14% over the past month. Related Reading: Cardano Sees 1,218% Spike In This Major Metric, Will ADA Price Follow? While whales show renewed interest in Ethereum, crypto analysts predict further price declines in the cryptocurrency following the launch of Spot Ethereum ETFs. However, as demand for Ethereum ETFs rises and market conditions stabilize, ETH could see its price potentially rising as high as $8,000 this market cycle. Featured image created with Dall.E, chart from Tradingview.com

Justin Sun, the founder of Tron, a decentralized blockchain-based operating system, has found himself joining the Spot Ethereum ETFs FOMO with a new $5 million investment in Ethereum (ETH), the world’s second-largest cryptocurrency.

Tron Founder Buys $5 Million Worth Of ETH

In an X (formerly Twitter) post on July 11, Spot On Chain, an AI-driven on-chain analytics platform, uncovered a new Ethereum transaction allegedly executed by Sun. According to the analytics platform, the Tron founder had supposedly spent $5 million to buy 1,614 ETH tokens at an approximate price of $3,097 per ETH.

Spot On Chain revealed that since February 8, 2024, Sun has purportedly purchased a total of 362,751 ETH tokens at an estimated cost of more than $1.11 billion, with an average price of $3,047 per ETH. This massive ETH transaction was executed via three crypto wallet addresses.

Additionally, the analytics platform noted that the Tron founder recently deposited 45 million USDT to Binance, a major crypto exchange, suggesting the possibility of new intentions to buy more Ethereum soon. The crypto founder has often received ETH coins from Binance right after depositing his stablecoin into the exchange.

Interestingly, Sun’s newest ETH purchase comes as the FOMO surrounding Spot Ethereum ETFs is growing stronger in the crypto market. Previously in June, Gary Gensler, the Chair of the United States Securities and Exchange Commission (SEC) announced that Spot Ethereum ETF trading will officially launch in the summer. As a result, the broader crypto market has been looking forward to the debut of a digital asset that could potentially trigger a major rally for ETH.

Before his $5 million ETH purchase, Sun had supposedly recorded a major loss after Ethereum declined by 10% on July 7. Spot On Chain disclosed that the Tron founder may have lost $66 million in the volatile market, erasing the initial $58 million profit he had gained just a day earlier.

Ethereum Whales Enter Accumulation Phase

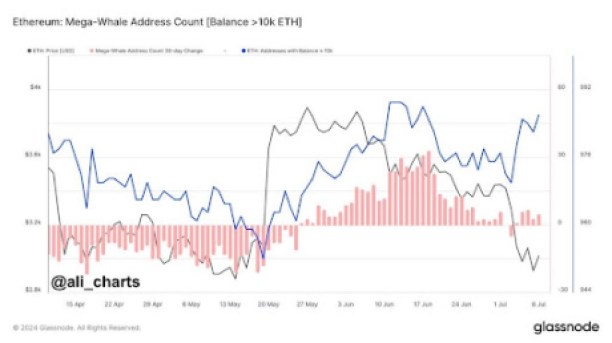

Despite the recent declines experienced by Ethereum, the FOMO and excitement surrounding Spot Ethereum ETFs may have triggered a change in market sentiment and investors’ demand for the cryptocurrency. According to prominent crypto analyst, Ali Martinez, Ethereum whales are back to accumulating ETH.

The analyst disclosed that the cryptocurrency had witnessed a brief distribution period, potentially triggered by Ethereum’s low market performance and subsequent drop to $3,055 as of writing. In addition to ETH, Bitcoin (BTC) has also declined significantly, plummeting by more than 14% over the past month.

While whales show renewed interest in Ethereum, crypto analysts predict further price declines in the cryptocurrency following the launch of Spot Ethereum ETFs. However, as demand for Ethereum ETFs rises and market conditions stabilize, ETH could see its price potentially rising as high as $8,000 this market cycle.

What's Your Reaction?